Free Trials or Financial Traps? Your Expert Guide to Navigating Offers and Avoiding Scams

The Allure of “Free” – Why Free Trials Are Everywhere

The word “free” holds undeniable appeal. In today’s digital marketplace, the opportunity to “try before you buy” through free trial offers has become a ubiquitous marketing strategy, allowing consumers to sample products and services without immediate financial commitment. This approach is widespread, spanning numerous sectors of the economy.

Consumers routinely encounter free trials for streaming services, with platforms like Hulu offering extended 30-day trials for on-demand plans and shorter 3-day trials for live TV, while Apple TV+, Paramount+, Philo, and FuboTV typically provide 7-day trials, and Amazon Prime Video offers a 30-day trial bundled with Prime membership. Interestingly, some major players like Disney+ have shifted focus towards bundles rather than traditional free trials, offering savings through combined packages with services like Hulu and Max.

The software and Software-as-a-Service (SaaS) industry also heavily utilizes free trials. SEO tools such as Search Atlas, Moz, Semrush, and others often provide trial periods ranging from 7 to 30 days, allowing potential customers to explore features like keyword research, site audits, and rank tracking before purchasing a subscription. This model allows users to assess the value and functionality of complex tools firsthand.

Beyond digital services, free trials are common for subscription boxes (like meal kits mentioned in ) and various consumer goods, particularly in the health and beauty space. Offers for skincare products, weight loss supplements, keto and CBD items, and teeth whiteners frequently employ the free trial model, often promising significant results with minimal initial cost beyond shipping and handling.

This very pervasiveness, however, creates a complex landscape for consumers. While legitimate businesses use free trials effectively, the model is also exploited by deceptive operators. The constant exposure to legitimate free trials from trusted brands in entertainment and productivity can normalize the practice, potentially lowering consumer vigilance when encountering offers from less reputable sources, particularly for desirable items like health supplements. This familiarity, cultivated by positive experiences with genuine offers , can create a cognitive shortcut, leading consumers to associate “free trial” with low risk. Scammers capitalize on this by mimicking the format and language of legitimate offers, making differentiation difficult. Thus, the success of genuine free trials paradoxically creates fertile ground for scams.

Furthermore, a divergence in strategy is observable. While established services like Disney+ and Netflix may reduce or eliminate free trials, perhaps finding bundles or brand value more profitable and less prone to abuse or high servicing costs for non-converting users , scam operations continue to rely heavily on the potent lure of “free”. This suggests that an overly aggressive “FREE” marketing approach, like the repetitive ads noted in the FTC’s TurboTax case , might itself serve as a warning sign. This article aims to equip consumers with the knowledge to navigate this terrain, distinguishing genuine opportunities from costly financial traps.

The Hidden Catch: Understanding Negative Option Marketing

The engine driving many free trial offers, both legitimate and deceptive, is a business model known as “negative option marketing.” At its core, this model operates on a principle where a consumer’s silence or failure to take an affirmative action (like cancelling an offer) is interpreted by the seller as consent to an agreement or to ongoing charges.

Negative option plans manifest in several common forms :

- Free-to-Pay / Nominal-Fee-to-Pay Conversions: This is the structure most relevant to problematic free trials. Consumers receive a product or service for free, or for a small shipping and handling fee, for a limited trial period. If they do not take specific action to cancel before the trial ends, the seller automatically begins charging the full price, often on a recurring basis.

- Automatic Renewals: Commonly used for subscriptions like magazines, software licenses, gym memberships, and streaming services. The subscription automatically renews (and the consumer is charged) at the end of each term (e.g., monthly or annually) unless the consumer actively cancels beforehand. While often legitimate, this requires consumers to track renewal dates.

- Continuity Plans: Consumers agree upfront to receive regular shipments of goods (like supplements or beauty products) or ongoing services, and are billed periodically until they cancel the arrangement.

- Prenotification Plans: Historically associated with book or music clubs, these plans involve sellers sending periodic notices offering specific goods. If the consumer doesn’t actively decline the offer by a deadline, the goods are shipped and charged. This model is less prevalent in the digital age but falls under the negative option umbrella.

