Final Defendant Sentenced to 14 Years in Prison for Nationwide Foreclosure Rescue Scam

Over $90 Million in Fraudulent Loans and Hundreds of Homes Stolen from Homeowners

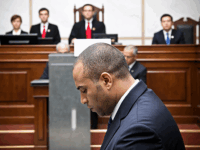

SACRAMENTO, Calif. — On Wednesday, September 14, 2016, Domonic McCarns, 41, of Irvine, was sentenced to 14 years in prison by U.S. District Judge Kimberly J. Mueller for conspiracy to commit mail fraud for his participation in a nationwide foreclosure-rescue scam, Acting U.S. Attorney Phillip A. Talbert announced.

McCarns is the final defendant to be sentenced for a pair of schemes that lured homeowners with the promise to help them avoid foreclosure and repair their credit. Two indictments were brought in 2008. Four defendants were convicted after two jury trials, 13 defendants pleaded guilty, and now, all 17 defendants have been sentenced. On September 9, 2013, Charles Head was sentenced to 35 years in prison, and on October 29, 2014, his brother and fellow leader in the scheme Jeremy Michael Head was sentenced to 10 years in prison.

Acting U.S. Attorney Talbert said: ‘This scheme purposely targeted the financially vulnerable during their time of greatest distress with promises of help. The defendants tricked the victims into handing over their most valuable assets, their homes. Few economic crimes are more reprehensible. This final sentence, in this case, will bring some measure of justice for their victims.”

“In large fraud schemes like the one devised by Charles Head, we can’t forget about the individual homeowners who comprised the millions of dollars in losses,” said Monica M. Miller, Special Agent in Charge of the Sacramento division of the FBI. “Today’s sentencing ends an investigation that has been ongoing for more than 10 years and brings some closure to the innocent people who were victimized by Head’s callous scheme.”

“Dominic McCarns and his co-conspirators assured innocent homeowners across the country facing foreclosure that they could turn around their misfortunes and keep their homes,” said Michael T. Batdorf, Special Agent in Charge, IRS-Criminal Investigation. “However the defendants had other plans which resulted in one of the most harmful mortgage fraud schemes in the country. The sentence handed down today by the court is befitting of this defendant and his actions.”

According to court documents, the defendants solicited homeowners facing foreclosure, and through misrepresentations, fraud, and forgery, substituted straw buyers for the victim homeowners on the titles of properties without the homeowners’ knowledge. These straw buyers were often friends and family members of the defendants or were solicited on the internet. Once the straw buyers were on the title to the homes, the defendants applied for mortgages to extract the maximum available equity from the homes. The defendants then shared the proceeds of the ill-gotten equity and the “rent” that the victim homeowners paid them. Ultimately, the victim homeowners were left with no home, no equity, and with damaged credit ratings.

Initially, the scam focused on distressed homeowners in California before expanding throughout the United States. In the course of the schemes, between January 2004 and June 2006, the defendants obtained over $90 million in fraudulent loans, caused estimated losses of over $50 million, and stole title to over 300 homes.

On December 2, 2013, McCarns was convicted after a five-week trial along with Charles Head, 36, of Pittsburgh, Pennsylvania, (formerly of Los Angeles); and Benjamin Budoff, 46, of Colorado Springs, Colorado. Head had been previously convicted in a trial in a nearly four-week trial in May 2013 with his brother Jeremy Michael Head, 34, of Huntington Beach.

This case was the product of an investigation by the Internal Revenue Service, Criminal Investigation and the Federal Bureau of Investigation. Assistant United States Attorneys Michael D. Anderson and Matthew Morris prosecuted the case.

Fourteen other defendants have been sentenced:

Elham Assadi, 39, of Irvine, sentenced to 5 years’ probation with 6 months of home detention;

Leonard Bernot, 50, of Laguna Hills, sentenced to 18 months in prison;

Akemi Bottari, 36, of Los Angeles, sentenced to 3 years’ probation with 6 months of home detention;

Keith Brotemarkle, 51, of Johnstown, Penn., sentenced to 5 years, 10 months in prison;

Benjamin Budoff, 49, Colorado Springs, Colo. sentenced to 4 years in prison;

Joshua Coffman, 37, of North Hollywood, sentenced to 20 months in prison;

John Corcoran, 61, of Anaheim, sentenced to 4.5 years in prison;

Sarah Mattson, 33, of Phoenix, Ariz., sentenced to 3 years’ probation with 3 months of home detention;

Omar Sandoval, 36, of Rancho Cucamonga, sentenced to 4 years and 10 months in prison;

Xochitl Sandoval, 37, of Rancho Cucamonga, sentenced to 8 months in prison;

Lisa Vang, 31, of Westminster, sentenced to 3 years’ probation;

Andrew Vu, 38, of Santa Ana, sentenced to 6 months in prison with 6 months of home detention;

Justin Wiley, 37, of Irvine, sentenced to 18 months in prison, and

Kou Yang, 40, of Corona, sentenced to 4 years in prison.

This case was part of the President’s Financial Fraud Enforcement Task Force. The task force was established to wage an aggressive, coordinated and proactive effort to investigate and prosecute financial crimes. With more than 20 federal agencies, 94 U.S. attorneys’ offices and state and local partners, it’s the broadest coalition of law enforcement, investigatory and regulatory agencies ever assembled to combat fraud. Since its formation, the task force has made great strides in facilitating increased investigation and prosecution of financial crimes; enhancing coordination and cooperation among federal, state and local authorities; addressing discrimination in the lending and financial markets and conducting outreach to the public, victims, financial institutions, and other organizations. For more information on the task force, please visit www.StopFraud.gov.