Affiliate marketing is a great way to make money online. But like any other online business, it’s not without its risks. One of the biggest risks is affiliate marketing scams.

Affiliate marketing scams are fraudulent schemes that are designed to take advantage of affiliate marketers and their audiences. They can come in many different forms, but they all have one thing in common: they’re designed to steal money from people.

1. Introduction

Affiliate marketing has become a popular way for people to earn money online. However, as with any online business, there are risks involved. Scammers are constantly looking for new ways to exploit the system to their advantage. By understanding the types of scams that exist, you can better protect yourself and your affiliate marketing business.

2. Types of Affiliate Marketing Scams

2.1. Cookie Stuffing

Cookie stuffing is a type of affiliate marketing fraud where scammers force malicious tracking code from multiple affiliate networks onto a visitor’s computer. This code then tracks the visitor’s browsing activity, even if they don’t click on any affiliate links. As a result, the scammer can earn commissions on sales that they didn’t actually generate.

Here’s how cookie stuffing works:

- The scammer creates a website that contains affiliate links to different merchants.

- The scammer then uses malicious code to force cookies from multiple affiliate networks onto the visitor’s computer.

- When the visitor visits another website that is also part of one of the affiliate networks, the malicious code will trigger the affiliate network to track the visitor’s visit as if they had come from the scammer’s website.

- If the visitor then makes a purchase from the merchant, the scammer will earn a commission, even though they did not actually refer the visitor to the merchant.

Cookie stuffing is a serious problem for affiliate marketers and merchants. It can lead to lost commissions for affiliate marketers and unfair profits for scammers.

There are a few things that you can do to protect yourself from cookie stuffing:

- Be aware of the signs of cookie stuffing: If you notice that you are suddenly getting a lot of traffic from affiliate links that you don’t recognize, it could be a sign of cookie stuffing.

- Use a cookie blocker: A cookie blocker is a software program that can help to prevent malicious cookies from being installed on your computer.

- Report cookie stuffing: If you think that you have been a victim of cookie stuffing, you can report it to the affiliate network or merchant that you were referred to. You can also report it to the Federal Trade Commission (FTC).

By following these tips, you can help to protect yourself from cookie stuffing.

2.2. Fake Affiliate Programs

A fake affiliate program is a fraudulent scheme that is designed to steal money from affiliate marketers. These programs typically offer high commissions or other incentives to attract affiliates, but they do not actually sell any products or services. Instead, they simply collect affiliate fees from unsuspecting affiliates.

Here are some of the signs of a fake affiliate program:

- The program offers high commissions or other unrealistic incentives.

- The program does not have a clear or transparent way of tracking sales.

- The program’s website is poorly designed or unprofessional.

- The program’s customer service is unresponsive or nonexistent.

If you are considering joining an affiliate program, it is important to do your research and be wary of any programs that seem too good to be true. Here are some tips for avoiding fake affiliate programs:

- Do your research: Before you join an affiliate program, be sure to do your research. Read the program’s terms and conditions carefully and make sure that you understand how it works. You should also check the company’s reputation online.

- Be wary of high-paying offers: If an affiliate program seems too good to be true, it probably is. Be wary of programs that offer commissions that are much higher than the industry average.

- Track your results: Once you’ve joined an affiliate program, be sure to track your results. This will help you to identify any suspicious activity. If you see any unusual patterns, such as a sudden increase in traffic or a decrease in conversions, be sure to investigate.

By following these tips, you can help to protect yourself from fake affiliate programs.

Here are some additional tips for avoiding fake affiliate programs:

- Only join affiliate programs that are affiliated with reputable companies.

- Be sure to read the terms and conditions of the affiliate program carefully before you join.

- Make sure that you understand how the affiliate program works and how you will be compensated.

- Track your results and be on the lookout for any suspicious activity.

- If you have any concerns about an affiliate program, contact the company directly.

By following these tips, you can help to protect yourself from fake affiliate programs and ensure that you are only working with legitimate companies.

2.3. Commission Hijacking

Commission hijacking is a type of affiliate marketing fraud where an affiliate marketer uses malicious code to redirect traffic from a merchant’s website to their own website. This allows the affiliate marketer to claim credit for the sale, even though they did not actually refer the customer to the merchant.

Here’s how commission hijacking works:

- The affiliate marketer creates a website that contains affiliate links to different merchants.

- The affiliate marketer then uses malicious code to redirect traffic from the merchant’s website to their own website.

