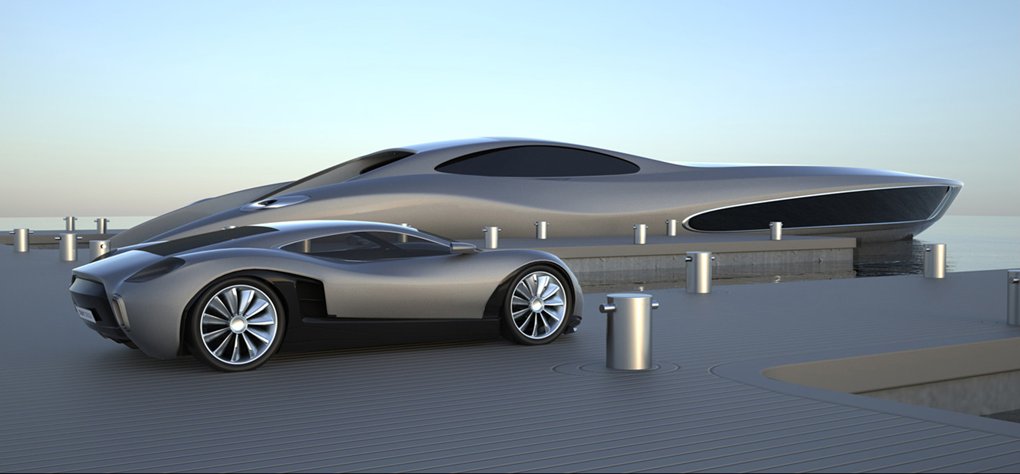

Financial Fraud: STEPHEN C. BROWERE Sentenced for Using Client Funds to Purchase a Yacht and Luxury Vehicle

Founder of West Suburban Investment Firm Sentenced to Five Years in Federal Prison in $3.7 Million Fraud Scheme

CHICAGO — The founder of a Geneva investment firm has been sentenced to five years in federal prison for using client funds to purchase a yacht and luxury vehicle and to trade his own stocks.

STEPHEN C. BROWERE, the founder of Geneva-based Stephens Capital Management Inc., used the promise of lucrative and guaranteed returns to persuade several clients to purchase $1.66 million in promissory notes in Douglas Capital Corp., located in Lisle. Many of the investors pledged their life savings or funds from retirement plans. Browere did not tell investors that his relative was the president of Douglas Capital, and that Browere ran Douglas Capital’s day-to-day operations and had access to its lines of credit. Instead of investing the funds in the promissory notes, Browere used the money to perform trades within his own investment portfolio, and to cover personal purchases such as a yacht and a BMW automobile.

Browere, 57, of Geneva, pleaded guilty in June to one count of mail fraud. U.S. District Judge Matthew F. Kennelly on Friday sentenced Browere to 60 months in prison. Judge Kennelly also ordered Browere to pay $3.7 million in restitution to the victims.

“Each investor thought defendant was investing his or her money in safe, stable investments that would provide income well into retirement,” Assistant U.S. Attorney Patrick Otlewski argued in the government’s sentencing memorandum. “They did not agree to give defendant free reign to use the savings as his personal slush fund to support a lavish lifestyle.”

Browere’s scheme began no later than 2007 and continued until approximately February 2014. In addition to spending the victims’ funds on himself, Browere concealed the fraud by using principal payments from some investors to make interest payments to others in a Ponzi-like fashion.

Browere also obtained the power of attorney on behalf of an elderly client who was infirm and suffering from dementia. The power of attorney gave Browere access to the client’s cash and property, which were valued at more than $2.1 million. Browere misappropriated some of this money to purchase four vacant lots in Lisle and to make interest payments to other clients. After the client died, Browere maintained control over the estate and continued to misuse the estate’s assets.

The sentence was announced by Zachary T. Fardon, United States Attorney for the Northern District of Illinois; Jeffrey A. Monhart, Regional Director of the Chicago Regional Office of the U.S. Department of Labor, Employee Benefits Security Administration; and E.C. Woodson, Inspector-in-Charge of the U.S. Postal Inspection Service in Chicago. The Illinois Secretary of State’s Office provided valuable assistance in the investigation.

The government is represented by Mr. Otlewski.