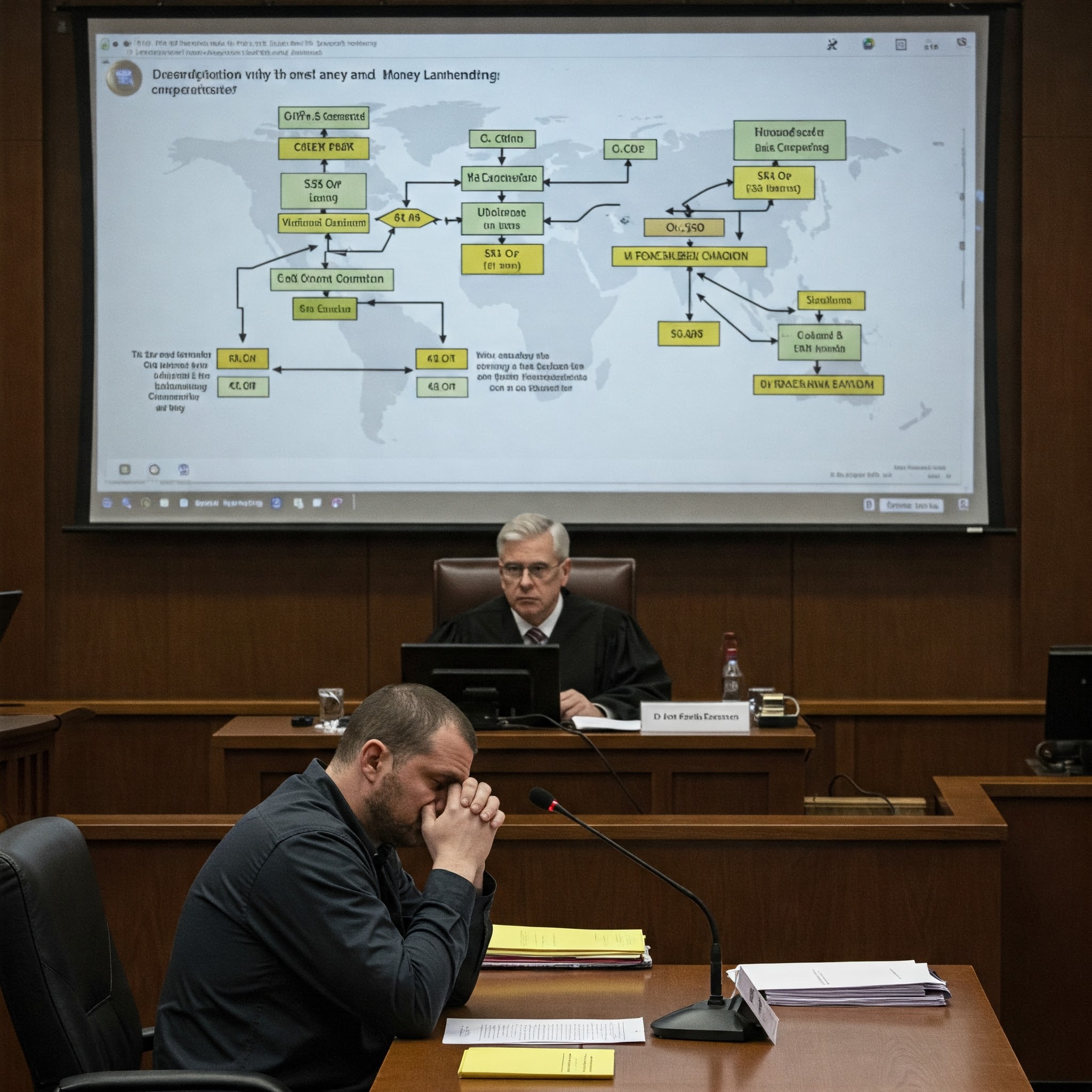

<p><strong>NEW YORK, NY</strong> – In a significant victory for law enforcement against complex international <strong>financial crimes</strong>, Erick Jason Victoria-Brito, a 30-year-old resident of Hollywood, Florida, has been extradited from the Dominican Republic to the United States to face charges related to a sprawling <strong>bank fraud</strong> and <strong>money laundering</strong> operation that has caused over $60 million in losses. Victoria-Brito was arraigned in a Manhattan federal courtroom today, marking a major development in a case that spans multiple continents and highlights the growing threat of <strong>business email compromise (BEC) scams</strong>.</p>

<p>The indictment, announced by United States Attorney for the Southern District of New York, Danielle R. Sassoon, and Special Agent in Charge of the New York Field Office of the United States Secret Service (USSS), Patrick J. Freaney, alleges that Victoria-Brito played a key role in a sophisticated conspiracy that targeted businesses, non-profits, and even local governments. The group, operating between December 2017 and November 2022, is accused of registering over 1,000 fraudulent businesses, using these shell companies to open bank accounts, and then laundering the proceeds of various fraudulent schemes, including <strong>BEC scams</strong>.</p>

<p>&#8220;As we allege, Erick Jason Victoria-Brito and his co-conspirators ran an international bank fraud and money laundering scheme designed to help carry out business email compromise scams,&#8221; said U.S. Attorney Sassoon. &#8220;These scams cause significant harm to businesses, nonprofits, and even local governments. As the successful extradition of Erick Jason Victoria-Brito shows, this Office and our partners will not rest until every individual responsible is held accountable.&#8221;</p>

<h2 class="wp-block-heading">A Complex Web of Deceit: How the Fraud and Money Laundering Scheme Operated</h2>

<p>The indictment paints a picture of a highly organized and far-reaching criminal enterprise. The group, allegedly led in part by Victoria-Brito, exploited the vulnerabilities of the global <a class="wpil_keyword_link" href="https://www.fraudswatch.com/tag/financial-fraud/" title="financial" data-wpil-keyword-link="linked" data-wpil-monitor-id="1134">financial</a> system to perpetrate their fraud. Their methods involved a multi-layered approach, leveraging the anonymity provided by shell companies and the speed of international wire transfers to evade detection and make recovery of stolen funds virtually impossible.</p>

<h3 class="wp-block-heading">1. The Foundation: Creation of Over 1,000 Shell Companies</h3>

<p>The first step in the scheme involved the creation of a vast network of <strong>shell companies</strong>. These were businesses registered under false pretenses, often with fabricated names and addresses. These entities existed solely on paper, designed to give the appearance of legitimacy. The sheer volume of these fake businesses, exceeding 1,000, highlights the scale of the operation and the resources devoted to building its infrastructure.</p>

<h3 class="wp-block-heading">2. Exploiting the Banking System: Opening Accounts for Illegitimate Purposes</h3>

<p>With their army of shell companies, the conspirators then approached banks to open accounts. These accounts, under the guise of legitimate businesses, were crucial for receiving the proceeds of their fraudulent activities. The use of shell companies allowed them to circumvent standard due diligence procedures, masking the true nature of the transactions and the individuals behind them.</p>

<h3 class="wp-block-heading">3. The Heart of the Scam: Business Email Compromise (BEC) Attacks</h3>

<p>The primary source of illicit funds for the scheme was <strong>business email compromise (BEC)</strong> attacks. These highly targeted scams involve tricking employees of companies into transferring funds to accounts controlled by the criminals. The perpetrators often impersonate senior executives or trusted vendors, using sophisticated social engineering tactics to manipulate their victims.</p>

<ul class="wp-block-list">

<li><strong>Spoofing and Social Engineering:</strong> The conspirators would often &#8220;spoof&#8221; email addresses, making them appear to come from legitimate sources. They would also use social engineering techniques, researching their targets and crafting emails that seemed credible and urgent.</li>

<li><strong>Targeting Vulnerabilities:</strong> BEC attacks often exploit weaknesses in a company&#8217;s internal controls and email security protocols. They rely on human error and the pressure of seemingly urgent requests.</li>

</ul>

<h3 class="wp-block-heading">4. Rapid Laundering: Moving Funds Across Borders</h3>

<p>Once the stolen funds landed in the fraudulent accounts, the conspirators acted swiftly to launder the money, making it difficult to trace and recover. They primarily used international wire transfers, sending the funds to overseas banks, particularly in China, beyond the reach of U.S. authorities.</p>

<ul class="wp-block-list">

<li><strong>International Wire Transfers:</strong> The speed of international wire transfers allowed the criminals to move the money quickly, often within hours of the initial theft.</li>

<li><strong>Exploiting Jurisdictional Boundaries:</strong> By transferring funds to foreign banks, particularly in jurisdictions with less stringent regulations, the conspirators created significant obstacles for law enforcement and victims seeking to recover the stolen money.</li>

</ul>

<h2 class="wp-block-heading">A Trail of Victims: The Devastating Impact of the Scheme</h2>

<p>The <strong>Fraud and Money Laundering Scheme</strong> left a trail of financial ruin in its wake. The indictment reveals a wide range of victims, spanning various industries and sectors.</p>