- When the customer clicks on the affiliate link, they are redirected to the affiliate marketer’s website.

- If the customer then makes a purchase from the merchant, the affiliate marketer will earn a commission, even though they did not actually refer the customer to the merchant.

Commission hijacking is a serious problem for affiliate marketers and merchants. It can lead to lost commissions for affiliate marketers and unfair profits for scammers.

There are a few things that you can do to protect yourself from commission hijacking:

- Be aware of the signs of commission hijacking: If you notice that you are suddenly getting a lot of traffic from affiliate links that you don’t recognize, it could be a sign of commission hijacking.

- Use a security suite: A security suite is a software program that can help to protect your computer from malicious code.

- Report commission hijacking: If you think that you have been a victim of commission hijacking, you can report it to the affiliate network or merchant that you were referred to. You can also report it to the Federal Trade Commission (FTC).

By following these tips, you can help to protect yourself from commission hijacking.

Here are some additional tips for protecting yourself from commission hijacking:

- Only use reputable affiliate networks: Reputable affiliate networks have measures in place to protect their affiliates from commission hijacking.

- Be careful about the affiliate links that you use: Only use affiliate links that you trust.

- Track your results: Track your results and be on the lookout for any suspicious activity.

- If you have any concerns, contact the affiliate network or merchant directly.

By following these tips, you can help to protect yourself from commission hijacking and ensure that you are only working with legitimate companies.

2.4. Forced Clicks

Forced clicks are a type of affiliate marketing fraud where scammers force users to click on affiliate links. This can be done by using malicious code to redirect users to affiliate links, or by using pop-ups or other forms of intrusive advertising.

Forced clicks are a serious problem for affiliate marketers and merchants. They can lead to lost commissions for affiliate marketers and unfair profits for scammers.

Here are some of the signs of forced clicks:

- A sudden increase in traffic from affiliate links that you don’t recognize.

- A decrease in conversions from affiliate links.

- A high bounce rate from affiliate links.

- A high number of clicks from the same IP address.

If you notice any of these signs, it’s possible that you’re the victim of forced clicks. There are a few things that you can do to protect yourself from forced clicks:

- Use a security suite: A security suite is a software program that can help to protect your computer from malicious code.

- Be careful about the websites that you visit: Only visit websites that you trust.

- Report forced clicks: If you think that you have been a victim of forced clicks, you can report it to the affiliate network or merchant that you were referred to. You can also report it to the Federal Trade Commission (FTC).

By following these tips, you can help to protect yourself from forced clicks.

Here are some additional tips for protecting yourself from forced clicks:

- Use a reputable affiliate network: Reputable affiliate networks have measures in place to protect their affiliates from forced clicks.

- Be careful about the affiliate links that you use: Only use affiliate links that you trust.

- Track your results: Track your results and be on the lookout for any suspicious activity.

- If you have any concerns, contact the affiliate network or merchant directly.

By following these tips, you can help to protect yourself from forced clicks and ensure that you are only working with legitimate companies.

2.5. Adware and Spyware

Adware and spyware are both types of malware that can be installed on your computer without your knowledge or consent. They can track your browsing habits, display unwanted ads, and even steal your personal information.

Adware is a type of malware that displays unwanted ads on your computer. These ads can be pop-ups, banners, or even full-screen ads. Adware can also track your browsing habits so that it can display ads that are more relevant to you.

Spyware is a type of malware that tracks your browsing habits and collects personal information about you. This information can include your IP address, your browsing history, and even your credit card information. Spyware can also be used to steal your passwords and other sensitive information.

Both adware and spyware can be a nuisance, but they can also be dangerous. If you are infected with adware or spyware, you may experience the following problems:

- Unwanted ads: Adware will display unwanted ads on your computer. These ads can be annoying and even disruptive.

- Slow performance: Adware and spyware can slow down your computer’s performance. This is because they are constantly running in the background and using up your computer’s resources.

- Security risks: Adware and spyware can pose a security risk to your computer. They can steal your personal information, such as your passwords and credit card numbers. They can also be used to install other malware on your computer.

There are a few things that you can do to protect yourself from adware and spyware:

- Use a security suite: A security suite is a software program that can help to protect your computer from malware.

- Be careful about the websites that you visit: Only visit websites that you trust.

- Keep your software up to date: Software updates often include security patches that can help to protect your computer from malware.

- Be careful about what you download: Only download files from trusted sources.

By following these tips, you can help to protect yourself from adware and spyware.

