Scams are an old story that’s written anew every day. Some scams have been around for at least a century, such as the Spanish prisoner scam, which has evolved into the Nigerian letter scam of today. Many newer scams utilize the latest in technological advancements to make it ever easier to part fools from their money. And not just fools-careful, intelligent people also fall prey to the many scams that pervade our everyday life. Scam artists, the rare criminals justifiably referred to as “artists,” often have a knowledge of psychology that would make Sigmund Freud proud. These criminals know just which buttons to push to appeal to our fears, friendships, charitable instincts, compassion, optimism, greed, and desire for quick-and-easy solutions to life’s problems.

Almost everything we do can be adapted to a scam. Fertile ground for scammers includes phony lotteries, charities, telephone services, healthcare (particularly weight-loss programs), travel services, government programs, scholarships, employment opportunities, dating services, and of course investments. And then there’s the mother lode of today’s scams: identity theft. Identity theft has become a worldwide epidemic of varying scams that carry the potential to empty your bank accounts, ruin your credit, or even send you to jail for a crime someone committed using your name. Regardless of how careful you think you are, you can become a victim of identity theft when your personal information is accessed from sources that may legitimately have this information, but fail to protect the security of this critical information. Steven Spielberg, Martha Stewart, Oprah Winfrey, Ross Perot, and even Warren Buffet have all been targeted in this fashion.

Scams Are Always in Season

During the holidays, when people are in a charitable mood, there’s never a shortage of legitimate-looking phony charities that are more than eager to take your money. You owe it to yourself to take the steps necessary to confirm that any charity you’re considering not only is legitimate. Additionally, you should learn just how much of your contribution is actually used for charitable purposes and how much goes to administrative purposes. (The proportional percentages in even some legitimate charities may astound you.)

During tax season, it’s not just the IRS that’s seeking your money, but also scammers. Phony notices and fraudulent tax schemes not only can cause you to lose money, but even subject you to possible criminal sanctions.

Much has been written about the problems in the sub-prime mortgage market and an increasing rate of mortgage foreclosures. But where others see problems, scammers see opportunity. Whatever the problem-health issues, relationships, financial difficulties-a scammer is there with an offer to “help” that ultimately just makes things worse. In one particular foreclosure scam, con artists tell homeowners in jeopardy that they can avoid foreclosure by transferring an interest in their home to a third party. The third-party con artist walks away with the money, and the foreclosure is unaffected. Scammers prey on us when we’re at our weakest and most vulnerable.

Scammers Do Their Homework

Scammers are adept at telling us what we want to hear. For instance, the scammer may say that his program is a legitimate business proposition in which you actually are sold some inexpensive item as part of the program. This factor, he says, is what differentiates his program from an illegal chain letter. Some purveyors of these particular scams even indicate in their written materials that the U.S. Postal Service approves their particular program. The truth is that the U.S. Postal Service never endorses or approves any particular business program.