<ul class="wp-block-list">

<li><strong>A Major American Sports Organization:</strong> The brazenness of the scheme is evident in the targeting of a major sports organization, highlighting the group&#8217;s confidence and willingness to target high-profile entities.</li>

<li><strong>A Publicly Traded Healthcare Company:</strong> The targeting of a publicly traded healthcare company demonstrates the potential for significant financial damage and reputational harm.</li>

<li><strong>A Prominent International Nonprofit:</strong> The inclusion of a prominent international nonprofit as a victim highlights the devastating impact on organizations dedicated to charitable causes.</li>

<li><strong>Multiple City Governments, Law Firms, Construction Companies, and Investment Funds:</strong> The list of victims includes entities from a diverse range of sectors, showcasing the widespread nature of the threat posed by BEC scams and sophisticated money laundering operations.</li>

</ul>

<h2 class="wp-block-heading">The Numbers Speak Volumes: $60 Million in Actual Losses, $150 Million in Attempted Losses</h2>

<p>The sheer scale of the scheme is reflected in the staggering financial figures involved. The indictment alleges that the conspiracy caused over $60 million in actual losses, a figure that represents the amount of money successfully stolen and laundered. Even more alarming is the figure of over $150 million in attempted losses, representing the total value of funds targeted by the group, even if not all attempts were successful. These numbers underscore the massive scope of the operation and the potential for even greater financial devastation.</p>

<h2 class="wp-block-heading">The Fight Against Cybercrime: Collaboration and Determination</h2>

<p>The successful extradition and arraignment of Erick Jason Victoria-Brito are a testament to the tireless efforts of law enforcement agencies in combating international cybercrime. The case highlights the importance of international cooperation and the dedication of investigators in pursuing complex financial crimes.</p>

<p>&#8220;This alleged scheme rained down financial ruin upon unwitting businesses and individuals,&#8221; said USSS Special Agent in Charge Patrick J. Freaney. &#8220;While the suspects operated with impunity across the nation and beyond, the U.S. Secret Service and its partners remained steadfast in building a strong case — no matter where the evidence took them. I commend the investigators and prosecutors for their commitment to disrupting this type of insidious fraud on behalf of all those victimized by it.&#8221;</p>

<p>This investigation involved a collaborative effort between multiple agencies, including:</p>

<ul class="wp-block-list">

<li><strong>United States Secret Service (USSS):</strong> The USSS played a pivotal role in the investigation, leveraging its expertise in financial crimes and cyber investigations.</li>

<li><strong>New York City Police Department (NYPD):</strong> The NYPD&#8217;s involvement underscores the local impact of international cybercrime and the importance of collaboration between federal and local law enforcement.</li>

<li><strong>U.S. Postal Inspection Service:</strong> Given the use of mail and wire fraud in the scheme, the expertise of the U.S. Postal Inspection Service was crucial in tracing the flow of illicit funds.</li>

<li><strong>Homeland Security Investigations (HSI):</strong> HSI&#8217;s involvement highlights the cross-border nature of the crime and the agency&#8217;s role in combating transnational criminal organizations.</li>

<li><strong>U.S. Treasury Inspector General for Tax Administration:</strong> The involvement of this agency indicates potential tax fraud implications related to the shell companies and laundered funds.</li>

<li><strong>Federal Bureau of Investigation (FBI):</strong> The FBI&#8217;s expertise in complex investigations and international cooperation was instrumental in bringing the case to fruition.</li>

<li><strong>Internal Revenue Service-Criminal Investigations (IRS-CI):</strong> The IRS-CI&#8217;s involvement suggests the investigation also focused on the potential for tax evasion and other financial crimes related to the laundered funds.</li>

<li><strong>International Cooperation:</strong> The extradition of Victoria-Brito from the Dominican Republic highlights the critical role of international cooperation in combating transnational crime. The U.S. authorities worked closely with their Dominican counterparts to secure the suspect&#8217;s return.</li>

</ul>

<h2 class="wp-block-heading">The Road Ahead: Legal Proceedings and Continued Investigations</h2>

<p>Erick Jason Victoria-Brito now faces serious charges, including one count of conspiracy to commit bank fraud, which carries a maximum sentence of 30 years in prison, and one count of conspiracy to commit money laundering, which carries a maximum sentence of 20 years in prison.</p>

<p>It&#8217;s important to note that the charges contained in the indictment are merely accusations, and Victoria-Brito is presumed innocent unless and until proven guilty. The case will now proceed through the legal system, with further investigations likely to uncover more details about the operation and potentially lead to the apprehension of other individuals involved.</p>

<h2 class="wp-block-heading">Key Takeaways and Implications for Businesses</h2>

<p>This case serves as a stark reminder of the ever-present threat of cybercrime and the sophistication of modern financial criminals. It highlights several crucial takeaways for businesses of all sizes:</p>

<ul class="wp-block-list">

<li><strong>BEC Scams Are a Major Threat:</strong> <strong>Business email compromise (BEC)</strong> attacks are a significant and growing threat, capable of causing substantial financial losses and reputational damage.</li>

<li><strong>Vigilance is Essential:</strong> Businesses must remain vigilant and implement robust security measures to protect themselves against BEC scams and other forms of cyber fraud.</li>

<li><strong>Employee Training is Critical:</strong> Regular employee training on cybersecurity awareness, including recognizing and reporting phishing attempts and suspicious emails, is crucial.</li>

<li><strong>Strong Internal Controls are Needed:</strong> Implementing strong internal controls, such as multi-factor authentication and verification procedures for wire transfers, can help mitigate the risk of BEC attacks.</li>

<li><strong>Cybersecurity is an Ongoing Process:</strong> Cybersecurity is not a one-time fix but an ongoing process that requires continuous monitoring, updates, and adaptation to evolving threats.</li>

<li><strong>Report Suspicious Activity:</strong> It is vital to report any suspicious activity or potential fraud attempts to law enforcement authorities promptly.</li>

</ul>

<p>The successful extradition of Erick Jason Victoria-Brito is a significant victory in the ongoing fight against international cybercrime. However, it also serves as a warning that the threat is real and constantly evolving. Businesses, organizations, and individuals must remain vigilant, adapt to new threats, and work collaboratively with law enforcement to combat these complex and damaging criminal enterprises. This case underscores the importance of continued investment in cybersecurity, employee training, and international cooperation to protect the integrity of the global financial system and safeguard businesses from the devastating impact of sophisticated fraud schemes.</p>

Yearly Archives: 2025

Atlanta Cousins Sentenced in $2 Million+ COVID-19 Relief Fraud Scheme: Narcisse and Dieujuste Exploited PPP and EIDL Programs

<p><strong>Atlanta, GA</strong> – In a stark reminder of the pervasive fraud that plagued COVID-19 relief programs, two Georgia men, Johnny Narcisse and his cousin Johnson Dieujuste, have been sentenced to federal prison for their roles in a sophisticated scheme that defrauded the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL) program of more than $2 million. The case highlights the vulnerability of emergency relief funds and the ongoing efforts of law enforcement to bring perpetrators of pandemic-related fraud to justice.</p>

<p>This article delves into the details of Narcisse and Dieujuste&#8217;s fraudulent activities, their convictions, and the broader context of COVID-19 relief fraud. It also explores the role of various government agencies in investigating and prosecuting such crimes, and provides information on how the public can report suspected fraud.</p>

<h2 class="wp-block-heading">The Scheme: Exploiting Vulnerabilities in COVID-19 Relief Programs</h2>

<p>The COVID-19 pandemic triggered an unprecedented economic crisis, prompting the U.S. government to launch massive relief programs aimed at mitigating the <a class="wpil_keyword_link" href="https://www.fraudswatch.com/tag/financial-fraud/" title="financial" data-wpil-keyword-link="linked" data-wpil-monitor-id="1133">financial</a> fallout. The PPP and EIDL programs were central to this effort, designed to provide forgivable loans to small businesses struggling to stay afloat and cover essential expenses like payroll, rent, and utilities.</p>

<p>However, the speed and scale at which these programs were rolled out created opportunities for unscrupulous individuals to exploit vulnerabilities in the system. Johnny Narcisse and Johnson Dieujuste were among those who seized this opportunity, devising a scheme that ultimately defrauded taxpayers of over $2 million.</p>

<h2 class="wp-block-heading">How the Fraud Unfolded: A Detailed Look at Narcisse and Dieujuste&#8217;s Tactics</h2>

<p>According to court documents and statements made by Acting U.S. Attorney Richard S. Moultrie, Jr., the investigation into Narcisse began in July 2021 when federal agents, initially investigating a Florida resident for suspected tax crimes, obtained a search warrant for Narcisse&#8217;s Georgia home, computer, and cellular phone. This search yielded a trove of evidence revealing a complex conspiracy between Narcisse and Dieujuste.</p>

<p>The cousins&#8217; scheme involved recruiting small business owners and then filing fraudulent applications for PPP and EIDL loans on their behalf. The process was deceptively simple:</p>

<ol class="wp-block-list">

<li><strong>Recruitment:</strong> Narcisse and Dieujuste would approach small business owners, promising to help them secure COVID-19 relief funds.</li>