Businesses utilize these models for understandable reasons. They can offer convenience for consumers who appreciate uninterrupted service or regular deliveries, and they provide businesses with predictable recurring revenue streams and enhanced customer retention.

However, the fundamental mechanism of negative option marketing—interpreting silence as consent—runs counter to traditional transaction principles requiring explicit agreement to pay. This inherent friction point is precisely why the model is susceptible to deceptive practices. Traditional purchases involve a clear decision to buy. Negative options shift the burden: the initial “agreement” might be vague (just clicking for a “free” item), while the obligation falls on the consumer to actively prevent future charges by remembering and acting before a deadline. Scammers exploit this by obscuring the future financial commitment tied to the initial offer and making the required cancellation process difficult or confusing.

This potential for abuse has led to specific regulations designed to protect consumers. Key among these are the federal Restore Online Shoppers’ Confidence Act (ROSCA) and the Federal Trade Commission’s (FTC) Negative Option Rule, which aim to ensure transparency and consumer control.

Moreover, the evolution of commerce has amplified the risks. Early negative option plans often involved physical goods, like books or CDs arriving in the mail, which served as tangible reminders of the subscription. The shift to digital services—streaming, software, online memberships—allows for instant enrollment and “delivery,” often without such physical cues. Consumers can quickly sign up for multiple digital trials online and easily forget about them. This lack of physical reminders, combined with the ease of digital sign-up, increases the likelihood that unwanted charges will accumulate unnoticed on bank or credit card statements. This digital transformation underscores the need for robust, online-focused regulations like ROSCA and the updated Negative Option Rule’s requirements for clear online disclosures and easy digital cancellation.

Spotting the Scam: Common Tactics Used in Deceptive Free Trial Offers

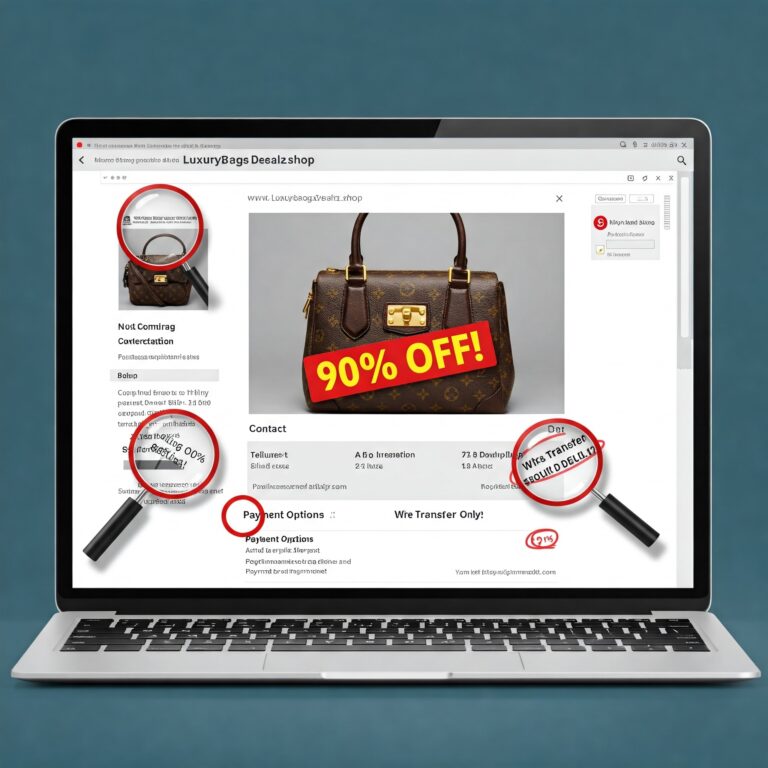

Recognizing the warning signs of a deceptive free trial offer is crucial for avoiding financial loss and frustration. Scammers employ a range of tactics designed to lure consumers in, obscure the true terms, bill without proper consent, and make cancellation exceedingly difficult.

Misleading Advertising & Landing Pages:

- Exaggerated Claims: Offers often promise unrealistic results, such as rapid weight loss or miraculous health benefits, playing on consumer desires.

