The Phantom Fortune: Unmasking Inheritance Scams and Protecting America’s Seniors from Financial Predators

A letter arrives, perhaps bearing an official-looking crest, promising millions. It speaks of a distant relative, previously unknown, who…

A letter arrives, perhaps bearing an official-looking crest, promising millions. It speaks of a distant relative, previously unknown, who…

DETROIT, MI – A Sterling Heights, Michigan electrical contracting firm, Slifco Electric, LLC, and its sole owner, John P….

Introduction: The Pervasive Threat of Malicious Software In today’s interconnected world, digital technologies underpin nearly every aspect of modern…

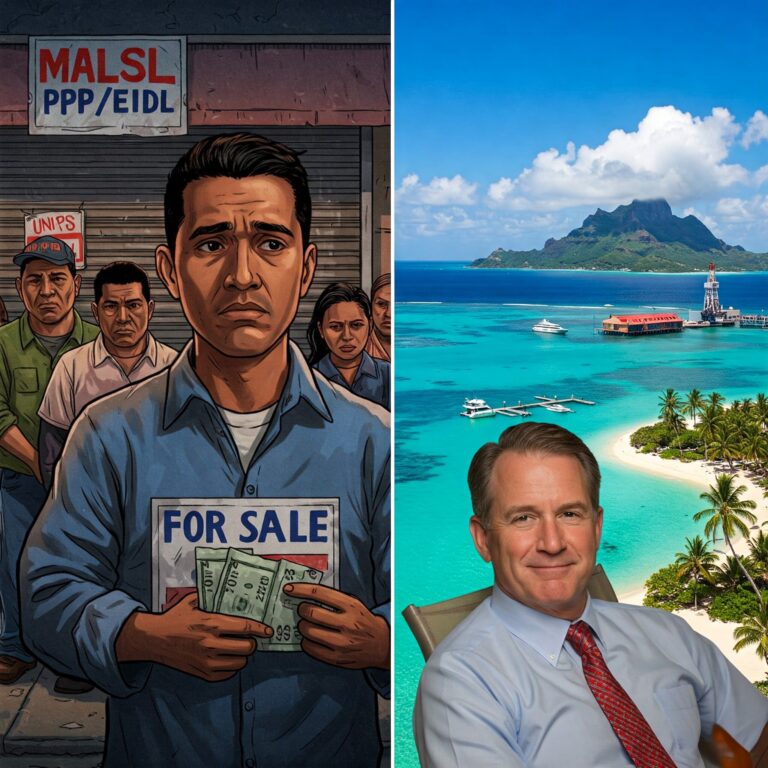

Executive Summary This report details the significant payroll tax fraud scheme orchestrated by Matthew S. Brown of Palm Beach…

Settlement Resolves False Claims Act and Anti-Kickback Statute Allegations Involving CGx/PGx Tests Procured Through Marketing and Telemedicine Scheme Introduction…

Introduction: Unveiling a Decade-Long Deception Affecting U.S. Treasury and Defense Operations WASHINGTON – A complex and long-running scheme designed…

Betraying Trust – Fraud Against Military Healthcare The recent sentencing of three individuals from the Lawton, Oklahoma area—Jimmie Mathews,…

DOJ alleges decade of illegal prescription filling; settlement mandates strict compliance measures, follows pattern of prior opioid-related penalties for…

CHARLESTON, S.C. — — In a significant development in the sprawling financial saga connected to convicted murderer Alex Murdaugh,…

U.S. Files False Claims Act Lawsuit Against Barco Uniforms, Executives, and Affiliated Companies Alleging Systemic Customs Duty Evasion Scheme…

Executive Summary This report provides a comprehensive analysis of the federal healthcare fraud case involving Dr. John R. Manning,…

The sudden, sinking feeling of a hand patting an empty pocket or rummaging through a purse only to find…

High-Stakes Allegations – Minnesota Couple Indicted in $15 Million Neurofeedback Billing Fraud Scheme A federal indictment unsealed in Minneapolis…

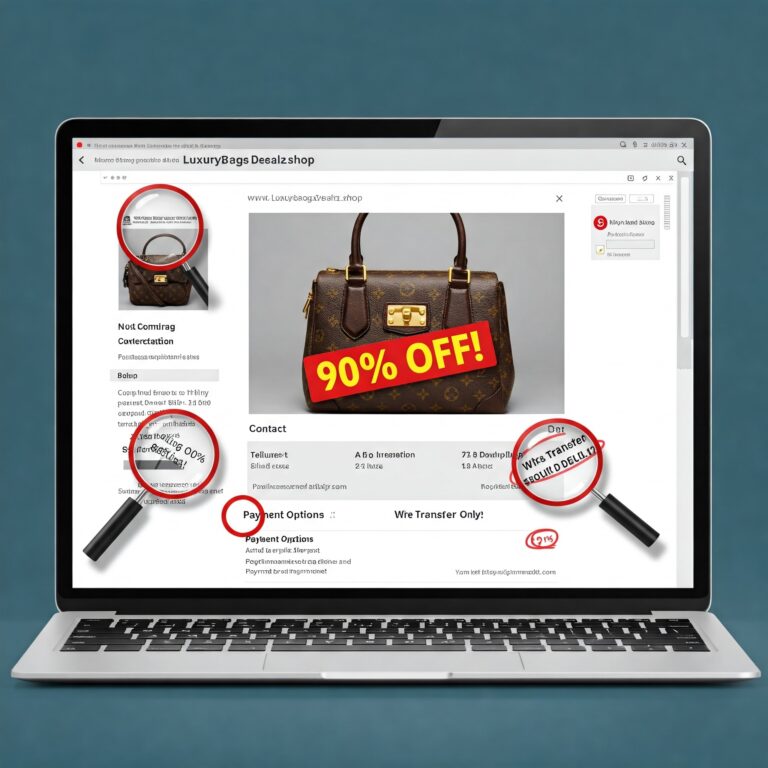

(Date: April 8, 2025) The digital marketplace is a marvel of modern convenience. With a few clicks, consumers can…

The internet connects us, empowers us, and entertains us. It’s an indispensable tool for modern life. But lurking beneath…

Protect Your Privacy and Business: Latest Tips, Essential Strategies, and Answers to Key Questions About Information Theft from Trash…

Federal Law Enforcement Cracks Down on $214 Million “Pump and Dump” Scheme in Chicago: Seven Individuals Indicted in Connection…

The digital age has brought unparalleled convenience to banking and payments, but it’s also opened the door to sophisticated…

The intentional misrepresentation of information or identity to deceive others for financial gain stands as a pervasive and ever-evolving…

Elaborate Scheme Used Fake Payroll Data to Steal Millions in PPP and EIDL Funds [Date of Publication – e.g.,…