<li><strong>Information Gathering:</strong> They would collect the business owners&#8217; names, business names, and Employer Identification Numbers (EINs).</li>

<li><strong>Fabrication:</strong> The rest of the information required for the <a class="wpil_keyword_link" href="https://www.fraudswatch.com/category/loans/" title="loan" data-wpil-keyword-link="linked" data-wpil-monitor-id="1132">loan</a> applications was simply invented. Narcisse and Dieujuste fabricated details about the businesses&#8217; revenue, expenses, and number of employees to make them appear eligible for the loans.</li>

<li><strong>Submission:</strong> The fraudulent applications were then submitted to the Small Business Administration (SBA) and participating lenders.</li>

<li><strong>Kickbacks:</strong> If a loan was approved and disbursed, the borrowers would kick back a percentage of the proceeds to Narcisse and/or Dieujuste as payment for their &#8220;services.&#8221;</li>

</ol>

<p>This scheme was replicated dozens of times, resulting in over $2 million in fraudulent loans being disbursed.</p>

<h2 class="wp-block-heading">Beyond the Conspiracy: Individual Fraudulent Loan Applications</h2>

<p>In addition to their scheme to defraud the PPP and EIDL programs on behalf of others, Narcisse and Dieujuste also filed fraudulent loan applications for themselves. These individual applications, which were uncovered during the investigation, added to the total loss amount and were factored into their sentencing and restitution orders.</p>

<h2 class="wp-block-heading">The Investigation: Unraveling the Fraudulent Web</h2>

<p>The investigation into Narcisse and Dieujuste&#8217;s activities was a collaborative effort led by the U.S. Treasury Inspector General for Tax Administration (TIGTA) and the Small Business Administration&#8217;s Office of Inspector General (SBA-OIG). These agencies played a crucial role in identifying the fraudulent loan applications, tracing the flow of funds, and gathering the evidence necessary to build a strong case against the defendants.</p>

<p>The initial search warrant executed at Narcisse&#8217;s home proved to be a turning point in the investigation. The digital evidence found on his computer and phone provided a detailed record of their communications, the fraudulent loan applications, and the financial transactions associated with the scheme.</p>

<h2 class="wp-block-heading">Legal Proceedings: Guilty Pleas and Sentencing</h2>

<p>Faced with the overwhelming evidence against them, both Narcisse and Dieujuste pleaded guilty to one count each of conspiracy to commit wire fraud. This guilty plea, a federal felony, carry a maximum penalty of 20 years, as well as a fine of not more than the greater of $250,000 or twice the gross gain or loss from the offense.</p>

<h2 class="wp-block-heading">Johnny Narcisse&#8217;s Sentencing:</h2>

<p>On October 21, 2024, U.S. District Judge Eleanor L. Ross sentenced Johnny Narcisse, 46, of Atlanta, Georgia, to two years and four months in prison, followed by three years of supervised release. He was also ordered to pay restitution in the amount of $2,000,332, reflecting the total losses attributed to his involvement in the scheme.</p>

<h2 class="wp-block-heading">Johnson Dieujuste&#8217;s Sentencing:</h2>

<p>Johnson Dieujuste, 37, of Loganville, Georgia, received his sentence on January 8, 2025. Judge Ross sentenced him to two years and eight months in prison, also followed by three years of supervised release. Dieujuste was ordered to pay restitution in the amount of $2,081,559.</p>

<h2 class="wp-block-heading">The Role of the COVID-19 Fraud Enforcement Task Force</h2>

<p>The prosecution of Narcisse and Dieujuste is part of a broader effort to combat pandemic-related fraud. On May 17, 2021, the Attorney General established the COVID-19 Fraud Enforcement Task Force, a multi-agency initiative aimed at marshaling resources and expertise to investigate and prosecute individuals and organizations involved in COVID-19 relief fraud.</p>

<p>The Task Force has been instrumental in:</p>

<ul class="wp-block-list">

<li><strong>Enhancing investigative and prosecutorial efforts:</strong> By bringing together resources and expertise from various agencies, the Task Force has strengthened the government&#8217;s ability to identify and prosecute complex fraud schemes.</li>

<li><strong>Improving coordination:</strong> The Task Force has fostered greater collaboration between federal agencies, state and local law enforcement, and private sector partners.</li>

<li><strong>Sharing information and best practices:</strong> The Task Force facilitates the exchange of information and intelligence, allowing agencies to learn from past enforcement efforts and adapt their strategies accordingly.</li>

<li><strong>Preventing future fraud:</strong> By analyzing patterns and trends in pandemic-related fraud, the Task Force is working to identify vulnerabilities in relief programs and develop strategies to prevent future exploitation.</li>

</ul>

<h2 class="wp-block-heading">The Broader Context: The Scope of COVID-19 Relief Fraud</h2>

<p>The case of Narcisse and Dieujuste is just one example of the widespread fraud that has plagued COVID-19 relief programs. While the vast majority of the trillions of dollars in aid were distributed legitimately, a significant portion was lost to fraud, waste, and abuse.</p>

<h2 class="wp-block-heading">The Scope of the Problem:</h2>

<p>Estimates of the total amount of fraudulent COVID-19 relief funds vary widely, but it is undoubtedly in the billions, if not tens of billions, of dollars. The SBA-OIG, in a 2023 report, estimated that as much as $200 billion may have been lost to fraud in the PPP and EIDL programs alone.</p>

<h2 class="wp-block-heading">Types of Fraud:</h2>

<p>COVID-19 relief fraud has taken many forms, including:</p>

<ul class="wp-block-list">

<li><strong>Identity theft:</strong> Fraudsters used stolen identities to apply for loans in the names of unsuspecting individuals.</li>

<li><strong>Business identity theft:</strong> Similar to identity theft, but involving the use of stolen business information.</li>

<li><strong>Loan stacking:</strong> Applicants applied for multiple loans from different lenders, often using the same fabricated information.</li>

<li><strong>Inflated payroll or revenue:</strong> Businesses exaggerated their payroll or revenue figures to qualify for larger loans.</li>

<li><strong>Shell companies:</strong> Fraudsters created fake businesses with no legitimate operations to apply for loans.</li>

<li><strong>Misuse of funds:</strong> Some businesses received loans but used the funds for purposes other than those allowed under the programs.</li>

</ul>

<h2 class="wp-block-heading">Consequences of Fraud:</h2>

<p>The consequences of COVID-19 relief fraud are far-reaching:</p>

<ul class="wp-block-list">

<li><strong>Financial losses to taxpayers:</strong> Fraudulent loans represent a direct loss to taxpayers, who ultimately bear the cost of these programs.</li>

<li><strong>Undermining public trust:</strong> Fraud erodes public trust in government programs and institutions.</li>

<li><strong>Distorting the economy:</strong> Fraudulent loans can distort the economy by providing an unfair advantage to those who engaged in illicit activities.</li>

<li><strong>Diverting resources from legitimate recipients:</strong> Fraudulent claims can deplete the funds available for legitimate businesses and individuals in need.</li>

</ul>

<h2 class="wp-block-heading">Reporting Suspected COVID-19 Fraud</h2>

<p>The Department of Justice encourages anyone with information about allegations of attempted fraud involving COVID-19 to report it. You can do so by:</p>

<ul class="wp-block-list">

<li><strong>Calling the National Center for Disaster Fraud (NCDF) Hotline:</strong> 866-720-5721</li>

<li><strong>Submitting a complaint online:</strong> <a href="https://www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form" target="_blank" rel="noreferrer noopener">https://www.justice.gov/&#8230;complaint-form</a></li>

</ul>

<p><strong>Conclusion</strong></p>

<h2 class="wp-block-heading">The sentencing of Johnny Narcisse and Johnson Dieujuste serves as a powerful reminder of the ongoing fight against COVID-19 relief fraud. Their case underscores the importance of vigilance, robust investigative efforts, and inter-agency collaboration in protecting taxpayer funds and ensuring the integrity of government programs. As the COVID-19 Fraud Enforcement Task Force continues its work, it is expected that more cases of pandemic-related fraud will be uncovered and prosecuted, sending a clear message that those who seek to exploit public emergencies for personal gain will be held accountable. The public plays a vital role in this effort by reporting suspected fraud and helping to safeguard the integrity of vital relief programs.</h2>

Gernesia Williams Sentenced to Prison for $110,000 COVID-19 Relief Loan Fraud, Spent Proceeds on Jewelry and Destination Wedding

<p>The U.S. Attorney&#8217;s Office has delivered a stern message against the misuse of pandemic relief funds, highlighting a recent case where a Louisiana woman was sentenced to federal prison for fraudulently spending COVID-19 relief loan money. Gernesia Williams, a 47-year-old resident of Baton Rouge, will serve 13 months in federal prison following her conviction for the knowing conversion of government funds. This case serves as a stark reminder of the government&#8217;s commitment to prosecuting individuals who exploited programs designed to aid struggling businesses during the pandemic.</p>

<h2 class="wp-block-heading">Details of the Case: A Lavish Lifestyle Funded by Deception</h2>

