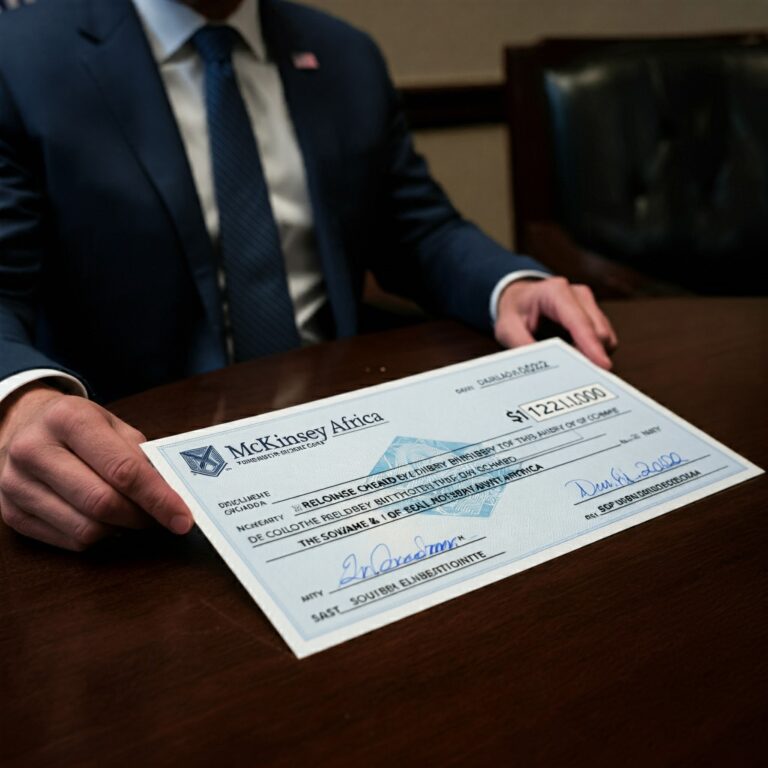

McKinsey Africa Pays $122 Million to Resolve Bribery Scheme in South Africa

Consulting giant implicated in widespread corruption, highlighting the need for greater transparency and accountability. Johannesburg, South Africa – McKinsey…

Consulting giant implicated in widespread corruption, highlighting the need for greater transparency and accountability. Johannesburg, South Africa – McKinsey…

70 Current And Former NYCHA Employees Charged With Bribery And Extortion Offenses The news last week of 70 current…

Former Nassau County Executive Edward Mangano and His Wife Linda Mangano Convicted of Corruption and Related Charges by a…

Department of Veterans Affairs Official Sentenced to 11 Years in Prison for $2 Million Bribery Scheme Involving Program for…

Two Former Executives Of Louis Berger International Sentenced In Foreign Bribery Scheme TRENTON, N.J. – Two former executives of…