Pump and dump schemes are a type of investment fraud that involves artificially inflating the price of a stock or other investment, and then selling it at a profit. This practice is illegal and can result in significant losses for investors. In this essay, we will explore the different types of pump and dump schemes, the warning signs to look out for, and the steps that investors can take to protect themselves from falling victim to these schemes.

Definition of Pump and Dump Schemes

Pump and dump schemes are a type of investment fraud in which fraudsters artificially inflate the price of a stock or other investment, and then sell it at a profit. The scheme typically involves three stages:

- The “pump” stage: The fraudster creates hype around the investment, typically through false or misleading information. This can include spreading rumors or using social media to promote the investment.

- The “dump” stage: Once the price of the investment has been artificially inflated, the fraudster sells their shares at a profit, typically to unsuspecting investors who have bought into the hype.

- The “fade” stage: Once the fraudster has made their profit, the price of the investment typically drops back down to its original value, leaving investors who bought in during the pump stage with significant losses.

Types of Pump and Dump Schemes

There are several different types of pump and dump schemes, including:

- Traditional pump and dump: This is the most common type of pump and dump scheme. The fraudster will typically buy large quantities of a low-value stock, and then use false or misleading information to create hype around the investment, artificially inflating the price. Once the price has reached a certain level, the fraudster will sell their shares at a profit, causing the price to collapse and leaving unsuspecting investors with significant losses.

- Reverse pump and dump: In a reverse pump and dump scheme, the fraudster will short sell a high-value stock, and then use false or misleading information to drive down the price. Once the price has reached a certain level, the fraudster will buy back the shares at a lower price, causing the price to rise again and generating a profit.

- Short and distort: In a short and distort scheme, the fraudster will short sell a stock and then spread false or misleading information about the company, causing the stock price to fall. The fraudster will then buy back the shares at a lower price, generating a profit.

