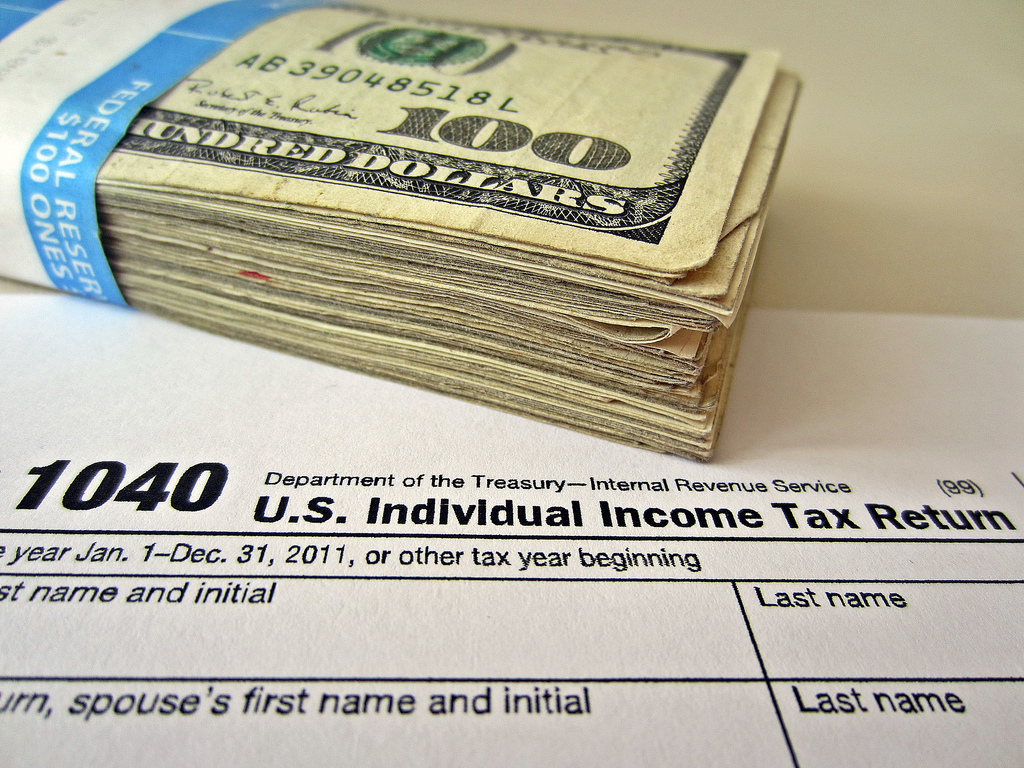

Financial Fraud: Eric Dentz and Rebecca Dentz Charged With Conspiracy to Obstruct Justice And Tax Violations

Brunswick couple charged with conspiracy to obstruct justice, tax violations A nine-count indictment was filed charging a Brunswick couple with failing to make payments to support the pension and benefits fund of its employees and then obstructing the subsequent investigation, said Carole S. Rendon, U.S. Attorney for the Northern District of Ohio. Eric Dentz and […]