The Crypto Scam Aftermath: A 2025 Guide to Taking Legal Action and Recovering Your Assets

The Turning Point for Crypto Justice If you are reading this, you may be one of the thousands who…

The Turning Point for Crypto Justice If you are reading this, you may be one of the thousands who…

From Victim to Advocate—Taking Control After Investment Fraud The discovery of being a victim of investment fraud is a…

Introduction and Background This survey note provides a comprehensive analysis of the recent guilty plea by Murex Management, Inc….

The Pandemic, The Panic, and The Alleged Profiteers In the chilling early days of March 2020, New York State…

An exhaustive analysis of the Scott Mason and Rubicon Wealth Management fraud. Learn how he deceived clients for over…

In a case that serves as a chilling reminder for small business owners everywhere, Jennifer L. Bengston Cook, a…

Superseding Indictment Alleges Sophisticated Conspiracy to Defraud Federally Qualified Health Center Serving Las Vegas’ Indigent Population; Funds Allegedly Diverted…

NEW YORK, NY – October 26, 2023 – A significant federal indictment was unsealed today by the U.S. Attorney’s…

I. Executive Summary This report details the extradition of Liridon Masurica, allegedly known as “@blackdb,” from Kosovo to the…

BRIDGEPORT, CT – The guilty plea of Yasir G. Hamed, a 60-year-old accountant from Woodbridge, Connecticut, on May 9,…

Brooklyn, NY – The architects of a sprawling $1.6 billion fraud that victimized over 10,000 investors faced their day…

Introduction: The Human Cost of a Calculated Deception – The Kingsley Ibhadore Case The fight against sophisticated financial fraud…

Executive Summary This report provides a comprehensive analysis of the criminal enterprise orchestrated by William Lamar Rhew, III, culminating…

HONOLULU, HI – The owner of a Honolulu massage therapy school has pleaded guilty to federal charges, admitting his…

DETROIT, MI – A Sterling Heights, Michigan electrical contracting firm, Slifco Electric, LLC, and its sole owner, John P….

Introduction: Unveiling a Decade-Long Deception Affecting U.S. Treasury and Defense Operations WASHINGTON – A complex and long-running scheme designed…

CHARLESTON, S.C. — — In a significant development in the sprawling financial saga connected to convicted murderer Alex Murdaugh,…

U.S. Files False Claims Act Lawsuit Against Barco Uniforms, Executives, and Affiliated Companies Alleging Systemic Customs Duty Evasion Scheme…

The intentional misrepresentation of information or identity to deceive others for financial gain stands as a pervasive and ever-evolving…

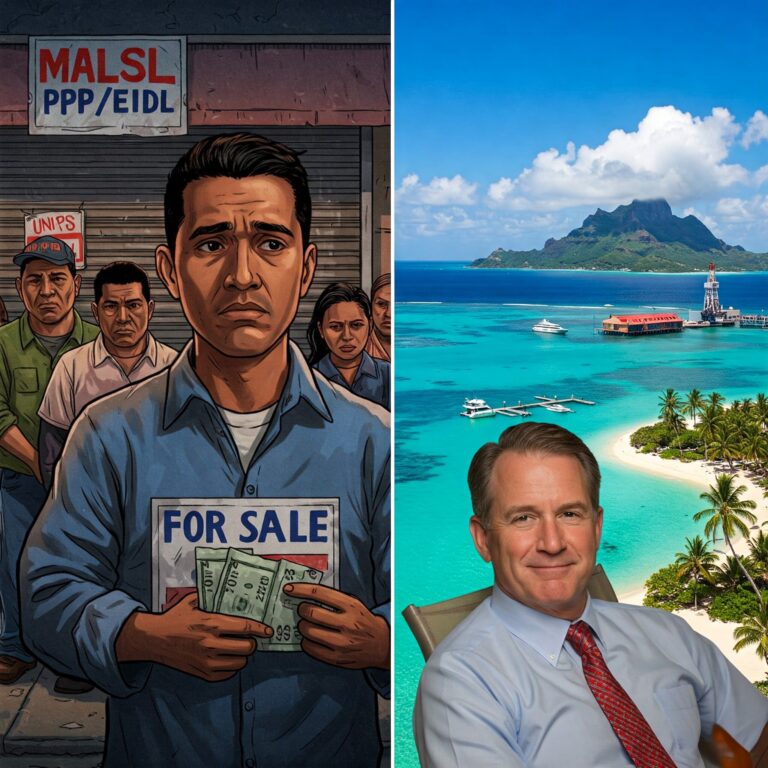

Elaborate Scheme Used Fake Payroll Data to Steal Millions in PPP and EIDL Funds [Date of Publication – e.g.,…