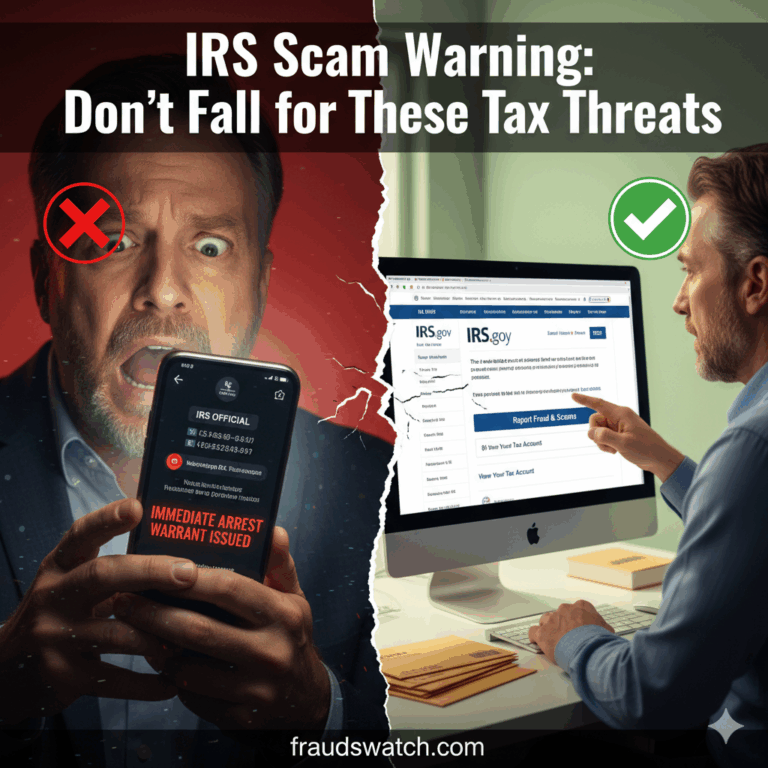

IRS Scam Warning: Don’t Fall for These Tax Threats

The Call That Steals More Than Money The phone rings on a Tuesday afternoon. For Brad, a new father…

The Call That Steals More Than Money The phone rings on a Tuesday afternoon. For Brad, a new father…

The Pandemic, The Panic, and The Alleged Profiteers In the chilling early days of March 2020, New York State…

The Latest Crack in the Dam: CPA Ofer Gabbay Pleads Guilty In a federal courtroom, the latest domino fell…

I. Executive Summary The case of Douglas Edelman, a former U.S. defense contractor, represents a significant instance of large-scale…

Introduction: Unveiling a Decade-Long Deception Affecting U.S. Treasury and Defense Operations WASHINGTON – A complex and long-running scheme designed…

The COVID-19 pandemic brought unprecedented economic challenges, prompting the US government to launch massive relief programs like the Paycheck…

NEW YORK – In a significant blow to its reputation and finances, American Express Company (AMEX) has agreed to…

ST. PAUL, Minn. – A federal grand jury has indicted two men, Henry Remington Herod, 42, of Minneapolis, and…

Operators Of Jacksonville Roofing Business Plead Guilty To Payroll Tax Fraud And Workers’ Compensation Fraud Two brothers who owned…

Stay one step ahead of scammers in the digital age. This comprehensive guide provides 20 actionable tips to protect…

Tax season is always a busy time for the Internal Revenue Service, but it’s also a prime opportunity for…

Tax identity theft remains a pervasive and evolving threat, causing significant financial and emotional distress to individuals and businesses….

Westfield Woman Pleads Guilty To Stealing Thousands Of Dollars From Health Care Agency BUFFALO, N.Y. – U.S. Attorney James…

Pelham- And Bronx-Based Tax Preparer Pleads Guilty In White Plains Federal Court To Preparing And Filing False Income Tax…

Inglewood-based Tax Preparer Convicted in Scheme that Sought More than $5 Million in Fraudulent Refunds LOS ANGELES – A…

Tax Preparer Convicted of Conspiracy to Defraud IRS and Preparing False Tax Returns TRENTON, N.J. – A Maryland man…

Tax Preparer Convicted of Conspiracy to Defraud IRS and Preparing False Tax Returns TRENTON, N.J. – A Maryland man…

Financial Broker Sentenced To 42 Months In Prison For Tax Evasion And Failure To File Tax Returns Geoffrey S….

Former Owner Of Local Nursing Homes Sentenced On Bank Theft And Tax Charges BUFFALO, N.Y. – U.S. Attorney James…

Financial Broker Pleads Guilty In Manhattan Federal Court To Tax Evasion And Failure To File Tax Returns Geoffrey S….