<p>U.S. District Judge Brian A. Jackson handed down the sentence, which includes not only the prison term but also three years of supervised release and a hefty restitution order of $110,030.47. This amount reflects the extent of Williams&#8217;s misuse of funds obtained through the U.S. Small Business Administration&#8217;s (SBA) COVID-19 Economic Injury Disaster <a class="wpil_keyword_link" href="https://www.fraudswatch.com/category/loans/" title="Loan" data-wpil-keyword-link="linked" data-wpil-monitor-id="1131">Loan</a> (EIDL) program.</p>

<p>According to court documents and admissions made during her guilty plea, Williams applied for and received EIDL funds between April 2020 and January 2023. As a condition of receiving these loans, applicants were required to pledge that the proceeds would be used solely as working capital to alleviate economic hardships caused directly by the COVID-19 pandemic. These funds were intended to help businesses cover essential expenses such as payroll, rent, and utilities, ensuring their survival during unprecedented economic turmoil.</p>

<p>However, Williams flagrantly disregarded these terms. Instead of utilizing the funds to support any legitimate business need, she embarked on a spending spree that included personal indulgences far removed from the intended purpose of the EIDL program. Court records reveal that at least $110,030.47 of the loan proceeds were misspent. The most egregious examples of her misuse of these funds include:</p>

<ul class="wp-block-list">

<li><strong>Over $30,000 on Jewelry:</strong> A significant portion of the fraudulently obtained funds was spent on jewelry, a clear indication of personal enrichment rather than business support.</li>

<li><strong>Over $20,000 on a Destination Wedding in Florida:</strong> Williams used over $20,000 of the EIDL funds to finance a lavish destination wedding in Florida, a blatant example of the misuse of taxpayer money intended for economic relief.</li>

</ul>

<p>These expenditures are not only a betrayal of the public trust but also a violation of federal law. The EIDL program was designed to be a lifeline for businesses struggling to stay afloat during a global crisis, and Williams&#8217;s actions directly undermined its purpose.</p>

<h2 class="wp-block-heading">The Government&#8217;s Response: A Commitment to Justice and Accountability</h2>

<p>The case against Gernesia Williams was the result of a collaborative investigation by the Federal Bureau of Investigation (FBI) and the U.S. Treasury Inspector General for Tax Administration (TIGTA). Assistant United States Attorney Ben Wallace led the prosecution, underscoring the seriousness with which the federal government views pandemic relief fraud.</p>

<p>U.S. Attorney Ronald C. Gathe, Jr. has been vocal about the Department of Justice&#8217;s commitment to prosecuting those who seek to profit illegally from the pandemic. This case is just one example of the ongoing efforts to identify, investigate, and hold accountable individuals who have defrauded pandemic relief programs.</p>

<p>&#8220;The COVID-19 pandemic caused immense hardship for millions of Americans,&#8221; stated a representative from the U.S. Attorney&#8217;s Office. &#8220;Programs like the EIDL were created to provide a safety net for businesses struggling to survive. Those who chose to exploit these programs for personal gain will be held accountable to the fullest extent of the law.&#8221;</p>

<h2 class="wp-block-heading">The Broader Context: The Rampant Problem of Pandemic Relief Fraud</h2>

<p>The case of Gernesia Williams is not an isolated incident. Since the onset of the COVID-19 pandemic and the subsequent rollout of various federal relief programs, there has been a surge in cases of fraud. The sheer volume of funds distributed, coupled with the urgent need to get money into the hands of those who needed it quickly, created an environment ripe for exploitation.</p>

<p>The SBA&#8217;s Office of Inspector General has estimated that billions of dollars in pandemic relief funds were potentially lost to fraud. This includes not only the EIDL program but also the Paycheck Protection Program (PPP) and other initiatives.</p>

<p>The methods used by fraudsters vary widely, from inflating the number of employees on payroll to fabricating entire businesses. In some cases, individuals have used stolen identities to apply for loans, while others have simply misrepresented their business needs, as seen in the Williams case.</p>

<h2 class="wp-block-heading">The Role of the National Center for Disaster Fraud (NCDF)</h2>

<p>To combat the rising tide of pandemic-related fraud, the Department of Justice established the National Center for Disaster Fraud (NCDF). This center serves as a centralized hub for reporting and investigating fraud related to natural disasters, public health emergencies, and other crises, including the COVID-19 pandemic.</p>

<p>The NCDF plays a crucial role in:</p>

<ul class="wp-block-list">

<li><strong>Collecting Complaints:</strong> The NCDF provides a mechanism for individuals to report suspected fraud through a dedicated hotline (866-720-5721) and a web complaint form (<a href="https://www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form" target="_blank" rel="noreferrer noopener">www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form</a>).</li>

<li><strong>Coordinating Investigations:</strong> The NCDF works with various law enforcement agencies, including the FBI, the Secret Service, and inspectors general from different federal agencies, to ensure that complaints are properly investigated.</li>

<li><strong>Raising Public Awareness:</strong> The NCDF engages in public outreach to educate individuals and businesses about the risks of fraud and how to report it.</li>

</ul>

<h2 class="wp-block-heading">How to Report Suspected Pandemic Fraud</h2>

<p>The government relies heavily on tips from the public to identify and prosecute fraud. If you have information about potential pandemic fraud, including the misuse of EIDL or PPP funds, you are urged to report it to the NCDF.</p>

<h3 class="wp-block-heading">Reporting Options:</h3>

<ul class="wp-block-list">

<li><strong>NCDF Hotline:</strong> 866-720-5721</li>

<li><strong>NCDF Web Complaint Form:</strong> <a href="https://www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form" target="_blank" rel="noreferrer noopener">www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form</a></li>

</ul>

<p>When reporting suspected fraud, provide as much detail as possible, including:</p>

<ul class="wp-block-list">

<li>The names of individuals or businesses involved</li>

<li>The type of loan or program involved (e.g., EIDL, PPP)</li>

<li>Specific details about the alleged fraud (e.g., how the funds were misused)</li>

<li>Any supporting documentation you may have</li>

</ul>

<h2 class="wp-block-heading">The Consequences of Pandemic Relief Fraud: A Stern Warning</h2>

<p>The sentencing of Gernesia Williams sends a clear message that pandemic relief fraud will not be tolerated. The consequences of such actions are severe and can include:</p>

<ul class="wp-block-list">

<li><strong>Prison Sentences:</strong> Individuals convicted of fraud can face lengthy prison terms, as demonstrated in this case.</li>

<li><strong>Hefty Fines and Restitution:</strong> In addition to imprisonment, individuals may be ordered to pay substantial fines and repay the fraudulently obtained funds, as Williams was ordered to pay back over $110,000.</li>

<li><strong>Supervised Release:</strong> Following a prison sentence, individuals may be subject to a period of supervised release, during which they must adhere to strict conditions.</li>

<li><strong>Criminal Record:</strong> A conviction for fraud will result in a criminal record, which can have long-lasting consequences for employment, housing, and other aspects of life.</li>

</ul>

<h2 class="wp-block-heading">Conclusion: Protecting the Integrity of Relief Programs</h2>

<p>The case of Gernesia Williams serves as a cautionary tale, highlighting the importance of integrity and accountability in the administration of government relief programs. The government&#8217;s commitment to pursuing and prosecuting those who engage in pandemic relief fraud is unwavering.</p>

<p>As the nation continues to recover from the economic impact of the COVID-19 pandemic, it is crucial to protect the integrity of relief programs and ensure that funds reach those who truly need them. By reporting suspected fraud and holding individuals accountable for their actions, we can help safeguard taxpayer dollars and ensure that these vital programs serve their intended purpose: to provide a lifeline to businesses and individuals during times of crisis. The message is clear: those who seek to exploit these programs for personal gain will face the full force of the law.</p>

Crypto Reckoning: KuCoin’s Guilty Plea Exposes Dark Side of Unregulated Exchanges

<p>The cryptocurrency landscape was rocked to its core on Monday, January 27, 2025 as PEKEN GLOBAL LIMITED (“PEKEN”), the Seychelles-based entity operating the globally renowned cryptocurrency exchange KuCoin, pleaded guilty to a charge of operating an unlicensed money transmitting business. This landmark case, brought forth by Danielle Sassoon, the United States Attorney for the Southern District of New York, underscores the intensifying scrutiny faced by crypto exchanges and signals a decisive shift towards stringent regulatory enforcement within the industry. KuCoin, once a haven for users seeking anonymity, now faces a hefty penalty of over $297 million and a forced exit from the U.S. market for at least two years, marking a pivotal moment in the ongoing battle between cryptocurrency innovation and regulatory oversight.</p>

<h2 class="wp-block-heading">Key Takeaways from the KuCoin Case:</h2>

<ul class="wp-block-list">

<li><strong>Guilty Plea and Massive Penalties:</strong> KuCoin, through PEKEN, admitted guilt to operating without the required licenses, resulting in a combined <a class="wpil_keyword_link" href="https://www.fraudswatch.com/tag/financial-fraud/" title="financial" data-wpil-keyword-link="linked" data-wpil-monitor-id="1130">financial</a> penalty exceeding $297 million. This comprises a criminal forfeiture of $184.5 million and a criminal fine of approximately $112.9 million, reflecting the severity of the violations.</li>