Here are some additional tips for protecting yourself from adware and spyware:

- Use an ad blocker: An ad blocker is a software program that can block unwanted ads from being displayed on your computer.

- Be careful about the ads that you click on: Don’t click on ads that you don’t recognize or that seem suspicious.

- Scan your computer for malware regularly: Use a security suite to scan your computer for malware on a regular basis.

By following these tips, you can help to protect yourself from adware and spyware and keep your computer safe.

2.6. Fake Reviews and Testimonials

Fake reviews and testimonials are reviews or testimonials that have been fabricated or manipulated to deceive consumers. They are often used to boost the ratings of products or services, or to damage the reputation of competitors.

Fake reviews and testimonials can be difficult to spot, but there are some red flags that you can look for. These include:

- Reviews that are all five stars or all one star: Real reviews are usually more mixed, with some positive and some negative feedback.

- Reviews that are very short or very long: Real reviews are usually more detailed and informative.

- Reviews that use similar language or phrases: This is often a sign that the reviews have been written by the same person or group of people.

- Reviews that are posted on the same day or within a short period of time: This is also a sign that the reviews have been written by the same person or group of people.

If you see any of these red flags, it’s best to be skeptical of the reviews. You can also try to verify the reviews by checking the reviewer’s profile or by looking for other reviews from the same person.

There are a few things that you can do to protect yourself from fake reviews and testimonials:

- Be aware of the signs of fake reviews: Look for the red flags listed above.

- Read reviews from multiple sources: Don’t just rely on reviews from one website or one source.

- Check the reviewer’s profile: See if the reviewer has a history of writing reviews.

- Look for other reviews from the same person: If you see the same reviewer writing multiple reviews, be suspicious.

By following these tips, you can help to protect yourself from fake reviews and testimonials.

Here are some additional tips for spotting fake reviews and testimonials:

- Look for reviews that are clearly paid or incentivized: Some companies offer incentives to people who write positive reviews of their products or services. These reviews are often easy to spot, as they will often be very positive and will not contain any negative feedback.

- Look for reviews that are posted on suspicious websites: There are many websites that are designed to sell fake reviews. These websites will often have a large number of reviews for a single product or service, and the reviews will often be very positive.

- Use a review verification service: There are a number of review verification services that can help you to identify fake reviews. These services will scan reviews for signs of manipulation, and they will also provide you with information about the reviewer’s profile.

By following these tips, you can help to protect yourself from fake reviews and testimonials and make informed decisions about the products and services that you purchase.

2.7. Cloaking

Cloaking is a search engine optimization (SEO) technique in which the content presented to the search engine spider is different from that presented to the user’s browser. This is done by delivering content based on the IP addresses or the User-Agent HTTP header of the user requesting the page.

Cloaking is often used as a spamdexing technique to attempt to sway search engines into giving the site a higher ranking. By the same method, it can also be used to trick search engine users into visiting a site that is substantially different from the search engine description, including delivering pornographic content cloaked within non-pornographic search results. Cloaking is a form of the doorway page technique. A similar technique is used on DMOZ web directory, but it differs in several ways from search engine cloaking: It is intended to fool human editors, rather than computer search engine spiders.

The purpose of cloaking is sometimes to deceive search engines so they display the page when it would not otherwise be displayed (black hat SEO). However, it can also be a functional (though antiquated) technique for informing search engines of content they would not otherwise be able to locate because it is embedded in non-textual containers, such as video or certain Adobe Flash components. Since 2006, better methods of accessibility, including progressive enhancement, have been available, so cloaking is no longer necessary for regular SEO.

Cloaking is considered a black hat SEO technique and can result in a website being banned from search engines. If you are considering using cloaking, it is important to be aware of the risks involved.

Here are some of the risks of using cloaking:

- Your website could be banned from search engines.

- Your website could lose credibility with users.

- You could be fined by search engines.

- You could be sued by competitors.

If you are concerned about the risks of using cloaking, there are a number of alternative SEO techniques that you can use to improve your website’s ranking. These techniques include:

- Creating high-quality content.

- Optimizing your website for keywords.

- Building backlinks to your website.

- Using social media to promote your website.

By using these techniques, you can improve your website’s ranking without resorting to cloaking.