- Fake News or Review Sites: Consumers may first encounter a “landing page” designed to look like an independent news article, blog post, or consumer review site, filled with fake testimonials and glowing praise for the product. These pages then link to the actual sales site.

- Fake Celebrity Endorsements: Scammers frequently use images of celebrities without permission, claiming they endorse or use the product. These endorsements are almost always false, and sometimes a disclaimer buried in the fine print even admits they aren’t real.

- False Urgency: Tactics like “limited supply” claims or countdown timers are used to pressure consumers into making hasty decisions without careful consideration.

- Deceptive Website Design: Scam websites can appear highly professional and legitimate. Some operations even copy the look and feel of major media outlets (like morning news shows) to enhance credibility.

Hidden Terms & Conditions:

- Obscured Details: Critical information—such as the actual length of the trial period (often only 14 days or less), the full price of the product, the fact that signing up enrolls the consumer in recurring monthly shipments (auto-ship or continuity plans), and the specific cancellation policy—is often hidden.

- Fine Print & Hyperlinks: These crucial terms may be buried in tiny, hard-to-read fine print at the bottom of the page or accessible only by clicking obscure hyperlinks leading to lengthy and confusing “Terms and Conditions” documents. Many consumers report never seeing these terms before providing payment details.

- Short Trial Periods: The trial period offered is often deliberately short (e.g., 14 days from the order date, not the delivery date). Combined with shipping times, this can make it practically impossible for consumers to receive the product, evaluate it, and return it within the window to avoid charges.

Unauthorized Billing & Subscription Traps:

- Immediate Charges: Despite being advertised as “free,” consumers are often charged immediately, either for the product itself or for exorbitant shipping and handling fees far exceeding actual costs.

- Automatic Enrollment: Accepting the initial “trial” offer frequently results in the consumer being unknowingly enrolled in expensive monthly subscription plans, leading to unexpected recurring charges on their credit or debit cards.

- Pre-Checked Boxes: Websites often use pre-checked boxes that, if left unchecked by the consumer, are treated as consent to the hidden terms, future charges, enrollment in additional programs, or sharing of personal data. Consumers must actively look for and uncheck these boxes.

- Refund Difficulties: Victims report significant struggles in obtaining refunds for unauthorized charges, with companies often refusing or offering only partial refunds.

- Evasion Tactics: More sophisticated operations use complex methods to avoid detection and chargebacks. This can include using multiple shell corporations to obtain numerous merchant accounts, employing dishonest payment processors (ISOs) who are complicit in the fraud, laundering charges through legitimate businesses to keep chargeback rates low, and frequently changing product names and website addresses. Some even display different website versions depending on how the user arrived, showing clear disclosures only to visitors who type the URL directly, making it hard for victims to later prove deception.

Difficult Cancellation Process:

- Unresponsive Customer Service: Attempts to contact the seller to cancel recurring charges or shipments are often met with unanswered phone calls, ignored emails, or unhelpful, sometimes rude, customer service representatives.

- Onerous Return Requirements: Companies may impose strict and often undisclosed conditions for returns, such as requiring a Return Merchandise Authorization (RMA) number that is difficult or impossible to obtain, or demanding returns via certified mail at the consumer’s expense.

- Cancellation Hurdles: The process to cancel is often intentionally made much more difficult than the process to sign up, involving navigating confusing phone menus, enduring lengthy hold times, or facing aggressive retention tactics. This practice directly contravenes the principles of the updated FTC Negative Option Rule requiring cancellation to be at least as easy as enrollment.

These tactics often work in concert, creating a sophisticated trap. Scammers intentionally leverage common human behaviors and psychological tendencies. The scarcity principle is triggered by “limited time” offers , encouraging impulse decisions. Authority bias is exploited through fake celebrity endorsements or mimicking trusted news sources , reducing critical evaluation. The reliance on fine print banks on the common tendency to skip reading lengthy terms. Pre-checked boxes utilize inertia, as it requires effort to uncheck them. This multi-layered psychological manipulation aims to bypass rational assessment and quickly secure the consumer’s payment information.