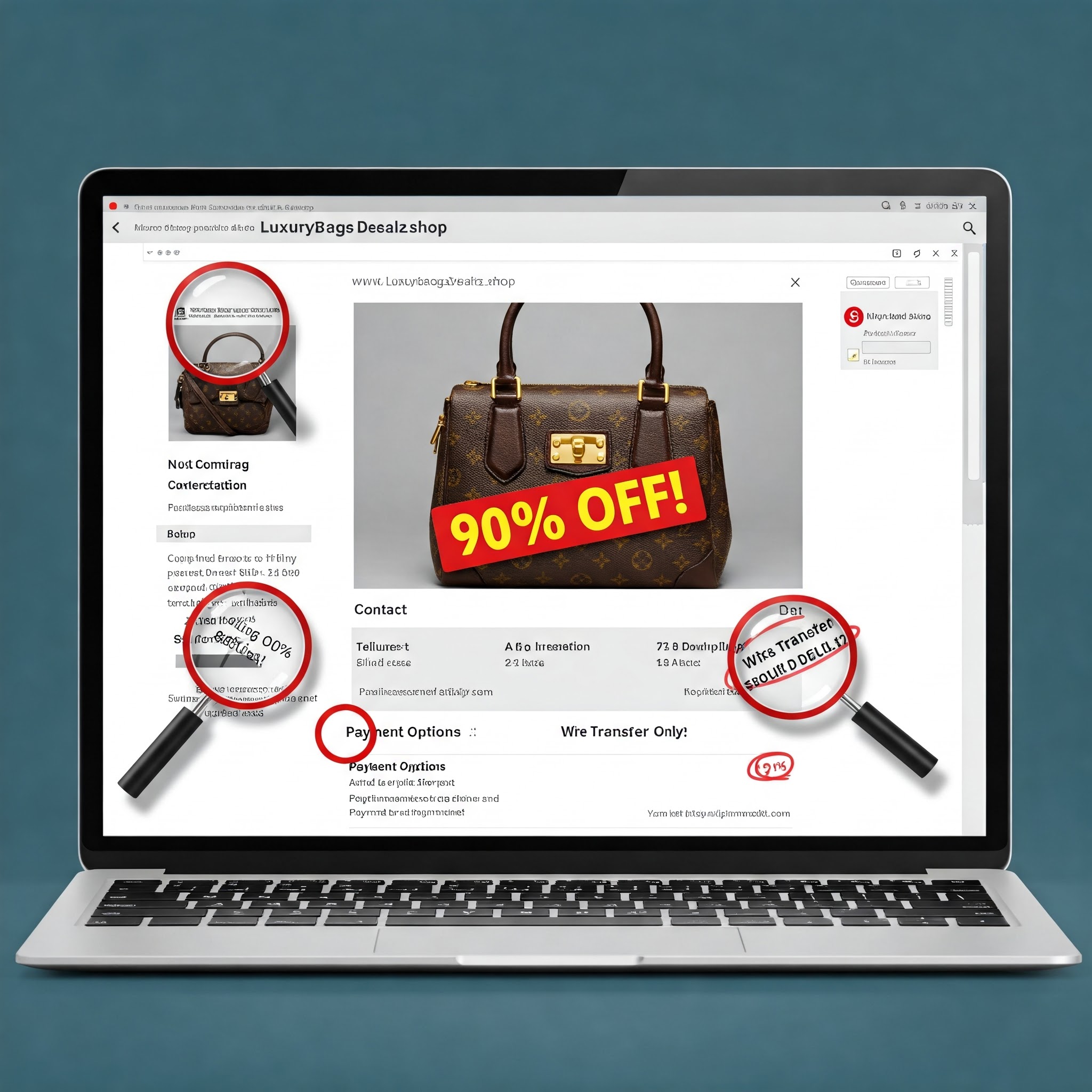

Perhaps you respond to an advertisement to be a personal shopper or to do market research. You even receive a “certified check” to pay you for your efforts. Certainly, that check must be legitimate! However, the check is written for more than the amount you’re owed, so you’re required to send your own check back to the company to “refund the difference.” The only problem is that the certified check that the scammer sends you is phony. Unfortunately, the check that you send is not.

Everyone loves to be a winner, and scammers know that fact as well as anyone. Lottery scams come in many variations. Some require you to send “processing fees” while you wait for the prize check that never comes. Other phony lotteries require you to pay to the company sponsoring the lottery the income taxes that you will owe on your prize. The problem is that legitimate lotteries never ask you for tax money. Either you pay the income taxes due on your winnings directly to the IRS, or the taxes are deducted from the prize before you receive it, in which case you receive a Form 1099 from the sponsor of the lottery informing you of the amount already deducted from your prize for taxes.

Whatever involvement you have with the federal government, from Social Security to Medicare to veterans benefits to the IRS, it’s just more fodder for scammers. They take advantage of the confusion many people suffer with the rules of these programs, and twist those rules to lure you into sending money to scammers posing as government representatives.

Scammers May Be Closer Than You Think

Scams can be high-tech, low-tech, even no-tech. They can be accomplished through sophisticated computer programs or merely by going through your trash. Scams are committed by people involved in organized crime located continents away from you, or your neighbor down the street. In fact, many fraud victims are scammed by members of their own families.

Surprisingly, wealthy and financially-literate people are actually more likely than average folks to be suckered by an investment scam. A little bit of knowledge can be a dangerous thing. A scam artist can take a sophisticated person’s interest in obtaining a high-return investment, along with her elementary knowledge of bonds, and concoct what appears to be a believable story about “secret prime bank investments” that can bring great profits in a short time. The only problem is that these prime bank investments don’t exist and never have existed-regardless of how legitimate they may sound.

Perhaps you’re skeptical about an investment opportunity that sounds almost too good to be true. Your fears may be allayed when you’re told that many people from your own social circle, or even your church or synagogue, have invested with the person providing this investment opportunity-and all of them have received the promised substantial profits. This person even looks like you. He may have the same racial, ethnic, or religious background. He wouldn’t cheat you. He hasn’t cheated your friends and family. What could be better? Those are probably the same thoughts that went through the minds of millions of victims of a common scam named after one of its earliest proponents, Charles Ponzi. Ponzi paid off early “investors” with the money given to him by later “investors,” using this as seed money to lure more people into his trap.

Scams can even take advantage of your concern about being scammed. You receive email that appears to be from your bank, credit card company, or online auction service, indicating that fraudulent activity has been detected on your account and that you must respond to the company immediately or your account will be closed. Unfortunately, the hyperlink in the email notice takes you to a phony site that uses information that you provide to make you a victim of identity theft. Perhaps you’re too smart to provide that personal information when directed to the phony site. Even so, it may be too late. Merely by clicking the link provided in the email notice, you may have unwittingly invited into your computer a Trojan Horse malicious software program that secretly gathers all of the personal information on your computer and sends it back to the identity thief.

Fortunately, there are clues in this type of scam. For instance, if you receive an email from PayPal that addresses you with a salutation of “Dear PayPal User” or “Dear PayPal Member,” you can be sure that it’s not genuine email from PayPal. PayPal will always address you specifically by your first and last name.

Scams Will Always Be Around

The key to avoiding scams is knowledge. You need to learn how to recognize the telltale signs of a scam. You need to learn to recognize the patterns of a scam. You need to learn to think like a scammer.

Be the first to comment