Financial Fraud: Clayton Marlow Anderson Sentenced For Fraudulent Investment Scheme

Disbarred Attorney Sentenced to Prison for Defrauding Former Clients and Investors SAN DIEGO – Clayton Marlow Anderson, Jr., a…

Disbarred Attorney Sentenced to Prison for Defrauding Former Clients and Investors SAN DIEGO – Clayton Marlow Anderson, Jr., a…

Federal Grand Jury Criminal Indictments Announced United States Attorney Trent Shores announced today the results of the November 2018…

Nevada District Court Permanently Enjoins 20 Defendants Connected To A Multi-Million Dollar Mail Fraud Scheme LAS VEGAS, Nev. –…

Former Tesla Employee Charged In Embezzlement Scheme At Tesla Approximately $9.3 Million Allegedly Embezzled in 2016 and 2017 SAN…

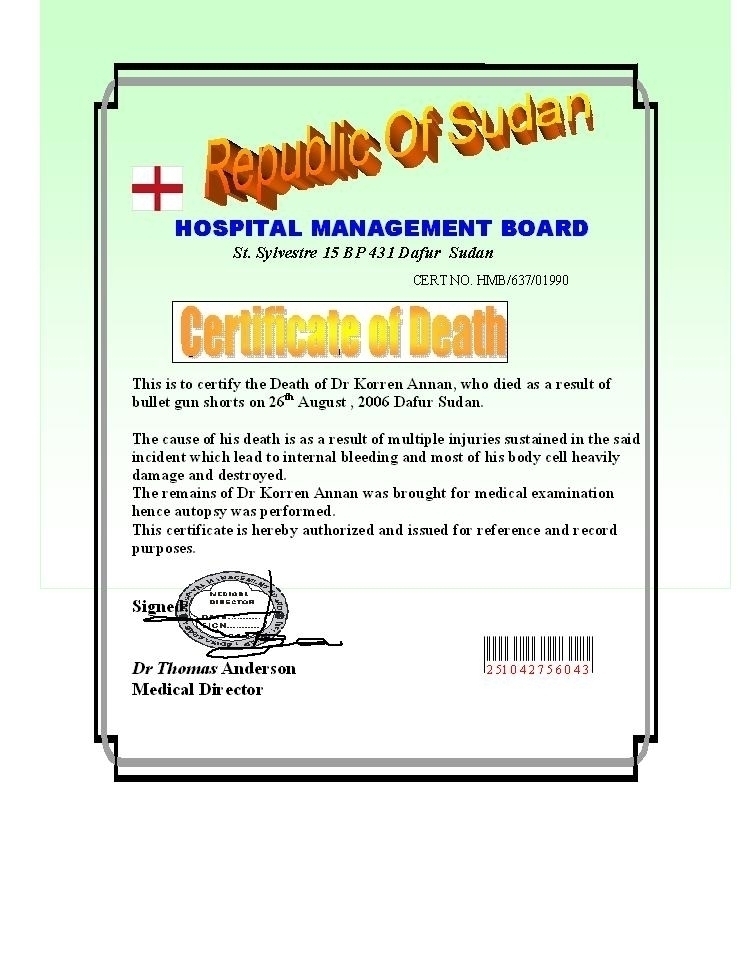

This is an email scam received about “RABO BANK LONDON Transfer Money And Melissa Annan Contact” is a phishing scam and…

Former Executive Director at Venezuelan State-Owned Oil Company, Petroleos de Venezuela, S.A., Pleads Guilty to Role in Billion-Dollar Money…

Co-Founder Of Investment Fund Charged In Manhattan Federal Court For Participating In Multi-Million Dollar Fraud Scheme Jason Rhodes Charged…

Nomura Agrees to Pay $480 Million in Civil Penalties for Misleading Investors in Sale of Residential Mortgage-Backed Securities The…

Mobile County Man Receives 18 Month Sentence for Making Counterfeit United States Currency, Ordered to Pay $130.00 Restitution and…

Ambler, Pennsylvania, Man Admits Defrauding FEMA Relating To Major Disaster CAMDEN, N.J. – An Ambler, Pennsylvania, man today admitted…

Founder and Former Administrator of Public Charter Schools in Albuquerque Sentenced to 60 Months for Conviction on Federal Theft,…

Founder of Bogus Green Energy Firm Convicted of Running a $54 Million Ponzi Scheme PHILADELPHIA – U.S. Attorney William…

Couple Sentenced to Lengthy Prison Terms for $12.7 Million Affinity Investment Fraud Defendants Preyed on Faith Communities to Fund…

Convicted Fraudster Sentenced To Five Years In Prison For $7 Million Ponzi Scheme SAN FRANCISCO – Kevin Kyes was…

Eight Therapists Arrested In Scheme to Defraud Program for Developmentally Disabled Children Defendants Allegedly Defrauded the New York State…

Surgeon Pleads Guilty In Forest Park Medical Center Bribery Scam A Mesquite-based bariatric surgeon today formally admitted his role…

Pennsylvania Man Pleads Guilty to Biodiesel Tax Conspiracy A Harrisburg, Pennsylvania man pleaded guilty yesterday in federal court to…

Pomona Woman Sentenced to Federal Prison in Scheme to Smuggle Restricted Space Communications Technology to China SANTA ANA, California…

Captain of Prominent Tourist Sailing Ship Sentenced to Prison for Illegally Claiming Disability Collected Disability Payments Claiming He Couldn’t…

Leader Of Darknet ItalianMafiaBrussels Drug Trafficking Organization Sentenced To 11 Years’ Imprisonment DENVER – U.S. Attorney Bob Troyer announced…