Furthermore, the technical sophistication employed by some scammers—like varying website content based on entry point, using shell companies, and laundering payments —indicates these are often not amateur efforts but organized operations designed to defraud consumers while evading detection by banks, credit card companies, and regulators. This underscores the scale of the problem, reflected in the significant consumer losses reported by organizations like the BBB and FTC , and highlights why both individual vigilance and robust regulatory enforcement are necessary.

Table 1: Red Flags of a Free Trial Scam

| Red Flag | Description | Supporting Sources |

|---|---|---|

| Aggressive “Free” Claims | Overemphasis on “free” with hidden costs (e.g., high S&H); sounds too good to be true. | |

| Fake Celebrity Endorsements | Uses celebrity images/names without permission; claims may be disproven or disclaimed in fine print. | |

| Hidden Terms / Fine Print | Key details (cost, trial length, auto-renewal, cancellation) are buried, hard to find, or unclear. | |

| Pre-Checked Boxes | Boxes are already checked, agreeing to terms, extra products, or future charges you didn’t explicitly select. | |

| Unclear Costs & Billing | Difficulty determining the exact price after the trial, when you’ll be billed, or the frequency of charges. | |

| Difficult Cancellation Info | Information on how to cancel is missing, hard to find before signup, or seems overly complicated. | |

| High-Pressure Tactics / Urgency | Uses countdown timers, “limited supply” claims, or pressure to act immediately without thinking. | |

| Requests Excessive Personal Info | Asks for more information than seems necessary for a simple trial, especially sensitive financial details for a “free” offer. | |

| Poor Company Reputation / No Contact Info | Online searches reveal many complaints/scam reports; legitimate contact details (address, phone) are missing or hard to verify. |

This table provides a quick reference for consumers to evaluate offers they encounter, helping them pause and investigate before committing.

Real-World Examples: Where You Might Encounter These Traps

Deceptive free trial offers are not confined to obscure corners of the internet; they often appear for products and services consumers actively seek out. Understanding common scenarios can help raise awareness.

- Health & Beauty Products: This is a particularly notorious category. Offers for skincare creams (especially anti-aging), weight loss supplements (like keto or garcinia cambogia), CBD oil products, and teeth whiteners are frequently promoted using deceptive free trial tactics. These campaigns often feature fake celebrity endorsements and make dramatic, unsubstantiated claims about effectiveness. The FTC has pursued numerous cases against operators selling such products through misleading “risk-free” trials that trap consumers in costly continuity plans. The FTC’s action against Tarr Inc., resulting in over $6 million in refunds, involved health products marketed deceptively. These products often target consumer insecurities about appearance or health, making potential victims more susceptible to exaggerated promises and less likely to critically examine the offer’s terms. This emotional appeal contrasts sharply with trials for more functional items like streaming services, where evaluation may be more rational.

- Streaming Service Lookalikes: As consumers increasingly rely on streaming services, scammers have adapted. Reports indicate bogus offers for free passes to legitimate services like Netflix appearing on social media. Clicking these links doesn’t lead to free streaming but aims to trick users into providing personal information (phishing), banking details, or downloading malware. This represents an evolution in tactics, moving beyond selling dubious products to leveraging the trust associated with major brands for outright data theft or cybercrime. The “free trial” lure becomes a vector for identity theft, expanding the potential harm beyond unwanted charges.

- Software and Online Services: The world of software, including specialized tools like those for Search Engine Optimization (SEO), also sees free trial issues. While many reputable SEO software companies offer legitimate free trials allowing users to test complex features , the field is also rife with scams. Some entities offer “free trial SEO services” that provide no actual value, may employ tactics harmful to a website’s ranking (“black hat” techniques), or are simply a ploy to gain administrative access to a website or obtain credit card details. Unsolicited emails promising guaranteed top Google rankings or huge traffic increases for a low monthly fee after a “free trial” are major red flags. Even legitimate-seeming offers require scrutiny; the FTC highlighted misleading “free” tax filing claims by TurboTax, demonstrating that even established companies can face scrutiny over how “free” offers are presented.

- Subscription Boxes and Other Physical Goods: Continuity plans, where consumers receive and are billed for regular shipments, exist for various physical goods beyond supplements. FTC cases have involved items like golf and kitchen gadgets sold through deceptive trial offers that led to unwanted recurring charges.

