Tips for Avoiding Mortgage Foreclosure Rescue Scams

Beware of Unethical Mortgage Foreclosure Rescue Operators

A fairly new and dangerous threat has arisen for householders UN agency have fallen behind on their mortgage payments and will be in danger of proceeding – expedient firms.

They usually see themselves as a “foreclosure advisor” or “mortgage consultant,”

and market themselves as a “foreclosure service” or “foreclosure rescue agency.” They judge householders being vulnerable and desperate.

These firms claim they will assist householders facing proceeding with choices that permit them to stay their property, finance or modify Associate in Nursing existing mortgage, repair credit or facilitate “buy longer.” essentially, these “options” area unit meant to win over you to require the incorrect steps so that they will take your cash and probably your home.

Remember the recent speech, “If it’s too sensible to be true, it most likely is.” Be safe. it’s vital that you just take action by contacting your mortgage investor – or any legitimate money counselor – to search out real choices to avoid proceeding. variety of agencies offer free counselling services to householders UN agency area unit having hassle creating ends meet ( see the “Protect Yourself and Resources Sections” ).

These agencies will assist you explore your choices, which can vary from modifying your loan to refinancing your loan to commerce your home and exploitation any equity to begin over.

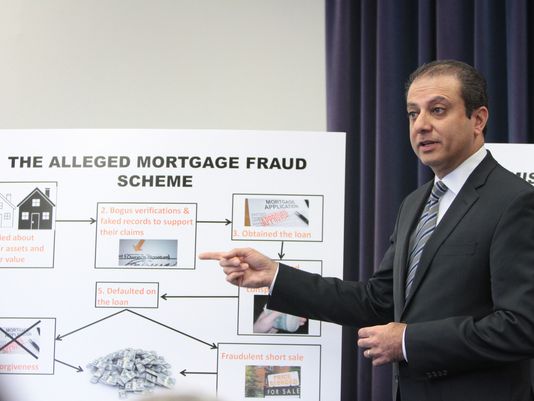

Watch Out for the Common proceeding Rescue Scams

Lease-Back or Repurchase Scams – during this situation, a promise is formed to pay off your delinquent mortgage, repair your credit and probably pay off credit cards and alternative debt. However, so as to try to to this, you need to “temporarily” sign your gift to a “third party” capitalist. you’re allowed to remain within the home as a renter with the choice to get the house back once a definite quantity of your time has passed or your money scenario improves. the difficulty is once you’ve got signed away your rights in your property, you will not be ready to repurchase the property later, even though you’ll and wish to. once the new owner takes possession of your property, the new owner will evict you. moreover, the sharpy is beneath no obligation to sell the house back to you. Typically, once the deed is signed away, the property changes hands various times. The sharpy could have taken a replacement mortgage out on your home for many thousands of greenbacks over your mortgage, creating it not possible for you to shop for back your home.

Partial Interest Bankruptcy Scams – The scam operator asks you to administer a partial interest in your home to 1 or additional persons. You then build mortgage payments to the scam operator in part of paying the delinquent mortgage. However, the scam operator doesn’t pay the present mortgage or look for new funding. every holder of a partial interest then files bankruptcy, one once another, with out your information. The bankruptcy court can issue a “stay” order on every occasion to prevent proceeding quickly. However, the keep doesn’t excuse you from creating payments or from repaying the complete quantity of your loan. This complicates and delays proceeding, whereas permitting the scam operator to keep up a stream of financial gain by collection payments from you, the victim. Bankruptcy laws offer vital protections to shoppers. This scam will solely quickly delay proceeding, and will keep you from exploitation bankruptcy laws licitly to deal with your money issues.

Refinance Scams– whereas there area unit legitimate refinancing programs offered, look out for folks motility as mortgage brokers or lenders giving to finance your loan thus you’ll afford the payments. The sharpy presents you with “foreclosure rescue” loan documents to sign. {you area unit|you’re} told that the documents are for a finance loan that may bring the mortgage current. What you don’t understand is that you just area unit surrendering possession of your home. The “loan” documents are literally deed transfer documents, and therefore the sharpy counts on your not really reading the work. Once the deed transfer is dead, you suspect your home has been reclaimed from proceeding for months or perhaps years till you receive Associate in Nursing eviction notice and see you now not own your home. At that time, it’s usually too late to try to to something concerning the deed transfer.