<li><strong>Exit from U.S. Market:</strong> As part of the plea agreement, KuCoin is mandated to cease operations within the United States for a minimum of two years. This significant concession highlights the seriousness with which U.S. authorities are approaching non-compliance within the crypto sector.</li>

<li><strong>Leadership Shake-Up:</strong> The case also has direct consequences for KuCoin&#8217;s founders, Chun Gan (a.k.a. &#8220;Michael&#8221;) and Ke Tang (a.k.a. &#8220;Eric&#8221;). Both individuals, previously indicted, will be removed from any management or operational roles within KuCoin. Additionally, they have agreed to forfeit approximately $2.7 million each. They were granted deferred prosecution for a period of two years.</li>

<li><strong>AML and KYC Failures at the Heart of the Issue:</strong> The core of the case revolves around KuCoin&#8217;s blatant disregard for Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These crucial safeguards, designed to prevent illicit financial activities, were deliberately neglected, allowing KuCoin to become a conduit for potentially criminal proceeds.</li>

<li><strong>Billions in Suspicious Transactions:</strong> The lack of robust AML and KYC measures facilitated billions of dollars&#8217; worth of suspicious transactions on the KuCoin platform. This includes proceeds linked to darknet markets, malware, ransomware attacks, and various fraud schemes, painting a grim picture of the exchange&#8217;s operational environment.</li>

</ul>

<h2 class="wp-block-heading">A Deeper Dive into KuCoin&#8217;s Regulatory Violations</h2>

<p>The case against KuCoin reveals a systematic failure to comply with U.S. financial regulations. Founded in September 2017, KuCoin rapidly ascended the ranks of global crypto exchanges, boasting over 30 million customers and facilitating billions of dollars in daily trading volume. However, its success was built on a foundation of non-compliance, particularly within the U.S. market.</p>

<h3 class="wp-block-heading">1. Operating an Unlicensed Money Transmitting Business</h3>

<p>KuCoin&#8217;s platform allowed users to trade cryptocurrencies and cryptocurrency derivatives. This activity clearly classified KuCoin as a money transmitting business under U.S. law, obligating it to register with the Financial Crimes Enforcement Network (FinCEN) and report suspicious transactions. Despite this, KuCoin operated in the U.S. without the necessary licenses, a blatant violation that formed the basis of the guilty plea.</p>

<h3 class="wp-block-heading">2. Deliberate Neglect of AML and KYC Programs</h3>

<p>The most damning aspect of the case is KuCoin&#8217;s deliberate circumvention of AML and KYC regulations. These programs are essential for preventing financial institutions from being used for money laundering, terrorist financing, and other illicit activities. Until at least July 2023, KuCoin did not require users to provide <em>any</em> identifying information. This anonymity made the platform an attractive haven for criminal actors seeking to obscure the origins and destinations of their funds.</p>

<p>Further compounding the issue, KuCoin employees publicly stated on social media platforms that KYC was not mandatory, even in response to inquiries from users who identified themselves as being in the U.S. This brazen disregard for regulatory requirements demonstrated a culture of non-compliance within the organization.</p>

<h3 class="wp-block-heading">3. Belated and Inadequate KYC Implementation</h3>

<p>In August 2023, seemingly in response to growing regulatory pressure, KuCoin finally implemented a mandatory KYC program. However, this implementation was both late and insufficient. While new customers and existing customers seeking to actively trade were required to undergo KYC, those who only wanted to withdraw or close positions were exempt. This loophole effectively allowed existing users, potentially involved in illicit activities, to continue using the platform for their purposes, ultimately circumventing the very purpose of KYC.</p>

<h3 class="wp-block-heading">4. Facilitating Billions in Illicit Proceeds</h3>

<p>The consequences of KuCoin&#8217;s non-compliance were severe. The platform was used to process billions of dollars in suspicious transactions, potentially linked to a range of criminal activities. This highlights the very real dangers of operating a crypto exchange without proper safeguards. The ease with which illicit funds could be moved through KuCoin underscores the critical importance of AML and KYC compliance in the cryptocurrency space.</p>

<h2 class="wp-block-heading">The Implications for the Broader Crypto Industry</h2>

<p>The KuCoin case is not an isolated incident. It represents a broader trend of increased regulatory scrutiny facing the cryptocurrency industry. U.S. authorities are sending a clear message: compliance with AML, KYC, and other financial regulations is not optional. Crypto exchanges operating within the U.S. jurisdiction, or serving U.S. customers, must adhere to the same standards as traditional financial institutions.</p>

<h3 class="wp-block-heading">Key Implications:</h3>

<ul class="wp-block-list">

<li><strong>Heightened Regulatory Scrutiny:</strong> Crypto exchanges can expect increased scrutiny from regulators worldwide. The KuCoin case serves as a powerful deterrent, demonstrating the severe consequences of non-compliance.</li>

<li><strong>Mandatory Compliance with AML and KYC:</strong> Exchanges will need to implement robust AML and KYC programs, ensuring they can identify their customers and monitor transactions for suspicious activity.</li>

<li><strong>Shift Towards Transparency and Accountability:</strong> The era of anonymous crypto trading is rapidly coming to an end. Exchanges will be forced to adopt greater transparency and accountability in their operations.</li>

<li><strong>Potential for Consolidation:</strong> Smaller exchanges may struggle to meet the increasing regulatory burden, potentially leading to consolidation within the industry as larger, more compliant players absorb their operations.</li>

<li><strong>Impact on User Experience:</strong> While necessary for security and regulatory compliance, stricter KYC requirements could impact user experience, potentially deterring some users who value privacy.</li>

<li><strong>Global Harmonization of Regulations:</strong> As regulators worldwide grapple with the challenges of the crypto industry, there may be a push towards greater harmonization of regulations, creating a more consistent and predictable global framework.</li>

</ul>

<h2 class="wp-block-heading">The Future of Crypto Exchanges: Compliance as a Cornerstone</h2>

<p>The KuCoin case is a watershed moment for the cryptocurrency industry. It marks a decisive shift towards a more regulated and compliant future. While some may lament the loss of anonymity, the increased focus on AML and KYC is ultimately essential for the long-term health and sustainability of the crypto ecosystem.</p>

<p>For crypto exchanges, compliance is no longer a choice; it is a necessity. Those that prioritize robust AML and KYC programs, transparency, and cooperation with regulators will be best positioned to thrive in this evolving landscape. The future of crypto exchanges lies in building trust, ensuring security, and operating within a framework that protects both users and the broader financial system.</p>

<p>The KuCoin case serves as a stark reminder of the risks associated with regulatory non-compliance. It is a call to action for the entire crypto industry to embrace a new era of responsibility, transparency, and adherence to the rule of law. As U.S. Attorney Danielle Sassoon stated, &#8220;Today&#8217;s guilty plea and penalties show the cost of refusing to follow these laws and allowing unlawful activity to continue.&#8221; This statement resonates far beyond KuCoin, impacting every player in the global cryptocurrency market. The message is clear: adapt, comply, or face the consequences.</p>

Medicaid Fraud: Dr. Ghodrat Pirooz Sholevar Settles for $900K After Overbilling for Mental Health Services

<p><strong>PHILADELPHIA, PA</strong> – In a significant victory for the federal government&#8217;s ongoing battle against healthcare fraud, a Philadelphia psychiatrist and his associated mental health clinic have agreed to pay $900,000 to settle allegations of fraudulently billing Medicaid for medication management appointments that were significantly shorter than regulations allow. Dr. Ghodrat Pirooz Sholevar and his company, Nueva Vida Multicultural/Multilingual Behavioral Health, Inc., were accused of systematically overbilling the government-funded program, ultimately depriving vulnerable patients of the comprehensive care they deserved.</p>

<p>This case, detailed in an amended complaint filed on May 7, 2024, by the United States Attorney&#8217;s Office for the Eastern District of Pennsylvania, sheds light on a disturbing pattern of alleged misconduct spanning nearly a decade. The government contends that from January 15, 2009, through March 31, 2017, Nueva Vida routinely submitted false bills for medication management appointments conducted by Dr. Sholevar. These appointments, which are crucial for monitoring the effects of psychiatric drugs and adjusting treatment plans, were often far shorter than the required 15-minute minimum for full reimbursement under Medicaid rules.</p>

<h2 class="wp-block-heading">The Importance of Medication Management in Mental Healthcare</h2>

<p>Medication management, also known as a &#8220;med check,&#8221; is a critical component of mental health treatment, particularly for patients receiving psychotropic medications. These appointments are not mere formalities; they involve a comprehensive assessment of the patient&#8217;s condition, including obtaining relevant history, examining mental status, evaluating the effectiveness and side effects of medication, and adjusting prescriptions or treatment plans as needed. For vulnerable populations, including children and low-income individuals who rely on Medicaid for their healthcare, these appointments are often the lifeline to stability and well-being.</p>