Being aware of these common categories can help consumers exercise extra caution when encountering free trial offers, especially those promoted through unsolicited emails, social media ads, or websites making extraordinary claims.

Know Your Rights: Regulations Protecting Consumers

Consumers are not powerless against deceptive free trial offers and negative option marketing. A framework of federal laws and regulations exists to provide protection, setting standards for how businesses must operate and offering avenues for recourse.

- FTC Act Section 5: This is the foundational consumer protection law in the U.S., prohibiting “unfair or deceptive acts or practices” in commerce.

- A practice is deceptive if it involves a material representation, omission, or practice that is likely to mislead a consumer acting reasonably under the circumstances. Hiding the terms of a negative option plan or misrepresenting a product falls under this.

- A practice is unfair if it causes or is likely to cause substantial consumer injury which is not reasonably avoidable by consumers themselves and not outweighed by countervailing benefits to consumers or competition. Billing consumers without their consent or making cancellation unreasonably difficult can be deemed unfair. The FTC uses Section 5 as its primary tool to challenge misleading free trial offers.

- Restore Online Shoppers’ Confidence Act (ROSCA): Enacted to specifically address deceptive practices in online negative option marketing. ROSCA mandates that online sellers must:

- Clearly and conspicuously disclose all material terms of the offer (including the existence of the negative option feature, its cost, and how to cancel) before obtaining the consumer’s billing information.

- Obtain the consumer’s express informed consent to the negative option charge before charging their financial account.

- Provide simple mechanisms for the consumer to stop recurring charges (e.g., easy online cancellation).

- FTC Negative Option Rule (16 CFR Part 425): Originally covering only prenotification plans, this rule has been significantly amended, with key provisions taking effect in January and May 2025. The updated rule applies to all forms of negative option marketing (including free trials, auto-renewals, continuity plans) across all media (online, phone, in-person). It reinforces and expands upon ROSCA and Section 5 principles with specific requirements :

- § 425.3 Misrepresentations: Prohibits misrepresenting any material fact related to the transaction, including the underlying product/service, costs, endorsements, or the negative option feature itself.

- § 425.4 Disclosure: Mandates clear and conspicuous disclosure of key terms (recurring charges, deadlines, costs, cancellation info) before obtaining billing information and immediately adjacent to the consent mechanism. Disclosures must be unavoidable online (not hidden behind clicks/hovers).

- § 425.5 Express Informed Consent: Requires obtaining unambiguous affirmative consent specifically for the negative option feature, separate from other parts of the transaction, before charging. Consent records must be maintained.

- § 425.6 Simple Cancellation Mechanism: This is a cornerstone of the updated rule. Cancellation must be “at least as easy” as the method used to sign up. It must be offered through the same medium (e.g., online signup requires online cancellation). Sellers cannot force consumers to interact with retention specialists or navigate complex processes if sign-up was simple. Cancellation must immediately halt further charges.

The evolution of these regulations—from the original rule focusing on mail-order clubs , to ROSCA addressing the rise of e-commerce , to the comprehensive 2025 amendments tackling persistent cross-media abuses —reflects an ongoing effort by regulators to adapt to changing market practices and technologies. Each iteration attempts to close loopholes exploited by deceptive marketers, demonstrating that regulation often follows observed consumer harm. This suggests that continued vigilance and potential future updates will likely be necessary as new tactics emerge.

Notably, the enhanced rule’s strong emphasis on making cancellation “at least as easy” as sign-up signifies a potential shift in regulatory focus. While prior rules centered heavily on upfront disclosure and consent , the persistent consumer complaints about cancellation difficulties prompted regulators to mandate low-friction processes for ending subscriptions. This acknowledges that initial consent might be flawed or later regretted, and consumers require a straightforward exit path, shifting some responsibility back to businesses to retain customers through value rather than inertia or obstacles.

- Enforcement and Industry Policies: The FTC actively enforces these rules, bringing cases against companies engaged in deceptive practices and securing settlements that return millions of dollars to affected consumers. The agency also collaborates with partners like the Better Business Bureau (BBB) and payment networks. Major credit card companies like Mastercard and Visa have also implemented their own policies requiring merchants to obtain clearer cardholder approval for recurring charges after trials and to simplify cancellation, complementing government regulations.

