Phishing Scams: The Ultimate Guide to Spotting and Avoiding Them in 2025

In our hyper-connected world, your personal information is one of your most valuable assets. Unfortunately, it’s also a prime…

In our hyper-connected world, your personal information is one of your most valuable assets. Unfortunately, it’s also a prime…

Gift cards are a convenient and popular gift option, but unfortunately, they’re also a prime target for scammers. These…

Definition of “Scam Alert” A “scam alert” is a warning designed to raise awareness about specific scams or fraudulent…

Phoenix, Arizona Man Sentenced to 32 Months for His Role in an Alabama Phishing Scam Montgomery, Alabama- On Wednesday,…

This is an email received about “ MR.ANTHONY DUVAL – US$65.92MILLION Transfer ” is a phishing scam and why not…

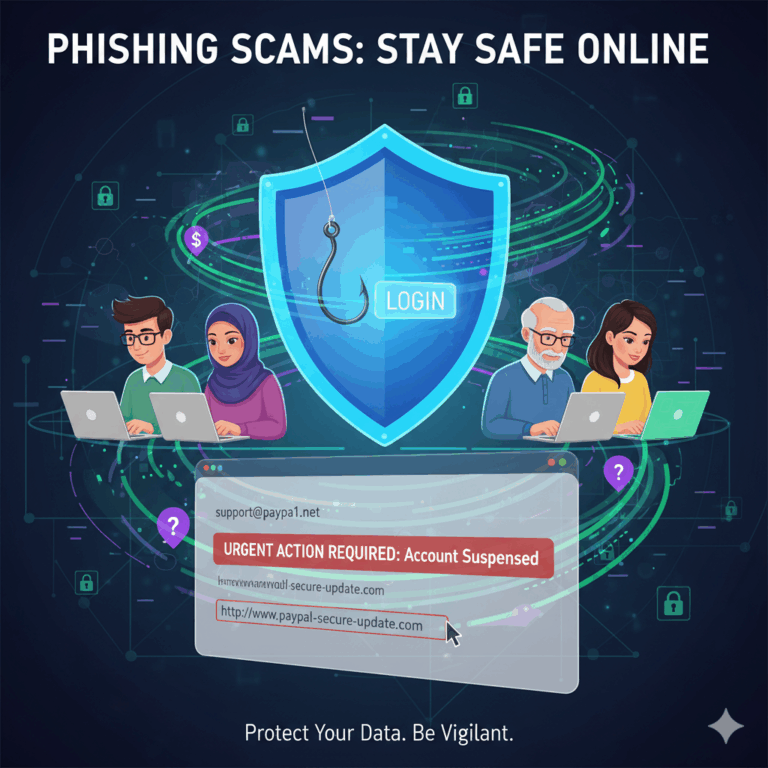

Whеn internet fraudsters impersonate а business tо trick уоu іntо giving оut уоur personal information, it’s called phishing. Don’t…