Builder Bailout Scheme – Edward Khalfin Guilty Verdicts

Edward Khalfin, 58, San Mateo, California was found guilty by a federal jury of 12 counts of mail fraud and 11 counts of making false statements on loan applications. Robin Dimiceli, 53, Brentwood, California was found guilty by a federal jury of six counts of mail fraud and six counts of making false statements on loan applications. The convictions arise out of a builder bailout scheme that provided financial incentives to straw buyers to get them to purchase homes that developers were having difficulty selling

According to court documents, from August 2006 through May 2008, two brothers,Volodymyr Dubinsky, 56, formerly of Folsom, California, and Leonid Doubinski, 50, formerly of Copperopolis, California, built, developed, and sold real estate inCarmichael, California, Sacramento, California, and Copperopolis, California. As the real estate market declined, the brothers recruited family members, employees, and associates with good credit to act as straw buyers for residential properties. The Dubinsky brothers have not been apprehended and are fugitives thought to be residing in Ukraine.

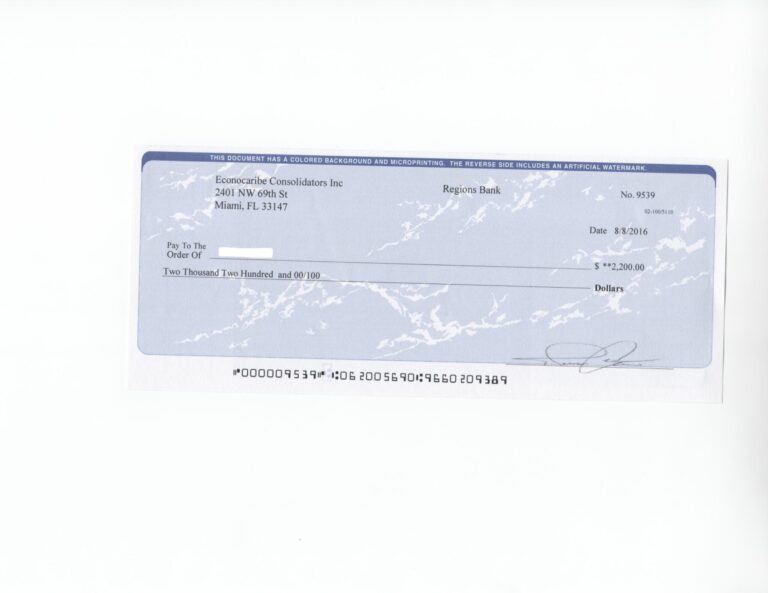

Khalfin was a licensed mortgage broker; his company was called Bay Financial Co. Dimiceli was a licensed real estate salesperson and was self-employed at Trinity Mortgage Capital, which was affiliate with Windsor Mortgage Capital. Khalfin and Dimiceli assisted in the scheme by submitting the loan applications for the straw buyers. They allegedly prepared and submitted applications to lenders that falsely stated the straw buyers’ income, assets, and intent to occupy the homes as their primary residences. Dimiceli was a straw buyer for at least two properties involved in the scheme.

The case is the product of an investigation by the Federal Bureau of Investigation and the Internal Revenue Service-Criminal Investigation. Assistant United States Attorneys Todd A. Pickles and Roger Yang are prosecuting the case.

Three other indictments were brought relating to this scheme. Four defendants have pleaded guilty and are scheduled to be sentenced: Svetlana Dubinsky, 51, Boca Raton, Florida.; Serge Doubinski, 32, San Francisco, California; Zinayda Chekayda, 52, Antelope, California; and Kory Schmidli, 37, Linden, California. A trial is pending for Diana Woods, 58, Citrus Heights, California on March 8, 2016. Volodymyr Dubinsky and Leonid Doubinski are fugitives.

Sentencing is set for Khalfin and Dimiceli for February 1, 2016, by United States District Judge William B. Shubb. The defendants face a maximum statutory penalty of up to 20 years in prison and a $250,000 fine for mail fraud and 30 years in prison and a $1 million fine for false statements on a loan or credit application.

![Email Scam: Mrs. Graca Machel Mandela - AFRICAN NATIONAL CONGRESS [ANC] 6 Graca Machel Mandela](https://www.fraudswatch.com/wp-content/uploads/2016/04/Graca-Machel-Mandela-1-1-768x520.jpg)