Table 2: Key Consumer Rights Under FTC Rules & ROSCA

| Consumer Right | Explanation | Relevant Regulations |

|---|---|---|

| Right to Clear Disclosure | Before providing billing info, you must be clearly told about recurring charges, costs, trial end dates/deadlines to avoid charges, and how to cancel. Disclosures must be easy to see and understand. | FTC Negative Option Rule (§ 425.4), ROSCA, FTC Act Section 5 |

| Right to Express Informed Consent | You must give unambiguous, affirmative agreement specifically to the negative option charges before you are billed. This consent must be separate from other parts of the transaction. | FTC Negative Option Rule (§ 425.5), ROSCA, FTC Act Section 5 |

| Right to Simple Cancellation | Cancelling must be at least as easy as signing up. You must be able to cancel through the same method (online, phone, etc.) you used to enroll. Cancellation must immediately stop future charges. | FTC Negative Option Rule (§ 425.6), ROSCA |

| Right to Be Free from Misrepresentation | Sellers cannot lie about or mislead you regarding any important aspect of the offer, the product/service, the costs, or the terms of the negative option plan. | FTC Negative Option Rule (§ 425.3), FTC Act Section 5 |

Export to Sheets

Knowing these rights empowers consumers to identify violations and provides leverage when disputing charges or filing complaints.

Your Defense Plan: How to Avoid Free Trial Scams

While regulations provide a safety net, proactive vigilance remains the best defense against falling victim to free trial scams. Consumers can take several steps before, during, and after signing up for a trial to protect themselves.

Pre-Sign-Up Research:

- Investigate the Company: Before providing any information, search online for the company name combined with terms like “scam,” “complaint,” or “review”. Check the Better Business Bureau (BBB) website for ratings, complaints, and scam reports.

- Verify Legitimacy: Look for clear and verifiable contact information, including a physical address and working phone number. Be extremely cautious of offers received through unsolicited emails or website contact forms, as these are common tactics for scams.

Scrutinize the Offer:

- Read ALL Terms and Conditions: Do not skip the fine print. Carefully read all terms, paying close attention to the trial duration, the full price after the trial, automatic renewal clauses, cancellation procedures, and refund policies. If anything is unclear or seems suspicious, do not proceed. Understand that scammers intentionally hide key details.

- UNCHECK Pre-Checked Boxes: Actively look for any boxes that have been checked for you. These often grant permission for future charges, enrollment in additional programs, or data sharing. Uncheck any box you do not explicitly agree to.

- Question “Free”: If the offer requires payment for shipping and handling, taxes, or other fees, it’s not truly free. Assess if these fees seem reasonable or excessive, as inflated S&H can be a way to profit even from the “trial”.

- Confirm Cancellation Details Upfront: Before entering payment information, make sure you understand exactly how to cancel the trial or subscription and that the process appears straightforward. If cancellation instructions are missing or convoluted, consider it a major red flag.

During the Trial:

- Mark Your Calendar: Immediately note the date the trial period ends. Set multiple reminders a few days before the deadline to give yourself ample time to evaluate the product/service and cancel if desired.

- Monitor Financial Statements: Regularly review your credit card and bank account statements online. Check for any charges from the company, especially unexpected amounts or charges appearing before the trial should have ended.

Payment and Information Protection:

- Choose Payment Method Wisely: Credit cards generally offer stronger fraud and chargeback protections than debit cards. Avoid paying for trials with wire transfers, gift cards, or reloadable cards, as these methods offer little recourse if something goes wrong and are favored by scammers.

- Consider Virtual Credit Cards: Many credit card issuers now offer virtual account numbers. These are unique numbers linked to your main account but can often be set with spending limits or restricted to a single merchant, and can be easily deleted after use, effectively cutting off future billing attempts.

- Utilize Payment Platform Controls: Services like PayPal may offer settings within your account to manage or block automatic recurring payments authorized for specific merchants.