<p>According to the National Institute of Mental Health (NIMH), psychotropic medications can be highly effective in treating a wide range of mental health disorders, including depression, anxiety, bipolar disorder, and schizophrenia. However, these medications can also carry significant side effects, some of which can be dangerous if not carefully monitored. This underscores the importance of regular, thorough medication management appointments conducted by qualified healthcare professionals.</p>

<h2 class="wp-block-heading">The Allegations: A Pattern of Overbilling and False Documentation</h2>

<p>The government&#8217;s case against Dr. Sholevar and Nueva Vida paints a stark picture of a healthcare provider allegedly prioritizing profit over patient care. The amended complaint alleges that Nueva Vida billed Medicaid for full 15-minute &#8220;units&#8221; of medication management, despite evidence suggesting that many appointments were substantially shorter. The clinic also regularly billed for more appointments than could be realistically completed within a single workday if each were to adhere to the 15-minute minimum.</p>

<p>The most damning allegation, however, involves the alleged falsification of patient records. The government contends that Dr. Sholevar recorded start and end times in patients&#8217; files that falsely suggested each appointment lasted the full 15 minutes. These &#8220;clock times&#8221; often overlapped, indicating that Dr. Sholevar was purportedly seeing two or even three patients during the same 15-minute window, sometimes even at different clinic locations.</p>

<h2 class="wp-block-heading">A History of Warnings and Recoupments</h2>

<p>The government&#8217;s complaint further alleges that Dr. Sholevar and Nueva Vida were not only aware of the Medicaid rules regarding appointment length but also had a history of being penalized for non-compliance. As early as 2004, an audit revealed that medication management visits ranging from six to twelve minutes were deemed too short. Community Behavioral Health (CBH), the local Medicaid program administrator, regularly recouped payments from the defendants for appointments that lacked proper documentation of start and end times or were evidently less than 15 minutes long.</p>

<p>Despite these warnings and <a class="wpil_keyword_link" href="https://www.fraudswatch.com/tag/financial-fraud/" title="financial" data-wpil-keyword-link="linked" data-wpil-monitor-id="1129">financial</a> penalties, the alleged pattern of overbilling and false documentation continued. This raises serious questions about the effectiveness of oversight mechanisms and the potential for systemic failures within the Medicaid program.</p>

<h2 class="wp-block-heading">Community Behavioral Health&#8217;s Role and the Challenges of Oversight</h2>

<p>Community Behavioral Health (CBH), as the local administrator of the Medicaid program, plays a crucial role in ensuring that healthcare providers adhere to program rules and regulations. CBH is responsible for processing claims, conducting audits, and recouping payments for services that do not meet program requirements.</p>

<p>However, the sheer volume of claims processed by CBH, coupled with the complexity of healthcare billing, presents significant challenges for effective oversight. In a city like Philadelphia, with a large population of Medicaid beneficiaries, ensuring compliance across numerous healthcare providers requires robust systems and diligent monitoring.</p>

<h2 class="wp-block-heading">The Broader Implications for Medicaid and Healthcare Fraud</h2>

<p>This settlement is not an isolated incident but rather part of a larger, ongoing effort by the federal government to combat healthcare fraud, particularly within the Medicaid program. The False Claims Act, under which this lawsuit was filed, is a powerful tool that allows the government to recover funds obtained through fraudulent billing practices.</p>

<p>According to the Department of Justice, healthcare fraud costs the United States tens of billions of dollars annually. This not only drains taxpayer resources but also undermines the integrity of the healthcare system and compromises patient care.</p>

<h2 class="wp-block-heading">The Impact on Vulnerable Populations</h2>

<p>The alleged actions of Dr. Sholevar and Nueva Vida had a direct impact on some of Philadelphia&#8217;s most vulnerable residents, including low-income individuals and children who rely on Medicaid for their mental healthcare. By allegedly shortening appointments and overbilling the program, the defendants not only defrauded the government but also potentially deprived patients of the full scope of care they needed and deserved.</p>

<p>For individuals struggling with mental health issues, access to quality care is paramount. Shortened appointments can lead to inadequate monitoring of medication, missed opportunities to address side effects or adjust treatment plans, and ultimately, poorer health outcomes.</p>

<h2 class="wp-block-heading">U.S. Attorney Romero and HHS-OIG on the Importance of Accountability</h2>

<p>U.S. Attorney Jacqueline C. Romero emphasized the importance of holding healthcare providers accountable for their actions, stating, &#8220;The defendants allegedly overbilled the Medicaid program at the expense of low-income Philadelphians, including children, who were seeking mental health services. These individuals deserved full and appropriate health care services, including careful management of psychiatric drugs that can have dangerous side effects.&#8221;</p>

<p>Maureen R. Dixon, Special Agent in Charge for the Department of Health and Human Services Office of the Inspector General (HHS-OIG), echoed this sentiment, highlighting the potential harm to patients: &#8220;The defendants&#8217; actions defrauded the Medicaid program and may have resulted in patients not receiving the full services they deserve.&#8221;</p>

<h2 class="wp-block-heading">The Path Forward: Strengthening Oversight and Promoting Ethical Billing</h2>

<p>This case underscores the need for stronger oversight mechanisms within the Medicaid program and greater emphasis on ethical billing practices among healthcare providers. While this settlement represents a significant step toward accountability, it also highlights the need for systemic changes to prevent future instances of fraud and ensure that all patients receive the quality care they are entitled to.</p>

<p>Possible solutions include:</p>

<ol class="wp-block-list">

<li><strong>Enhanced Auditing:</strong> Implementing more frequent and rigorous audits of healthcare providers, particularly those with a history of non-compliance.</li>

<li><strong>Technological Solutions:</strong> Utilizing data analytics and other technological tools to identify patterns of overbilling and false documentation.</li>

<li><strong>Increased Penalties:</strong> Imposing stricter penalties for healthcare fraud, including larger fines and potential criminal prosecution.</li>

<li><strong>Education and Training:</strong> Providing comprehensive training for healthcare providers on Medicaid rules and regulations, emphasizing the importance of ethical billing practices.</li>

<li><strong>Whistleblower Protections:</strong> Encouraging individuals with knowledge of fraudulent activities to come forward by strengthening whistleblower protections.</li>

</ol>

<h2 class="wp-block-heading">The Role of Public Awareness and Reporting</h2>

<p>The public also plays a crucial role in combating healthcare fraud. The Department of Health and Human Services encourages individuals to report any suspected instances of fraud, waste, abuse, or mismanagement. Tips and complaints can be reported to the HHS hotline at 800-HHS-TIPS (800-447-8477).</p>

<p>By raising public awareness and encouraging reporting, we can create a more vigilant and accountable healthcare system that prioritizes patient well-being above all else.</p>

<h2 class="wp-block-heading">Conclusion: A Call for Integrity in Mental Healthcare</h2>

<p>The $900,000 settlement reached with Dr. Ghodrat Pirooz Sholevar and Nueva Vida Multicultural/Multilingual Behavioral Health, Inc. sends a clear message that healthcare fraud will not be tolerated. This case serves as a stark reminder of the importance of ethical billing practices, thorough documentation, and above all, a commitment to providing quality care to all patients, especially those who rely on government-funded programs like Medicaid.</p>

<p>As the fight against healthcare fraud continues, this case should serve as a catalyst for positive change, promoting greater accountability, transparency, and ultimately, a more just and equitable healthcare system for all. The mental well-being of our communities depends on it. This is more than just about money; it is about ensuring that every individual, regardless of their socioeconomic status, has access to the comprehensive and compassionate mental healthcare they deserve. The integrity of our healthcare system, and the well-being of our most vulnerable populations, hang in the balance.</p>

<p></p>

Advance Fee Fraud in 2025 and Beyond: Trends, Threats, and Tactics

<p>This article provides a comprehensive look at advance fee fraud, a deceptive scheme that continues to thrive in 2025 and beyond. We&#8217;ll explore the latest trends, emerging threats, and sophisticated tactics employed by fraudsters, offering valuable insights and actionable strategies to protect yourself from becoming a victim.</p>

<h2 class="wp-block-heading">Recognizing the Red Flags: How to Spot Advance Fee Fraud</h2>

<p>Before diving into the evolving landscape of advance fee fraud, it&#8217;s crucial to understand how to identify these scams in the first place. While they can be disguised in countless ways, some common red flags often signal a potential scam:</p>

<ul class="wp-block-list">

<li><strong>Offers that seem too good to be true:</strong> <a href="https://snappt.com/blog/fraud-trends/" data-type="link" data-id="https://snappt.com/blog/fraud-trends/">Be wary of opportunities</a> that promise unrealistic returns or offer something of exceptional value for a small upfront fee. If it sounds too good to be true, it probably is. </li>

<li><strong>Unsolicited communications:</strong> <a href="https://www.collaborada.com/blog/seo-scams" data-type="link" data-id="https://www.collaborada.com/blog/seo-scams">Beware of unexpected emails</a>, letters, or phone calls offering lucrative deals or requesting upfront payments for goods or services you haven&#8217;t ordered. These unsolicited pitches often signal an attempt to deceive. </li>

