Chicago Businessman Convicted in $55 Million Fraud Scheme Targeting COVID-19 Relief Funds and Financial Institutions

Federal Jury Finds Rahul Shah Guilty of Bank Fraud, Money Laundering, and Aggravated Identity Theft in Landmark Case Chicago,…

Federal Jury Finds Rahul Shah Guilty of Bank Fraud, Money Laundering, and Aggravated Identity Theft in Landmark Case Chicago,…

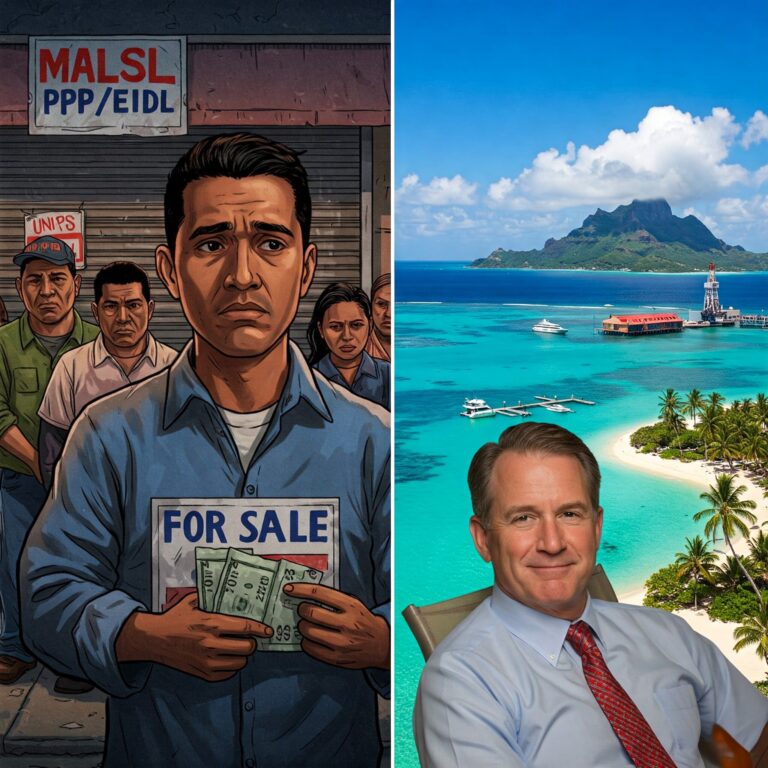

Elaborate Scheme Used Fake Payroll Data to Steal Millions in PPP and EIDL Funds [Date of Publication – e.g.,…

MEMPHIS, TN – A Mississippi woman has admitted to masterminding a sophisticated scheme that defrauded the U.S. government’s Paycheck…

Atlanta, GA – In a stark reminder of the pervasive fraud that plagued COVID-19 relief programs, two Georgia men,…

The U.S. Attorney’s Office has delivered a stern message against the misuse of pandemic relief funds, highlighting a recent…