Sources

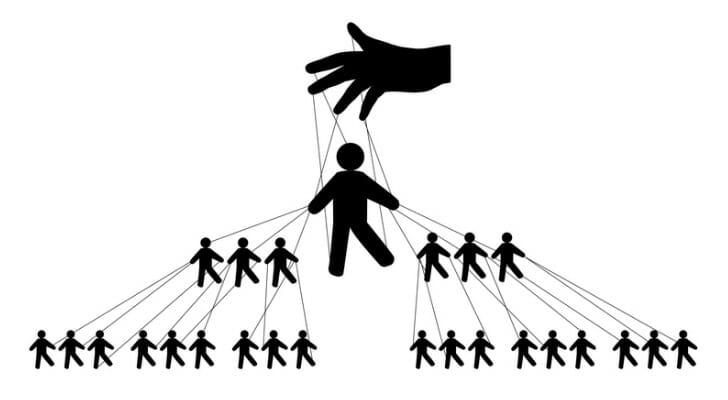

2.8. Pyramid Schemes

A pyramid scheme is a fraudulent investment strategy where participants are promised money in return for recruiting new members into the scheme. The scheme is unsustainable because it relies on an ever-increasing number of new recruits to generate revenue. As the number of new recruits declines, the scheme eventually collapses, leaving most participants with nothing.

Here are some of the key characteristics of a pyramid scheme:

- Participants are paid to recruit new members: The only way to make money in a pyramid scheme is to recruit new members.

- There is no real product or service being sold: Pyramid schemes are not based on the sale of a product or service. The only product being sold is the opportunity to join the scheme.

- The scheme is unsustainable: Pyramid schemes require an ever-increasing number of new recruits to generate revenue. As the number of new recruits declines, the scheme eventually collapses.

Pyramid schemes are illegal in most countries. If you are considering joining a pyramid scheme, it is important to be aware of the risks involved.

Here are some of the risks of joining a pyramid scheme:

- You could lose all of your money: Pyramid schemes are designed to take money from participants, not to make them money.

- You could be sued: Pyramid schemes are illegal in most countries. If you are caught participating in a pyramid scheme, you could be sued by the government or by other participants.

- You could damage your reputation: Pyramid schemes are associated with fraud and deception. If you are caught participating in a pyramid scheme, you could damage your reputation.

If you are concerned about the risks of joining a pyramid scheme, there are a number of alternative investment strategies that you can use. These strategies include:

- Investing in stocks: Stocks are shares of ownership in a company. When you buy stocks, you are essentially buying a piece of the company.

- Investing in bonds: Bonds are loans that you make to a company or government. When you buy bonds, you are essentially lending money to the company or government.

- Investing in mutual funds: Mutual funds are baskets of stocks or bonds that are managed by a professional. When you invest in a mutual fund, you are essentially investing in a diversified portfolio of assets.

By investing in these alternative strategies, you can reduce your risk of losing money and protect your reputation.

2.9. Chargeback Fraud

Chargeback fraud, also known as friendly fraud, is a type of fraud where a customer files a chargeback with their credit card company for a legitimate purchase. This is done in order to get a refund from the merchant, even though the customer has already received the goods or services.

There are a number of reasons why a customer might commit chargeback fraud. These include:

- They are unhappy with the product or service: The customer may be unhappy with the product or service they purchased, and they may try to get a refund by filing a chargeback.

- They are trying to get a free product or service: The customer may be trying to get a free product or service by filing a chargeback.

- They are simply trying to scam the merchant: The customer may be trying to scam the merchant by filing a false chargeback.

Chargeback fraud can be a serious problem for merchants. It can lead to lost revenue, increased costs, and damage to the merchant’s reputation.

There are a number of things that merchants can do to protect themselves from chargeback fraud. These include:

- Have clear and concise terms and conditions: Merchants should have clear and concise terms and conditions that outline their refund policy. This will help to protect merchants from customers who try to file false chargebacks.

- Document all transactions: Merchants should document all transactions, including the date, time, amount, and product or service purchased. This documentation can be used to defend against false chargebacks.

- Be responsive to customer complaints: Merchants should be responsive to customer complaints. If a customer is unhappy with a product or service, the merchant should try to resolve the issue to the customer’s satisfaction. This will help to reduce the likelihood of the customer filing a false chargeback.

By following these tips, merchants can help to protect themselves from chargeback fraud.

Here are some additional tips for preventing chargeback fraud:

- Use a fraud prevention service: There are a number of fraud prevention services that can help merchants to identify and prevent fraudulent chargebacks.

- Train employees: Merchants should train their employees on how to identify and prevent fraudulent chargebacks.

- Monitor chargebacks: Merchants should monitor their chargeback rates and investigate any suspicious chargebacks.

