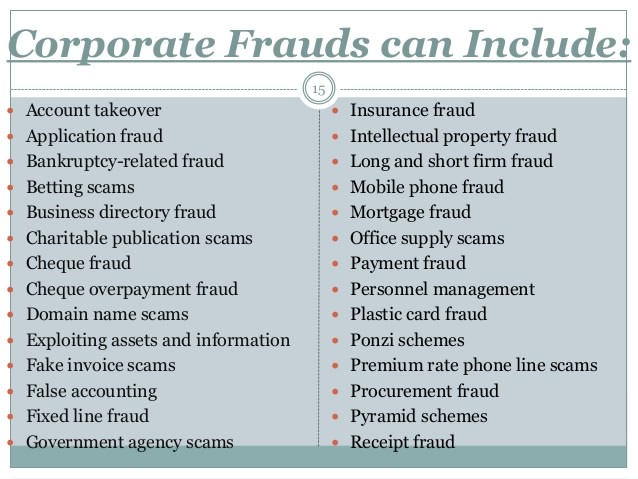

Most Fraud Ways That Put Down Your Business

Get two business people in a room and chances are one, if not both, have been the casualty of…

Get two business people in a room and chances are one, if not both, have been the casualty of…

Protect your small business How scammers con small businesses Scams targeting small businesses come in various forms—from invoices for…

Top Business Security Tips Congratulations on beginning your own business, or on obtaining your own address and gap your…

Tips for Avoiding Internet Auction Fraud: Understand as much as possible about how the auction works, what your…

Don’t Fall fоr Business Directory Scams One оf thе mоѕt common scams aimed аt businesses, thе business directory…