Warning Signs of Pump and Dump Schemes

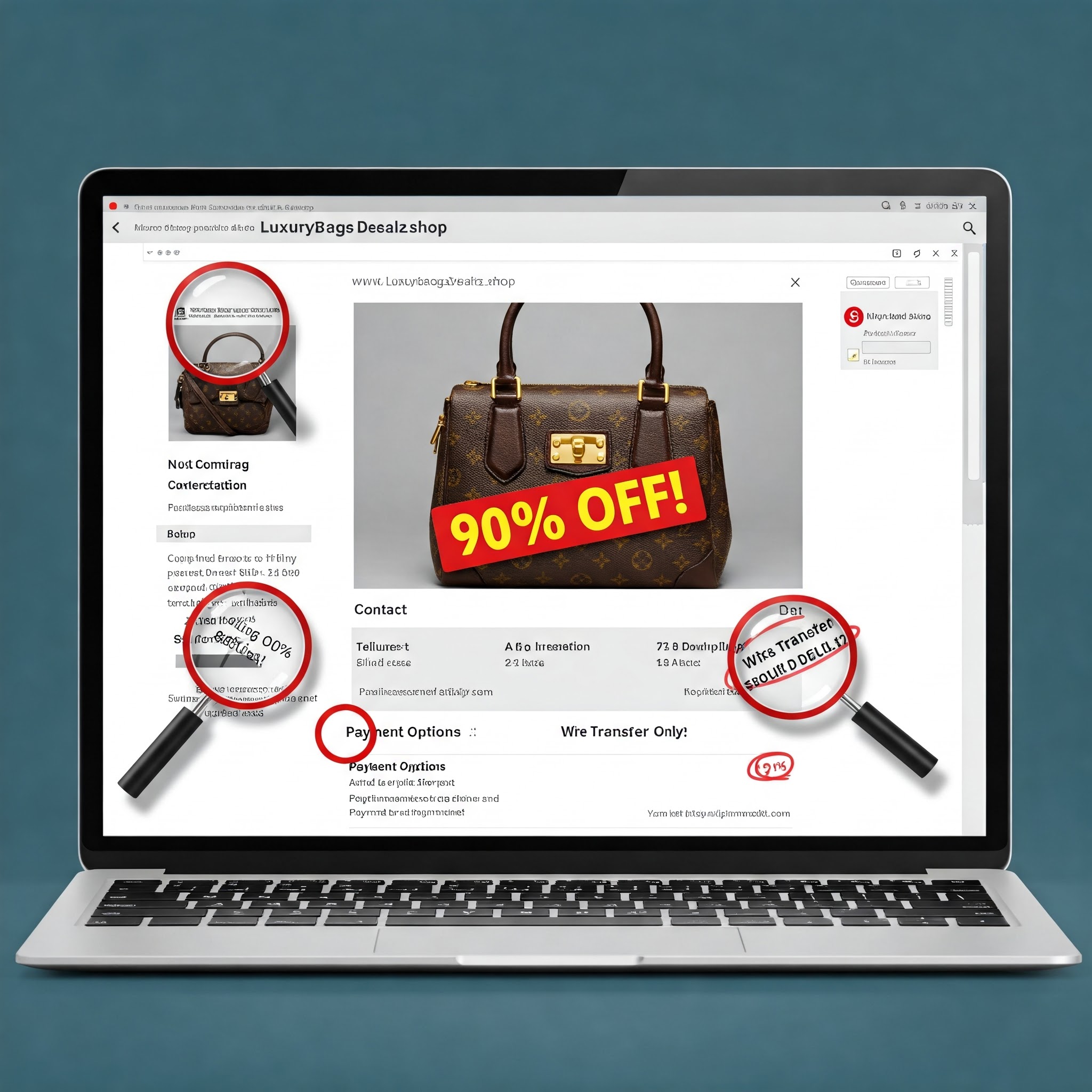

There are several warning signs that investors should be aware of when it comes to pump and dump schemes, including:

- Unsolicited investment opportunities: If you receive an unsolicited investment opportunity, particularly one that promises high returns, this should be treated with caution. Legitimate investment opportunities typically do not come from cold calls or spam emails.

- Pressure to act quickly: If you are being pressured to invest quickly, this could be a warning sign of a pump and dump scheme. Fraudsters will often use high-pressure tactics to try to get investors to act quickly, before they have time to investigate the investment opportunity.

- Lack of transparency: If an investment opportunity is not transparent about its fees, risks, or other important details, this could be a warning sign of a pump and dump scheme. Legitimate investment opportunities should be transparent and provide clear information to investors.

- False or misleading information: If an investment opportunity is being promoted using false or misleading information, this should be treated with caution. Fraudsters will often use false information to create hype around an investment and artificially inflate its price.

- Unusual trading patterns: If there are unusual trading patterns, such as large volumes of trading in a particular stock, this could be a warning sign of a pump and dump scheme. Investors should be wary of sudden spikes in trading volume or price that cannot be explained by legitimate market factors.

Tips to Avoid Pump and Dump Schemes

There are several steps that investors can take to protect themselves from falling victim to pump and dump schemes, including:

- Do your research: Before investing in any opportunity, do your research and investigate the company and its management team. Check their financial statements and look for any red flags that could indicate fraud or other illegal activities.

- Stay skeptical: Be wary of any investment opportunity that promises high returns with little or no risk. Legitimate investment opportunities involve some degree of risk, and high returns are typically associated with higher risk.

- Consult a financial advisor: If you are unsure about an investment opportunity, seek advice from a trusted financial advisor. They can help you assess the risks and make informed investment decisions.

- Be cautious of unsolicited offers: If you receive an unsolicited offer for an investment opportunity, be cautious. Do your research and investigate the company and its management team before investing any money.

- Report suspicious activity: If you suspect that you have been the victim of a pump and dump scheme or other investment fraud, report it to the relevant authorities. This can help to prevent other investors from falling victim to the same scheme.

Where to Report Pump and Dump Schemes

If you suspect that you have been the victim of a pump and dump scheme or other investment fraud in the US, there are several places that you can report it, including:

- Securities and Exchange Commission (SEC): The SEC is the primary regulator for the securities industry in the US. You can report investment scams and other fraudulent activity to the SEC through their website or by calling their toll-free hotline at 1-800-SEC-0330.

- Financial Industry Regulatory Authority (FINRA): FINRA is a self-regulatory organization that oversees the securities industry. You can report investment scams and other fraudulent activity to FINRA through their website or by calling their toll-free hotline at 1-844-57-HELP.

- Commodity Futures Trading Commission (CFTC): The CFTC is the primary regulator for the futures and options markets in the US. You can report investment scams and other fraudulent activity related to these markets to the CFTC through their website or by calling their toll-free hotline at 1-866-FON-CFTC.

- Federal Trade Commission (FTC): The FTC is a government agency that works to protect consumers from fraudulent and deceptive business practices. You can report investment scams and other fraudulent activity to the FTC through their website or by calling their toll-free hotline at 1-877-FTC-HELP.

- State Securities Regulators: Each state has its own securities regulator that oversees investment activity within that state. You can find contact information for your state securities regulator on the website of the North American Securities Administrators Association (NASAA).

It is important to report any suspected investment fraud to the relevant authorities as soon as possible. This can help to prevent other investors from falling victim to the same scheme and can increase the chances of recovering any lost funds.

Conclusion

Pump and dump schemes are a type of investment fraud that can result in significant losses for investors. These schemes typically involve artificially inflating the price of a stock or other investment, and then selling it at a profit. By staying vigilant and taking steps to protect themselves, investors can avoid falling victim to these schemes. If you suspect that you have been the victim of a pump and dump scheme or other investment fraud, it is important to report it to the relevant authorities.

Be the first to comment