By following these tips, merchants can help to reduce their risk of being a victim of chargeback fraud.

2.10. Non-Payment of Commissions

Non-payment of commissions is a serious issue that can have a significant impact on employees’ financial well-being. In some cases, it can even lead to financial hardship.

There are a number of reasons why an employer might fail to pay commissions. Some of the most common reasons include:

- Lack of understanding of the commission agreement: The employer may not understand the terms of the commission agreement, and they may not realize that they are required to pay commissions.

- Financial difficulties: The employer may be experiencing financial difficulties, and they may not be able to afford to pay commissions.

- Intentional fraud: The employer may be intentionally refusing to pay commissions in order to avoid paying the employee what they are owed.

If an employee is not paid their commissions, they have a number of options available to them. They can:

- Talk to their employer: The employee should first try to talk to their employer about the issue. If the employer is willing to pay the commissions, this may be the simplest solution.

- File a complaint with the labor board: If the employer is not willing to pay the commissions, the employee can file a complaint with the labor board. The labor board will investigate the complaint and may order the employer to pay the commissions.

- Sue the employer: If the labor board is unable to resolve the issue, the employee may be able to sue the employer. The employee would need to prove that the employer breached the commission agreement and that they were damaged as a result.

If you are not paid your commissions, it is important to speak to an attorney to discuss your options. An attorney can help you to understand your rights and to protect your interests.

Here are some additional tips for dealing with non-payment of commissions:

- Keep good records: Keep track of all of your sales and commissions. This will help you to document your earnings and to support your claim if you need to take legal action.

- Document all communications: If you have any communication with your employer about the non-payment of commissions, be sure to document it. This includes emails, letters, and phone calls.

- Be persistent: If you are not paid your commissions, be persistent in your efforts to get them. Do not give up until you have received what you are owed.

3. Preventing Affiliate Marketing Scams

3.1. Research Affiliate Programs

Before joining an affiliate program, do thorough research to ensure its legitimacy. Look for reviews from other affiliates, check its reputation in online forums, and read the terms and conditions carefully.

3.2. Monitor Your Traffic and Commissions

Regularly check your affiliate traffic and commissions for any unusual patterns or discrepancies, which could indicate fraudulent activity.

3.3. Use Reputable Affiliate Networks

Joining reputable affiliate networks can help protect you from scams, as these networks often have strict guidelines and vetting processes for merchants.

3.4. Update Your Security Measures

Keep your computer, browser, and antivirus software up to date to help protect against adware, spyware, and other malicious software.

3.5. Educate Yourself

Stay informed about the latest scams and fraud techniques by reading industry blogs, joining affiliate marketing forums, and attending relevant webinars or conferences.

4. Reporting Affiliate Marketing Scams

If you think that you’ve been the victim of an affiliate marketing scam, you can report it to the following organizations:

- Federal Trade Commission (FTC): The FTC is the government agency that enforces consumer protection laws. You can file a complaint with the FTC online or by mail.

- Better Business Bureau (BBB): The BBB is a non-profit organization that helps consumers resolve disputes with businesses. You can file a complaint with the BBB online or by mail.

- Your state’s attorney general: Your state’s attorney general may also be able to help you with your complaint. You can find contact information for your state’s attorney general online.

When you report an affiliate marketing scam, be sure to include the following information:

- The name of the affiliate program or website that you were scammed by.

- The date and time of the scam.

- The amount of money that you lost.

- Any other information that you think would be helpful.

Reporting affiliate marketing scams helps to protect other consumers from being scammed. It also helps to bring the scammers to justice.

Here are some additional tips for reporting affiliate marketing scams:

- Keep records: Keep all of the documentation that you have related to the scam, such as emails, screenshots, and bank statements. This will help you to support your complaint.

- Be clear and concise: When you report the scam, be clear and concise about what happened. The more detailed your report is, the better.

- Be persistent: If you don’t hear back from the organization that you reported the scam to, don’t give up. Keep following up until you get a response.

By following these tips, you can help to protect yourself and others from affiliate marketing scams.

5. Conclusion

Affiliate marketing scams can be damaging to both your finances and your reputation. By understanding the types of scams that exist, taking preventive measures, and knowing how to reportsuspected fraud, you can better protect yourself and your affiliate marketing business. Stay vigilant, research affiliate programs thoroughly, and always keep your security measures up to date to reduce the risk of falling victim to scams. Remember, knowledge is power – stay informed and share your experiences to help create a safer affiliate marketing community for all.