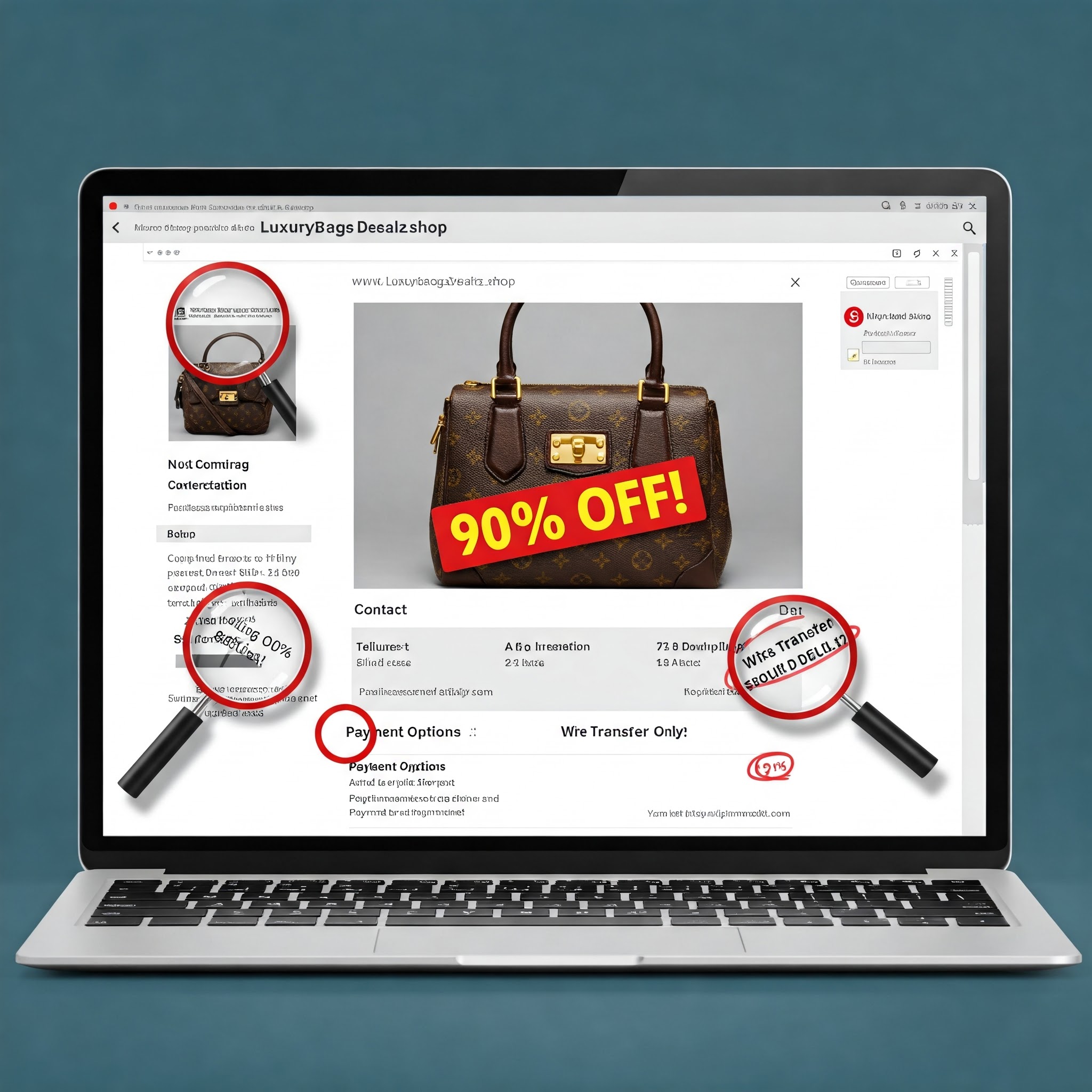

Internet and Phone Scams – Some scam lenders win over you to use for a low-interest real estate loan on the phone or net. They then extract important info, like your social insurance and checking account numbers. during this scam, the loan is straight away accepted, once that you begin faxing the documents and causation wire transfer payments to the phony company while not even meeting the investor. sadly, this scam can place you in double the maximum amount trouble–your personal details are purloined or sold , golf stroke you in danger of fraud, and your house is still in danger of proceeding.

Phantom facilitate Scams – The scam operator presents himself as somebody UN agency is in a position to counsel or facilitate a house owner out of proceeding. In exchange for his or her “services,” outrageous fees area unit charged and grand guarantees area unit created for strong illustration, that ne’er happens. The “services” performed entail light-weight work or occasional phone calls that you just may simply have created yourself. In the end, you’re worse off than before, as a result of you’ve got very little or no time to avoid wasting your home, or look for alternative help.

Caught in a very proceeding Scam?

If you get caught in one in every of these scams, it’s imperative that you just contact a professional person at once. Associate in Nursing professional will assist you as you navigate your method through the method. Lower financial gain people is also ready to realize free legal services; see http://www.findlegalhelp.org. If you suspect that you just area unit the victim of criminal activity, like cast documents being bestowed for your signature, you ought to contact your native enforcement agency.

Be the first to comment