- Protect Personal Information: Be cautious about how much personal information you provide. Consider using a secondary email address specifically for trial sign-ups to limit spam or potential data exposure if the company is breached or sells data.

Maintain Healthy Skepticism:

- Trust Your Gut: If an offer seems too good to be true, it likely is.

- Resist Pressure: Do not be rushed into decisions by high-pressure sales tactics, countdown timers, or claims of extreme urgency. Legitimate businesses will give you time to consider.

- Talk it Over: Before signing up, especially if you feel uncertain, discuss the offer with a trusted friend or family member. Talking about it can help clarify thoughts and spot potential red flags.

Implementing these steps requires a combination of proactive research before committing and diligent monitoring during the trial period. Relying solely on one aspect, like setting a calendar reminder without fully understanding the terms, leaves vulnerabilities. A multi-layered defense strategy—researching the company, scrutinizing the terms, managing payment methods, setting reminders, and monitoring statements—is the most effective approach to counter the multi-layered tactics employed by scammers.

Furthermore, the advice regarding payment methods highlights the crucial role financial intermediaries play. While regulations target merchant behavior, consumers can exert significant control at the payment level by choosing methods with better protections (credit cards) or utilizing tools like virtual cards or PayPal controls that allow user-managed blocking of unwanted charges. This suggests that consumer empowerment through payment technology is a valuable complement to regulatory enforcement.

Table 3: Your Free Trial Checklist: Before You Click “Submit”

| Checklist Item | Action / Question to Consider | Sources |

|---|---|---|

| 1. Researched the Company? | Did you search online for the company name + “scam,” “complaint,” “review”? Checked BBB? | |

| 2. Found Contact Info? | Is there a legitimate physical address and working phone number listed? | |

| 3. Read ALL Terms? | Did you find and read the full terms & conditions? Understand trial length, post-trial cost, renewal policy, cancellation steps, refund policy? | |

| 4. Understood Cancellation Process? | Is it clear HOW and WHEN you need to cancel? Does the process seem simple and straightforward? | |

| 5. Checked for Pre-Checked Boxes? | Did you look for and UNCHECK any boxes agreeing to extra charges, subscriptions, or terms you don’t want? | |

| 6. Confirmed Total Cost (incl. S&H)? | Do you know the exact amount you might be charged after the trial? Is the initial shipping/handling fee reasonable? | |

| 7. Offer Seem Realistic? | Are the product claims believable? Does the offer seem too good to be true? Are there high-pressure tactics? | |

| 8. Payment Method Secure? | Are you using a credit card (preferred for protection) or a secure method like a virtual card? Avoid debit cards if possible for unknown merchants. |

Using this checklist before providing payment details encourages due diligence and helps counteract impulsive decisions driven by misleading advertising.

Caught in the Trap? Steps to Take if You’ve Been Scammed

Despite best efforts, consumers can still find themselves enrolled in unwanted subscriptions or facing unauthorized charges from deceptive free trial offers. If this happens, acting quickly and methodically is crucial.

- Contact the Company Directly (Attempt Resolution):

- Your first step should be to contact the merchant responsible for the charge. Locate their customer service phone number or email address (often found on the transaction details on your statement or their website, if accessible).

- Clearly state that you wish to cancel the subscription/service immediately and request a refund for any unauthorized charges.

- Keep detailed records of all communication: dates, times, names of representatives spoken to, and exactly what was discussed or promised.

- Be persistent, but be aware that companies engaged in scams are often uncooperative and may refuse cancellation or refunds.

- Contact Your Credit Card Company or Bank (Dispute the Charge):

- If the company is unresponsive or refuses to cancel/refund, contact your credit card issuer or bank immediately. Use the customer service number found on the back of your card.

- Inform them you want to dispute the charge(s) (initiate a “chargeback”).

- Clearly explain the situation: you did not authorize the charge, you were deceived by the offer’s terms, you attempted to cancel but were unable, the company is unresponsive, etc. Provide any evidence you collected (e.g., cancellation confirmation emails, screenshots of misleading terms, communication logs).

- Credit cards generally offer more robust chargeback rights than debit cards. However, for unauthorized electronic fund transfers from a bank account via debit card, Regulation E provides certain protections, including requiring written authorization for recurring debits. Mention this if applicable when contacting your bank.