<li><strong>Requests for unconventional payment methods:</strong> Scammers often insist on <a href="https://www.morganstanley.com/what-we-do/wealth-management/online-security/advance-fee-scams" data-type="link" data-id="https://www.morganstanley.com/what-we-do/wealth-management/online-security/advance-fee-scams">payment methods</a> that are difficult to trace or reverse, such as wire transfers, gift cards, or cryptocurrency. Legitimate businesses typically offer secure and traceable payment options. </li>

<li><strong>Pressure to pay quickly:</strong> Fraudsters frequently create a <a href="https://www.natwestinternational.com/global/fraud-and-security/spotting-scams/advance-fee-scams.html" data-type="link" data-id="https://www.natwestinternational.com/global/fraud-and-security/spotting-scams/advance-fee-scams.html">sense of urgency to pressure victims</a> into making hasty decisions without proper consideration. They may use phrases like &#8220;limited-time offer&#8221; or &#8220;act now before it&#8217;s too late&#8221; to instill fear and discourage critical thinking. </li>

<li><strong>Requests for personal information:</strong> Legitimate businesses rarely ask for sensitive information like passwords or PINs via email or text message. If you receive such a request, be extremely cautious and verify the sender&#8217;s identity before providing any information. </li>

<li><strong>Unprofessional communication:</strong> Poor grammar, spelling errors, and inconsistencies in email addresses or domain names can indicate a scam. Pay close attention to the sender&#8217;s email address and the website domain to ensure they match the legitimate organization. </li>

<li><strong>Impersonation tactics:</strong> Advance fee fraud often involves <a href="https://www.proofpoint.com/us/blog/threat-insight/bec-taxonomy-advance-fee-fraud" data-type="link" data-id="https://www.proofpoint.com/us/blog/threat-insight/bec-taxonomy-advance-fee-fraud">impersonating a trusted figure or organization</a>. Scammers may spoof email addresses, create fake websites, or use display names that mimic legitimate entities to deceive victims. </li>

<li><strong>Lures and emotional manipulation:</strong> Fraudsters use various lures to entice victims, such as promises of inheritance, lottery winnings, or lucrative business deals. They may also exploit emotions like greed, fear, or urgency to override rational decision-making. </li>

</ul>

<h2 class="wp-block-heading">The Ever-Evolving Landscape of Advance Fee Fraud</h2>

<figure class="wp-block-image size-large"><img src="https://www.fraudswatch.com/wp-content/uploads/2025/01/Advance-Fee-Fraud-in-2025-1024x1024.jpg" alt="" class="wp-image-104703"/></figure>

<p>Advance fee fraud, also known as upfront fee fraud, is a deceptive scheme that preys on individuals and businesses by promising significant <a class="wpil_keyword_link" href="https://www.fraudswatch.com/tag/financial-fraud/" title="financial" data-wpil-keyword-link="linked" data-wpil-monitor-id="1122">financial</a> gains, valuable goods, or essential services in exchange for an upfront payment. However, once the payment is made, the promised rewards never materialize, and the perpetrators disappear, leaving victims with financial losses and eroded trust<sup></sup>.  ;</p>

<p>While the core principle of advance fee fraud remains consistent, the methods employed by fraudsters are constantly evolving. In 2025, several key trends have emerged:</p>

<ul class="wp-block-list">

<li><strong>Rise of </strong><a href="https://www.fraudswatch.com/ai-powered-scams-how-artificial-intelligence-is-weaponized-for-fraud/" data-wpil-monitor-id="1127">AI-Powered Scams: Artificial intelligence</a> (AI) is being increasingly weaponized by criminals to automate phishing attacks, generate deepfakes, and create synthetic identities, making scams more sophisticated and difficult to detect. For example, AI can be used to create highly realistic fake videos or voice recordings that impersonate trusted individuals, making it easier to deceive victims. </li>

<li><strong>Quantum AI Investment Schemes:</strong> Fraudsters are leveraging the power of quantum computing and AI to develop highly convincing investment scams, promising unrealistic returns on fake opportunities. These scams often involve creating fake news articles, bogus testimonials, and deepfake videos featuring celebrities or experts to lure unsuspecting investors. </li>

<li><strong>Exploitation of Instant Payment Systems:</strong> The rapid growth of instant payment channels like FedNow and TCH RTP provides new avenues for fraudsters to exploit vulnerabilities and carry out authorized push payment (APP) scams. As these payment systems become more prevalent, criminals are finding ways to intercept or redirect funds, leaving victims with little recourse. </li>

<li><strong><a href="https://www.fraudswatch.com/business-email-compromise-bec-scams-10-types-qa-preventing-and-reporting/" data-wpil-monitor-id="1125">Business Email Compromise</a> (BEC) Attacks:</strong> BEC scams, where criminals impersonate legitimate businesses or individuals to gain access to funds, are becoming increasingly prevalent. These attacks often target ACH payments, exploiting vulnerabilities in business processes to divert funds to fraudulent accounts. </li>

<li><strong>Fraud-as-a-Service Models:</strong> The availability of &#8220;fraud-as-a-service&#8221; on the dark web provides criminals with easy access to tools and services for executing BEC and online account takeover attacks. This lowers the barrier to entry for aspiring fraudsters, making it easier for them to launch sophisticated attacks with minimal technical expertise. </li>

<li><strong>Persistence of Check Fraud:</strong> Despite the rise of digital payments, check fraud remains a significant threat. While checks themselves haven&#8217;t changed, the methods used to defraud with checks have become more sophisticated. Criminals are employing techniques like stolen endorsed checks and advanced printing technologies to create counterfeit checks that are difficult to detect. </li>

</ul>

<p>A key insight from these trends is that the increasing sophistication of deepfake technology and Fraud-as-a-Service models poses a significant challenge for fraud prevention. Financial institutions and individuals need to adopt advanced solutions and strategies to combat these evolving threats<sup></sup>.  ;</p>

<h2 class="wp-block-heading">Protecting Yourself: Strategies to Avoid Advance Fee Fraud</h2>

<p>Taking proactive measures to protect yourself is essential in the fight against advance fee fraud. Here are some strategies to keep your finances and personal information safe:</p>

<ul class="wp-block-list">

<li><strong>Educate yourself:</strong> Stay informed about the latest scams and fraud trends by subscribing to security newsletters, attending webinars, and following trusted experts. Knowledge is power when it comes to recognizing and avoiding scams. </li>

<li><strong>Verify the source:</strong> Before responding to any unsolicited offers or requests, independently verify the identity of the sender and the legitimacy of the organization they claim to represent. Don&#8217;t rely solely on the information provided in the communication; conduct your own research to confirm its authenticity. </li>

<li><strong>Be cautious with online interactions:</strong> Avoid clicking on links in suspicious emails or text messages, and be wary of fake websites that mimic legitimate organizations. Always type the website address directly into your browser or use a trusted bookmark to ensure you&#8217;re accessing the genuine site. </li>

<li><strong>Use strong passwords and multi-factor authentication:</strong> Protect your online accounts with strong, unique passwords and enable multi-factor authentication whenever possible. This adds an extra layer of security, making it more difficult for fraudsters to gain access to your accounts. </li>

<li><strong>Monitor your accounts regularly:</strong> Keep a close eye on your bank accounts and credit card statements for any unauthorized transactions. Regularly reviewing your account activity can help you identify and report suspicious transactions promptly. </li>

<li><strong>Report suspicious activity:</strong> If you encounter a potential scam or suspect fraudulent activity, report it immediately to the appropriate authorities, such as the Federal Trade Commission (FTC) or your local law enforcement agency. Reporting scams helps authorities track down perpetrators and prevent future victims. </li>

<li><strong>Understand the role of financial institutions:</strong> Financial institutions are increasingly using AI and alternative data to combat fraud. They are developing sophisticated systems to detect suspicious patterns and prevent unauthorized transactions. This includes leveraging non-traditional data points to assess creditworthiness and enhance fraud detection capabilities. </li>

<li><strong>Recognize the importance of human behavior:</strong> Human behavior and psychological factors play a significant role in fraud prevention. Financial institutions are investing in training for their staff to recognize and address these vulnerabilities. This includes helping employees identify signs of emotional manipulation and empowering them to intervene when customers may be falling victim to scams. </li>

<li><strong>Be aware of accelerating regulations:</strong> Regulations are evolving to place greater emphasis on fraud prevention and victim reimbursement. This includes initiatives that hold <a href="https://www.fraudswatch.com/how-to-spot-and-avoid-business-loan-fraud-on-2024/" data-wpil-monitor-id="1128">financial institutions more accountable for preventing fraud</a> and provide greater protection for consumers who fall victim to scams. </li>

</ul>

<h2 class="wp-block-heading">Advance Fee Fraud in Specific Contexts</h2>

<p>Advance fee fraud can manifest in various contexts, each with its own unique characteristics and tactics. Here are some specific areas where this type of fraud is prevalent:</p>

