First of Five Sentenced to Federal Prison in Large Fraud Scheme

HOUSTON – The first of five people from three different states has been ordered to federal prison following their convictions related to a $23 million nonexistent commercial accounts receivable scheme, announced U.S. Attorney Kenneth Magidson along with Special Agent in Charge Rick Goss of IRS-Criminal Investigation (CI).

Stefano Guido Vitale, 40, of Scottsdale, Arizona, pleaded guilty March 21, 2016, while Alan Leschyshyn, 53, of Cave Creek, Arizona; Bree Ann Davis, 40, of Lakewood, Colorado, and Tammie Roth Hanania, 59, and Edward Peter Hanania, 64, both of Folsom, California, all had previously entered their respective pleas. All were convicted of conspiring to engage a scheme to defraud and conspiracy to commit money laundering. Vitale and Leschyshyn were also convicted of eight additional counts of wire fraud.

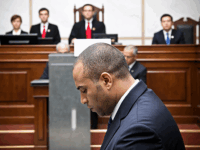

Today, U.S. District Judge Vanessa Gilmore ordered Leschyshyn to serve a total of 235 months in federal prison to be followed by five years of supervised release. He was also ordered to pay restitution in the amount of $6,477,451.85.

Tammie and Edward Hanania are set for sentencing later this month, while Davis and Vitale will be sentenced in January 2017.

“Today’s sentencing of Leschyshyn for his role in a $6 million fraud scheme is well deserved,” said Goss. “Leschyshyn abused his training and expertise by creating convincing false documents and information to support this massive fraud. The jail time handed down to Leschyshyn attests that no matter how sophisticated the fraud is, IRS-CI Agents will uncover the crimes and pursue those responsible.”

“>The scheme produced approximately $6.4 million in fraudulently obtained proceeds which the defendants agreed to launder through various bank accounts. They executed the scheme to defraud by using and establishing various business entities to sell, at a discount, nonexistent commercial accounts receivable. The defendants would approach factoring companies as sellers of customized gaming vault bundles and present fabricated invoices as evidence the defendants were owed a certain amount of money for goods provided to another one of their business entities. To establish creditworthiness of these companies and to convince the factoring company the credit risk was minimal, the defendants fabricated and/or altered documents and provided them to the factoring company.

The fraud conspiracy also proved that Vitale and Leschyshyn defrauded BOKF, NA, doing business as Bank of Arizona, when they applied for and received a $1 million line of credit secured by the Export Import Bank of the United States.

Leschyshyn was previously released on bond but ordered into custody following the hearing today. Vitale has been and remains in custody, while the remaining defendants are on bond pending their sentencing hearings.

The investigation leading to the charges was conducted by IRS – CI. Assistant U.S. Attorney Melissa Annis is prosecuting the case.