- Follow your card issuer’s specific dispute process, which may involve filling out a form online or mailing a letter. The FTC provides a sample dispute letter that can be adapted. Sending documentation via certified mail with a return receipt is advisable for important correspondence.

The chargeback mechanism is a vital tool for consumers facing unresponsive or fraudulent merchants. It allows bypassing the merchant to seek resolution directly from the financial institution. While success isn’t guaranteed, especially if the merchant provides “proof” of agreement to fine print , prompt action and clear documentation significantly improve the chances of recovering funds. It represents one of the few direct financial remedies available in these situations.

- Report the Scam to Authorities:

- Reporting the deceptive practices helps protect other consumers and provides valuable data for law enforcement and regulatory agencies. While reporting may not result in direct individual restitution, it contributes to identifying patterns, triggering investigations, and informing policy changes. Aggregated complaint data is crucial for agencies like the FTC and BBB to track trends and target enforcement efforts. File reports with:

- Federal Trade Commission (FTC): ReportFraud.ftc.gov

- Better Business Bureau (BBB): BBB.org/scamtracker. Consider also reporting misleading advertising via BBB AdTruth.

- Your State Attorney General: Find contact information through the National Association of Attorneys General website or a direct online search.

- FBI Internet Crime Complaint Center (IC3): ic3.gov, particularly if the scam involved significant financial loss, identity theft concerns, or other cybercrime elements.

- (If applicable) Canadian Anti-Fraud Centre: antifraudcentre-centreantifraude.ca.

- Reporting the deceptive practices helps protect other consumers and provides valuable data for law enforcement and regulatory agencies. While reporting may not result in direct individual restitution, it contributes to identifying patterns, triggering investigations, and informing policy changes. Aggregated complaint data is crucial for agencies like the FTC and BBB to track trends and target enforcement efforts. File reports with:

Taking these steps—attempting direct resolution, disputing charges, and reporting the scam—provides the best chance of mitigating personal financial damage and contributing to broader consumer protection efforts.

Conclusion: Stay Vigilant in the Subscription Economy

Free trial offers are an ingrained feature of the modern marketplace, offering genuine value when presented transparently but posing significant risks when used deceptively. The convenience of trying before buying can easily morph into the frustration and financial drain of unwanted recurring charges due to negative option marketing tactics. As explored, these traps often rely on misleading advertising, hidden terms, unauthorized billing, and difficult cancellation processes.

The rise of the “subscription economy,” where ongoing relationships replace discrete purchases, fundamentally alters how consumers interact with businesses. This shift necessitates a new level of consumer diligence. Managing numerous recurring payments requires active oversight—regularly reviewing financial statements, understanding subscription terms, and promptly cancelling unwanted services—to avoid accumulating unnecessary costs or falling prey to scams that exploit this landscape.

Fortunately, consumers are not without recourse. Robust regulations like the FTC Act, ROSCA, and the significantly strengthened FTC Negative Option Rule provide crucial protections by mandating clear disclosures, express informed consent, and simple cancellation mechanisms. Understanding these rights empowers consumers to identify violations and demand accountability.

However, effective consumer protection requires a multi-faceted approach. Regulation sets the baseline but relies on enforcement and adaptation. Industry self-regulation, such as updated policies from credit card networks , plays a supporting role. Technological solutions, like virtual credit cards , offer consumers direct control points. And continuous consumer education—through resources like this guide and outreach from agencies like the FTC and BBB —is vital for fostering awareness and vigilance. The persistence of free trial scams despite these efforts underscores that no single element is sufficient; a coordinated, ongoing commitment across all fronts is essential.

Ultimately, the most powerful defense lies with the informed consumer. By approaching free trial offers with healthy skepticism, conducting thorough research, meticulously reading terms, actively managing subscriptions, utilizing available payment protection tools, and knowing how to act decisively when encountering deceptive practices, individuals can navigate the subscription economy more safely and confidently. Utilize the checklists provided, stay alert for red flags, and report suspicious activity—protecting yourself also helps protect the broader community from these pervasive financial traps.