Former Harrison Police Chief Pleads Guilty To Tax Evasion

Evaded More than $782,000 in Federal Income Tax by Failing to Report More than $2.5 Million in Revenue from 2011 through 2016

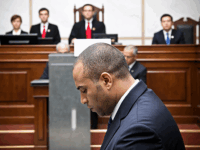

Geoffrey S. Berman, the United States Attorney for the Southern District of New York, and Jonathan D. Larsen, the Acting Special Agent in Charge of the New York Field Office of the Internal Revenue Service, Criminal Investigation (“IRS-CI”), announced that ANTHONY MARRACCINI pled guilty today to tax evasion before U.S. District Judge Kenneth M. Karas in White Plains federal court.

U.S. Attorney Geoffrey S. Berman said: “As he admitted in court today, former Harrison Police Chief Anthony Marraccini failed to report more than $2.5 million he earned through his ownership of a construction company and several rental properties. At a time when he was the top law enforcement officer in Harrison, Marraccini broke the law and evaded more than $780,000 in income taxes. Sworn officers of the law should be held to a higher standard. At a bare minimum, they should be expected to obey the law.”

IRS-CI Acting Special Agent in Charge Jonathan D. Larsen said: “As the Chief of Police for the Town of Harrison, Anthony Marraccini held a position of trust in the eyes of the public. That trust was broken when he decided to commit a serious tax felony. The laws of the land apply to everybody, regardless of position or power. IRS-CI special agents will continue their work to ensure that everybody pays their fair share.”

According to the allegations contained in the Information:

During the relevant time period of 2011 to 2016, MARRACCINI was the Chief of Police for the Town of Harrison, New York. MARRACCINI also owned and operated Coastal Construction Associates LLC (“Coastal Construction”), a construction business, and was also employed as a salesperson for two title companies. In addition, MARRACCINI owned several residential rental properties. MARRACCINI reported some of Coastal Construction’s revenue and expenses, and the rental income from some of his rental properties, on his personal federal income tax return.

MARRACCINI failed to report all of Coastal Construction’s revenue on his income tax returns from 2011 through 2016. Instead, he deposited some checks Coastal Construction received for construction work into his personal bank accounts. He also cashed some checks Coastal Construction received at a check cashing service and kept the cash for his personal use. In some instances, MARRACCINI deposited checks Coastal Construction received into Coastal Construction’s bank accounts but took portions of the deposits as cash, thus reducing the amounts of the deposits on Coastal Construction’s bank account statements. MARRACCINI then falsely represented to his tax return preparers that Coastal Construction’s bank account statements showed the vast majority of the company’s revenue for each year.

MARRACCINI failed to report more than $2.3 million in revenue for Coastal Construction for the tax years 2011 through 2016.

MARRACCINI also failed to report a total of more than $199,800 in rents received from two rental homes he owned in Purchase, New York, from 2011 through 2015. In addition, MARRACCINI failed to report $24,500 in rents he received from a rental home he owned in Rye, New York, in 2013 and 2014.

In total, MARRACCINI failed to report more than $2.5 million in revenue from Coastal Construction and the rental properties, thereby evading more than $782,000 in federal income tax from 2011 through 2016.

* * *

MARRACCINI, 54, of West Harrison, New York, pled guilty to one count of tax evasion, which carries a maximum sentence of five years in prison. The maximum potential sentence is prescribed by Congress and is provided here for informational purposes only, as the sentence will be determined by the court.

MARRACCINI is scheduled to be sentenced by Judge Karas on May 16, 2019.

Mr. Berman praised the outstanding investigative work of the IRS-CI and the Special Agents of the United States Attorney’s Office for the Southern District of New York.

This case is being handled by the Office’s White Plains Division. Assistant United States Attorney James McMahon is in charge of the prosecution.