Student Loan Scam Faced by The Federal Agency

Federal government investigators have halted an alleged student loans debt pain relief scam that bilked more than $11 million from consumers nationwide.

Strategic Student Solutions and several related companies inaccurately promised to minimize or eliminate student loans debt and also offered the borrowers no credit repair services, as a swap for upfront fees and monthly installments, the Federal Control Commission charged in courtroom papers made public Thurs.

Although borrowers allegedly received no respite from their financial obligations, Dave Green, owner of the companies, used company funds to pay for jewelry, casino tabs, mortgage loan payments, luxury vehicles and construction of any pool, the FTC charged.

FTC Problem v Strategic Student Solutions

A federal government court in Florida approved a momentary restraining order that halted the operation, pending a hearing on a long lasting injunction.

“Consumers who paid Strategic Student Solutions for assist with their student loans watched their situations go from bad to worse, ” Tom Pahl, acting director of the FTC’s consumer protection bureau, said in a written statement. “The main point here: never pay an up-front payment to a company declaring they will provide debts relief. ”

Jeffrey Backman and Richard Epstein, attorneys representing the companies and Green, did not immediately react to a telephone message seeking comment.

Seeing that at least 2014, the companies preyed on student loans borrowers by falsely encouraging to reduce their monthly payments or eliminate part of the debt by enlisting them in income-driving repayment plans or loan forgiveness programs, the FTC judge complaint charged.

In return, the borrowers allegedly were incurred illegitimate upfront fees up to $1, 200 plus monthly installments that typically totaled $49. 99.

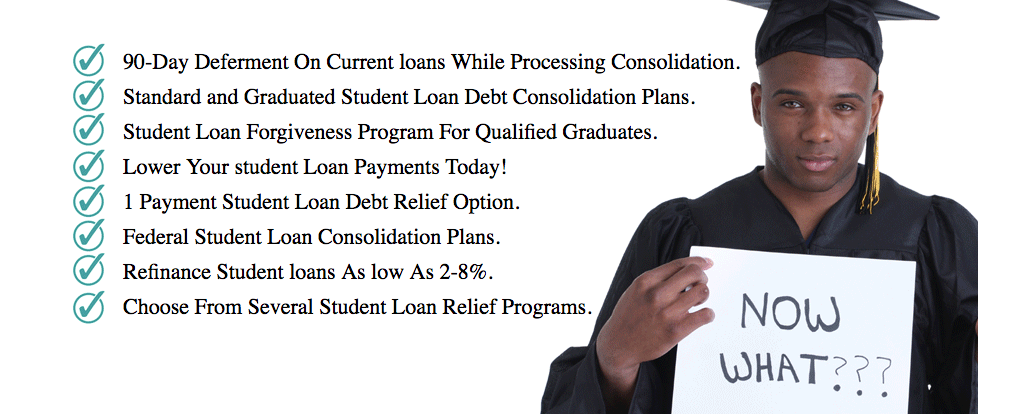

One of the company websites, which was inaccessible Thursday, allegedly promoted “1 Payment Education loan Debt Relief Option” and also promised “Payments as low as $0 Regular monthly, ” the complaint recharged.

Donald Trump’s expense lowering back key student loans programs

President Trump is proposing to cut back student loan programs aimed at borrowers who need the most help.

Outlined in his 2018 budget that was released Tuesday, his proposals reflect Trump’s priorities in streamlining federal programs and reducing government involvement in the loans business.

Only afterward did the consumers learn that the promises were empty. Additionally, they learned that none of the payments they made to the companies experienced been applied toward paying off their student loans.

“In some instances, consumers have ended up owing more on their student loans than when they first fixed up” for the companies’ purported relief programs, the complaint alleged.

Borrowers who attempted to cancel their enrollments with the companies sometimes allegedly were aware that “they could undergo adverse consequences for future eligibility for federal loan forgiveness programs. ” That statement, too, was fake, federal investigators charged.

The average student loans debt in each and every state

FTC spokeswoman Nicole Jones said investigators would not yet have an estimate of the quantity of consumers defrauded by the alleged scam. Nevertheless , an online posting by a Bbb office in Florida indicated it acquired received 194 complaints against the Strategic Student Solutions.