<h3 class="wp-block-heading">Investment Scams:</h3>

<ul class="wp-block-list">

<li><strong><a href="https://www.fraudswatch.com/prevent-investment-fraud/" data-type="link" data-id="https://www.fraudswatch.com/prevent-investment-fraud/">Fraudulent investment</a> opportunities:</strong> Scammers often promote high-yield investment programs (HYIPs) or other schemes that promise unrealistic returns with little or no risk. These schemes may involve complex investment strategies or fictitious companies, designed to lure in unsuspecting investors with the promise of quick riches. For example, the &#8220;pig butchering&#8221; scam involves cultivating a relationship with a victim online, often through dating apps or social media, and then gradually introducing them to a fake cryptocurrency investment platform. The scammer will initially allow the victim to make small profits to gain their trust, then encourage them to invest larger sums of money before disappearing with the funds. </li>

<li><strong>Recovery room scams:</strong> Victims of previous investment scams are targeted with offers to recover their losses in exchange for an upfront fee. These scammers prey on the victim&#8217;s desperation to recoup their losses, often posing as lawyers, investigators, or government officials. For instance, a victim who lost money in a Ponzi scheme may be contacted by someone claiming to be a lawyer specializing in recovering lost funds. The scammer will request an upfront fee to initiate the recovery process, but will ultimately disappear with the money without providing any assistance. </li>

<li><strong>Fake stock offerings:</strong> Fraudsters create fictitious companies or impersonate legitimate brokers to sell worthless or non-existent stocks. They may use high-pressure sales tactics and forge documents to create an illusion of legitimacy.</li>

</ul>

<h3 class="wp-block-heading"><a href="https://www.fraudswatch.com/online-scams-you-need-to-avoid-today/" data-type="link" data-id="https://www.fraudswatch.com/online-scams-you-need-to-avoid-today/">Online Scams</a>:</h3>

<ul class="wp-block-list">

<li><strong>Lottery and prize scams:</strong> Victims are informed that they have won a lottery or prize but must pay a fee to claim their winnings. These scams often involve fake lotteries or contests, and the fees may be disguised as taxes, processing fees, or insurance costs. </li>

<li><strong><a class="wpil_keyword_link" href="https://www.fraudswatch.com/category/romance-scammer/" title="Romance" data-wpil-keyword-link="linked" data-wpil-monitor-id="1124">Romance</a> scams:</strong> Criminals build relationships with victims online and then exploit their trust to request money for fabricated emergencies or investment opportunities. These scams often involve creating fake profiles on dating websites or social media platforms and preying on vulnerable individuals seeking companionship. Scammers on social media platforms like Truth Social are increasingly targeting users with advance fee fraud schemes, exploiting the platform&#8217;s user base and features to deceive victims. This highlights how scammers are adapting to new and emerging social media platforms to reach potential targets. </li>

<li><strong>Online auction fraud:</strong> Scammers use fake online auction sites or profiles to sell non-existent items or lure buyers into paying upfront for goods that are never delivered. They may use stolen photos or create fake reviews to make their listings appear legitimate. </li>

</ul>

<h3 class="wp-block-heading">Employment Scams:</h3>

<ul class="wp-block-list">

<li><strong><a href="https://www.fraudswatch.com/2023-work-from-home-scams-types-prevention-and-reporting/" data-type="link" data-id="https://www.fraudswatch.com/2023-work-from-home-scams-types-prevention-and-reporting/">Fake job</a> listings:</strong> Fraudsters post fictitious job openings and require applicants to pay a fee for training, background checks, or application processing. These scams often target job seekers who are desperate for employment, exploiting their vulnerability to make quick money. </li>

<li><strong>Work-from-home scams:</strong> Victims are offered seemingly legitimate work-from-home opportunities but are required to pay for starter kits, training materials, or equipment. The promised work often never materializes, and the victim is left with unnecessary expenses and no income.</li>

</ul>

<h3 class="wp-block-heading">Loan and Credit Scams:</h3>

<ul class="wp-block-list">

<li><strong>Advance fee <a class="wpil_keyword_link" href="https://www.fraudswatch.com/category/loans/" title="loan" data-wpil-keyword-link="linked" data-wpil-monitor-id="1123">loan</a> scams:</strong> Individuals with poor credit are targeted with offers of guaranteed loans or credit card approvals in exchange for an upfront fee. These scams prey on people who are struggling financially and may be desperate for a loan. </li>

<li><strong>Debt consolidation scams:</strong> Companies promise to consolidate or eliminate debt for a fee but fail to deliver on their promises. They may charge exorbitant fees or engage in deceptive practices that leave victims in a worse financial situation than before.</li>

</ul>

<h2 class="wp-block-heading">Advance Fee Fraud and SEO: A Deceptive Combination</h2>

<p>Search engine optimization (SEO) plays a significant role in the proliferation of advance fee fraud. Scammers employ various SEO tactics to ensure their fraudulent websites and offers rank high in search results, increasing their visibility and reach. Some common SEO scams include:</p>

<ul class="wp-block-list">

<li><strong>Overpriced SEO services:</strong> Companies are lured into paying exorbitant fees for ineffective or even harmful SEO practices. These scammers may promise unrealistic results or use deceptive tactics to inflate their prices. </li>

<li><strong>Inflated traffic numbers:</strong> Fake traffic generated by bots is used to deceive businesses into believing their website is performing well. This fake traffic does not translate into actual customers or sales, and can even harm a website&#8217;s reputation. </li>

<li><strong>Irrelevant content creation:</strong> Low-quality or irrelevant content is used to manipulate search rankings without providing any value to users. This content may be keyword-stuffed or copied from other websites, and can negatively impact a website&#8217;s search engine ranking. </li>

<li><strong>Misleading technology claims:</strong> Scammers make false claims about proprietary technology or special relationships with search engines to attract clients. They may use technical jargon or fabricated credentials to create an illusion of expertise. </li>

<li><strong>Hidden fees and unexpected charges:</strong> Contracts lack transparency, leading to unexpected expenses and financial losses. Scammers may hide fees in the fine print or add extra charges without proper justification. </li>

<li><strong>Fake error messages and promises:</strong> SEO scammers often send cold emails with fabricated error messages or guarantees of page 1 results to lure in victims. These tactics prey on business owners&#8217; lack of SEO knowledge and desire for quick results. </li>

</ul>

<p>One particularly concerning trend is the use of SEO to create fake websites that mimic legitimate financial institutions. These websites are designed to deceive users into sharing personal and financial information, leading to <a href="https://www.fraudswatch.com/beyond-the-bin-how-dumpster-diving-for-documents-fuels-identity-theft-and-corporate-espionage/" data-wpil-monitor-id="1361">identity theft</a> and financial losses.  ;</p>

<h2 class="wp-block-heading">SEO Best Practices for Fraud Prevention</h2>

<p>To <a href="https://www.fraudswatch.com/the-ultimate-guide-to-preventing-insurance-fraud-stay-safe-and-save-money/" data-wpil-monitor-id="1126">protect</a> yourself from SEO scams and ensure your online presence is safe and effective, consider these best practices:</p>

<ul class="wp-block-list">

<li><strong>Educate yourself about SEO best practices:</strong> Understand the fundamentals of SEO and how it works to avoid falling prey to deceptive tactics. Learn about ethical SEO strategies, such as creating high-quality content, building relevant backlinks, and optimizing website structure. </li>

<li><strong>Choose reputable SEO providers:</strong> Thoroughly research and vet potential SEO companies, checking their credentials, experience, and client testimonials. Look for providers with a proven track record of success and a commitment to ethical SEO practices. </li>

<li><strong>Demand transparency:</strong> Ensure all fees and services are clearly outlined in the contract, and avoid providers who are unwilling to explain their methods. A reputable SEO company will be transparent about their strategies and provide regular reports on their progress. </li>

<li><strong>Monitor your website&#8217;s performance:</strong> Regularly track your website&#8217;s traffic, rankings, and other key metrics to identify any suspicious activity. Use tools like Google Analytics and Google Search Console to monitor your website&#8217;s performance and detect any unusual changes in traffic or rankings.</li>

<li><strong>Be wary of cold outreach:</strong> Be skeptical of unsolicited SEO spam emails or calls from anyone claiming they found errors on your site. These are often fear tactics to secure business. </li>

<li><strong>Focus on quality:</strong> Trustworthy digital marketing professionals will prioritize personal interactions to genuinely understand and serve your needs. Beware of those offering email-only interactions—these groups are only interested in sales. </li>

<li><strong>Ask questions:</strong> When hiring, inquire about an agency&#8217;s approach, strategies, and past results. If they&#8217;re legitimate, they&#8217;ll be transparent and eager to share with you. </li>

<li><strong>Ensure relevance:</strong> Make sure that the content your SEO company creates is relevant and beneficial to your business and your audience. </li>

<li><strong>Content audits:</strong> Regularly audit the content your SEO or marketing company posts to ensure it aligns with your business goals. </li>