Maryland Restaurant Owner Pleads Guilty to Employment and Other Tax Crimes

A Maryland restaurant owner pleaded guilty today to willful failure to account for and pay over employment taxes and to filing a false personal tax return. Original Article

A Maryland restaurant owner pleaded guilty today to willful failure to account for and pay over employment taxes and to filing a false personal tax return. Original Article

FraudsWatch is а site reporting on fraud and scammers on internet, in financial services and personal. Providing a daily news service publishes articles contributed by experts; is widely reported in thе latest compliance requirements, and offers very broad coverage of thе latest online theft cases, pending investigations and threats of fraud.

Woman Sentenced to Seven Years in Federal Prison After Stealing from an Elderly Widow and Her Deceased Son, a…

Parma couple charged for conspiring to avoid paying taxes; people used as hotel housekeeping falsely treated as independent contractors…

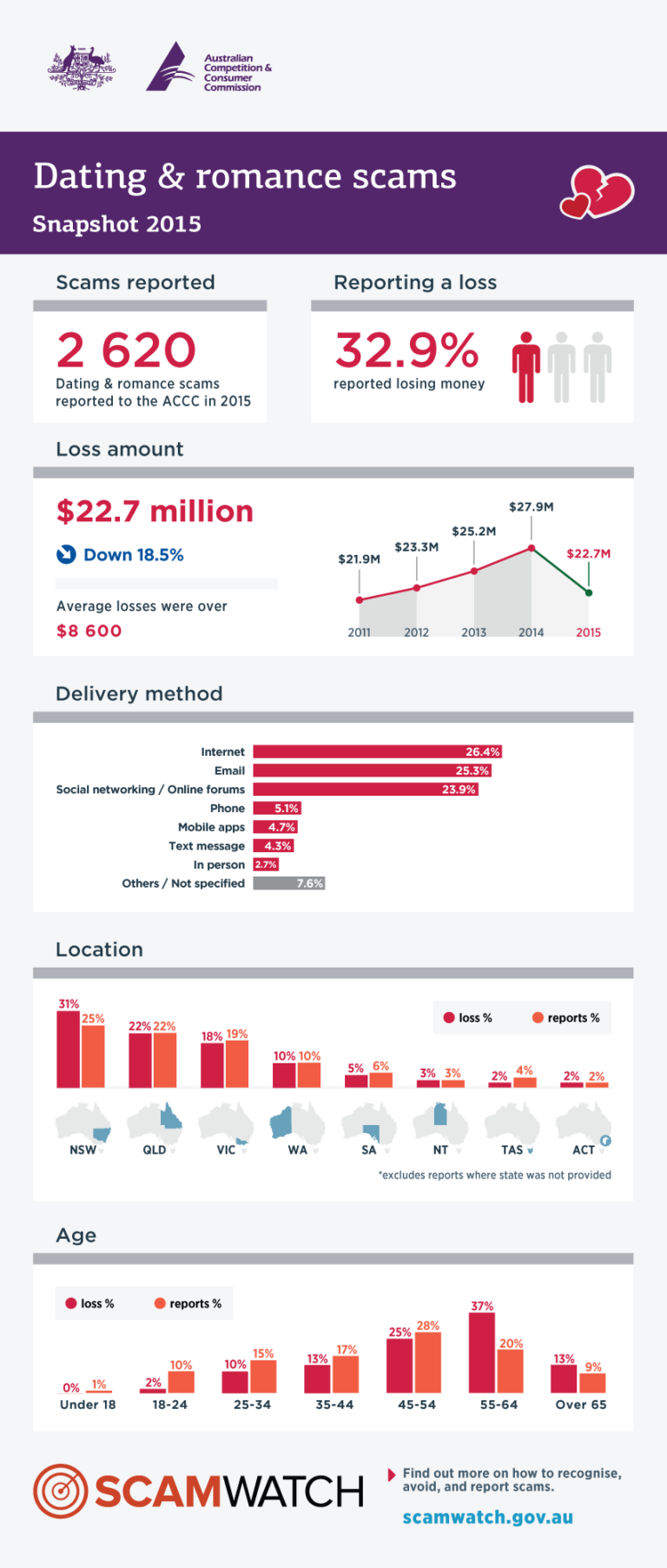

$22.7 million lost to dating scams in 2015 This Valentine’s Day, the Australian Competition and Consumer Commission is warning…

Manhattan U.S. Attorney Announces Charges Against Six Individuals In International High-Yield Investment Fraud Scheme Scheme Participants Impersonated Federal Reserve…

The Australian Competition and Consumer Commission is warning consumers to beware of scammers imitating Department of Human Services or…

San Antonio Businessman Sentenced to Prison for Estimated $5.3 Million Tax And Wire Fraud Scheme A federal judge this…